India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Outlook Arena

- Best Intraday Stocks for Today

Best Intraday Stocks for Today

When it comes to intraday trading, you cannot just place a trade on any stock. You need to be very selective.

First, lay out a process which will help you filter out the best intraday stocks to trade today. Here's a broad set of steps you can follow:

Define your strategy and stock basket.

Trade in liquid stocks. This is the most important parameter one should look for in intraday trading.

Look for market trends. If the market shows signs of weakness, instead of placing a bullish call, you can short the stock/index and make profits even when the stock market is going down.

Sectoral check. This is another thing to look at before you place an intraday trade. If the entire IT pack is going down due to recession concerns and you think 'ABC' stock will outperform due to its strong fundamentals, you may as well be wrong. For the short term at least.

Traders often look at market and sectoral trends to trade. This method of identifying the market and sectoral trend is known as top-down approach.

From a trading perspective, a top-down trader first analyzes the trend of the entire market, followed by the trend of the sector, and then the trend of specific stocks.

Avoid boring stocks. Not going to give out any names here but you get an idea. Look for intraday trading in stocks which are affected by the news out there. A trending EV stock which is subject to news flow is far better for trading than a boring PSU power stock.

Timing is important. Intraday trading is for those who monitor the stock continuously. For a person who is engaged full time in some profession, or a business may not be the right fit for intraday trading.

If you are deep into trading and know technical analysis, here are some hardcore trading strategies for you:

Over the years, many new traders have entered the market. Most of them have started intraday trading.

However, they seem to be going about it without any trading system.

Many don't use stop losses and often, commit large amounts of capital in a single trade. In such situations, a single bad trade takes a big bite out of their trading capital which is hard to earn back.

That is why you need to:

- Have patience

- Keep stop losses

- Cut the losses (if you're deep in red)

- Evaluate from your mistakes

Do all of this and you'll find the best intraday stocks for today.

If you want to learn more about trading and charts to improve your trading, we recommend you check out our timeless reading section: Fundamentals of Technical Analysis. It's a simple and easy to understand guide that should help you get started.

Also take a look at which are the best intraday stocks for tomorrow.

Have a safe and happy trading day!

You can also checkout our playlist on Intraday Trading on Equitymaster's YouTube channel.

![]() Why Asian Paints Share Price is Falling

Why Asian Paints Share Price is Falling

Oct 3, 2024

The bluest of bluechip stocks, Asian Paints falls around 4% intraday. What's causing this dip?

![]() Why Bajaj Finance Share Price is Falling

Why Bajaj Finance Share Price is Falling

Mar 6, 2024

Shares of the NBFC fell 5% in intraday trade as its Q3 earnings handed a reality check.

![]() Why Ambuja Cement Share Price is Falling

Why Ambuja Cement Share Price is Falling

Mar 20, 2023

Ambuja Cement recorded its biggest intraday fall since 2006, tracking a sharp selloff in Adani group stocks.

![]() Can Anyone Learn Trading?

Can Anyone Learn Trading?

Sep 15, 2022

The amazing story of Michelle Williams will convince you that successful trading can indeed be taught and learnt in a classroom.

![]() Why IT Stocks Are Falling Today...

Why IT Stocks Are Falling Today...

Apr 18, 2022

Infosys plunged over 9% intraday after the company posted its earnings. The fall was primarily because brokerage houses lowered their margins.

![]() How to Pick Stocks for Intraday Trading

How to Pick Stocks for Intraday Trading

Nov 5, 2021

In this video, I'll show you how I pick stocks for intraday trading.

![]() Intraday Versus Swing Trading

Intraday Versus Swing Trading

Aug 20, 2021

In this video, I'll show you the nuances between intraday and swing trading.

![]() Earn Faster Intraday Trading Profits

Earn Faster Intraday Trading Profits

Aug 18, 2021

A simple tool that can boost your day trading profits.

![]() These Stocks Are Ready to Zoom

These Stocks Are Ready to Zoom

Aug 2, 2021

These stocks are the best from a traders point of view.

Why You Should Trade

Jun 22, 2021

This is why you should consider making consistent trading profits.

![]() Weekly Market Review: Birla Takes on Tata & Reliance, Upcoming IPOs, and A Crucial Fed Meeting

Weekly Market Review: Birla Takes on Tata & Reliance, Upcoming IPOs, and A Crucial Fed Meeting

Jul 27, 2024

In next week's crucial meeting, the Fed could give an indication as to when the much-anticipated rate hike will happen.

![]() Bulk Deal Alert: Radhakishan Damani Sells Over 290,000 Shares of Andhra Paper

Bulk Deal Alert: Radhakishan Damani Sells Over 290,000 Shares of Andhra Paper

Feb 6, 2024

Radhakishan Damani sold 299,296 shares of this paper stock via a bulk deal, taking the stock down over 9% in intraday trade.

![]() Dealing with Trading Losses

Dealing with Trading Losses

Sep 19, 2022

From personal experience, I can say that ample experience will reduce your turn around time and also help you bounce back faster and harder.

![]() Why Jubilant FoodWorks Share Price is Falling

Why Jubilant FoodWorks Share Price is Falling

Aug 23, 2022

The company's shares were down over 5% intraday yesterday. Here is why...

![]() Nifty 50 - At the Law of Averages

Nifty 50 - At the Law of Averages

Apr 13, 2022

For intraday traders, the gap is filled at 17,530 level and the momentum may shift back to the higher levels towards 17,600-17620 zone.

![]() My September Trading Blueprint

My September Trading Blueprint

Aug 26, 2021

This is how you should trade in September.

![]() How the Taliban Changed our Markets

How the Taliban Changed our Markets

Aug 19, 2021

In this video, I'll show you the immediate impact of the Taliban on our stock market.

![]() Secret Hack of Millionaire Traders

Secret Hack of Millionaire Traders

Aug 10, 2021

Follow this simple hack to boost your intraday trading profits.

![]() What Ails the Market?

What Ails the Market?

Jul 8, 2021

Let me tell you why the bulls are finding it difficult to push the market higher.

![]() Why Did Shares of Divi's Lab Rally Today?

Why Did Shares of Divi's Lab Rally Today?

Jun 10, 2021

The stock jumped 3.6% in intraday trade to hit its 52-week high.

FAQs

What is the secret of intraday trading?

The secret to day trading is simple. Follow a clear trading strategy.

You see, most intraday traders don't follow any strategy at all. They just 'read the tape' and hope for the best.

Or they trade in anticipation of some news that may move a stock intraday.

Rarely do they have a system to fall back on. If you have one, then you will immediately set yourself apart from 99% of intraday traders in the market.

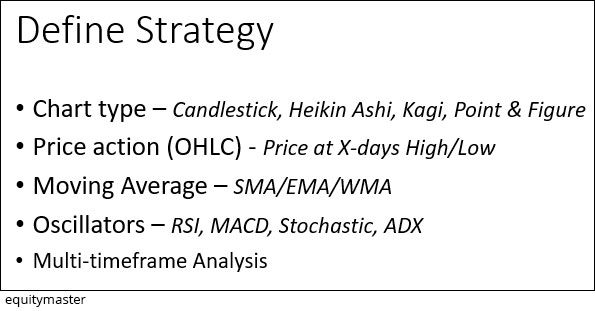

Your intraday strategy must be based in the competent use of short-term technical charts. These will be 3, 5, 15, 25, and 75 minute charts. We suggest using Heikin Ashi candlestick charts.

You should also use technical indicators that are appropriate for intraday trading. The moving average convergence-divergence (MACD), average directional index (ADX), and Relative Strength Index (RSI) are three good choices.

Finally, always trade with a stop loss and follow sound money management principles.

Is intraday trading profitable?

Most intraday traders lose money. This is because they trade without a plan, without a strategy.

Many don't use stop losses. Often, they commit large amounts of capital in a single trade. In such situations, a single bad trade takes a big bite out of their trading capital which is hard to earn back.

To make consistent profits in intraday trading, you need to follow a sound trading strategy. This strategy should be built upon a good grounding in the fundamentals of technical analysis.

It will require some trial and error on your part. It will take some time. But once you have a winning trading strategy, intra-day trading will become profitable.

What is the most successful intraday trading strategy?

There is no single strategy that is consistently successful in any form of trading, including intraday trading. Financial markets are dynamic. Traders all around the world are constantly learning and improving their knowledge and skills.

You will need to do the same. Stay up to date with charting techniques and keep learning all the time.

Soon you will be able to develop your own intraday trading strategy which will beat the market.

What is the difference between trading and investing?

A lot of time people mix up trading and investing in the stock markets. In fact, many a times retail investors aren't even aware if they are investing or trading a stock.

There is a basic difference between the two.

To put it simply, investing is owning a piece of the business. When you're purchasing a stock as an investor, you're not buying a piece of paper. You are buying a stake in the business. Investing is all about looking at the fundamental aspects of a stock and then deciding if that stock is worth buying or not.

Trading, on the other hand, is simply buying a stock based on price. Here, the fundamental aspects of the business are not considered. Traders simply think in price terms. The judgment is simply based on human behavior related to stock price movements. A trader tries to predict how the stock price will move based on the collective action of multiple other players in the market.

Trading or investing - what is better suited for a retail investor?

Trading involves a lot of activity and constant tracking of price movements. A trader normally has to be fully involved with the happenings of a stock market on a daily basis.

For majority of retail investors though, investing is about using savings to get a reasonable rate of return for investment in stock markets. Also, a retail investor might have a day job leaving limited time for him to dedicate to the markets on a daily basis.

Also, long-term investing is less likely to be volatile than trading and might suit the average retail investor.

Considering all these factors, it makes sense for a retail investor to follow the investing approach.

Overall, an individual should follow that he/she is comfortable with and also one that helps them get the best results from the stock market.