India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Outlook Arena

- Best Chemical Stocks in India

Best Chemical Stocks in India

The Indian chemical sector is immensely diversified, covering over 80,000 commercial goods.

It can be divided into bulk chemicals, specialty chemicals, agrochemicals, petrochemicals, polymers, and fertilizers.

It is also one of the most significant contributors to a country’s economy. So much so that the industrial development of a country is measured by gauging the consumption of Sulphuric acid. This is because sulphuric acid is practically used in every important industry and hence is a leading economic indicator.

As per government data, the Indian chemical industry is expected to grow to US$ 304 billion by 2025 at a compound annual growth rate (CAGR) of 15-20%.

This means it could contribute to over 30% of the total manufacturing GDP of US$1 tn expected by 2025.

Massive investments of up to Rs 8 tn are set to flow in the industry by 2025.

A notable segment from the chemical space is the specialty chemical segment where companies have enjoyed FMCG-like PE ratios, time and again.

Now, just like other sectors, the Covid-19 pandemic shook the entire chemical industry owing to supply chain constraints and higher raw material costs.

However, the prospects of the industry look solid, now that government has announced a PLI scheme and as Indian chemical companies make the most of the China plus one strategy.

China plus one is a huge economic shift happening in the world right now. It's a megatrend that is gaining in strength and is long-term in nature.

Large chemical companies are moving some of their manufacturing plants out of China and in to at least one other country. This is usually, Vietnam, Taiwan, Mexico, Thailand, or India.

In India, chemical companies are building an entire ecosystem and increasing capacities along with focusing on forward and backward integration.

India is a serious contender to benefit the most from China plus one, now that the government has sweetened the deal with the PLI (production linked incentive) scheme. Significant investment incentives will allow companies to look for vendors in India.

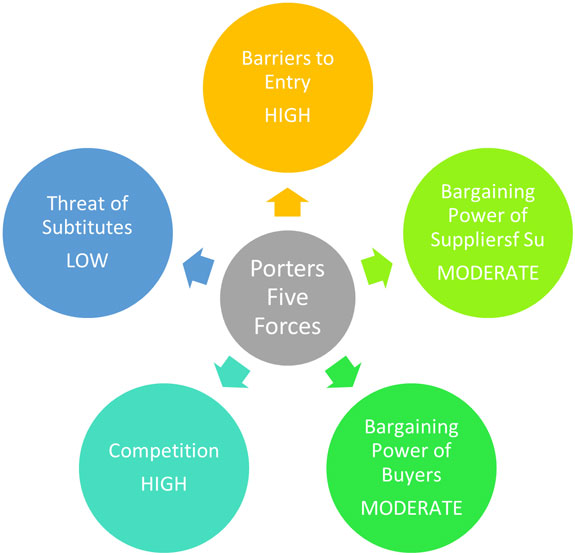

Porter's Five Forces Analysis of the Chemical Sector in India

Porter's Five Forces is a model that identifies and analyzes five competitive forces that shape every industry.

These are barriers to entry, bargaining power of suppliers, bargaining power of customers, threat of substitutes and competition within the industry.

A change in any of the forces normally requires a company to re-assess the marketplace.

Let us have a look at how these five forces shape the chemical sector -

#1 Barriers to Entry

The most attractive segment is one in which barriers to entry are high as they restrict the threat of new entrants.

Conversely if the barriers are low, the risk of new companies venturing into a given market is high.

In the chemical sector, barriers to entry are high. This is because companies looking to enter need to make huge investments in setting up R&D facilities.

Government’s regulations and restrictions also act as a hurdle for incumbents. US, Japan and Europe currently dominate the market.

#2 Bargaining Power of Suppliers

The bargaining power of suppliers is the ability of suppliers to put the firm under pressure. Suppliers may refuse to work with the firm or charge excessively high prices for unique resources.

For the chemical sector, the bargaining power of suppliers is moderate. Small and fragmented suppliers have limited bargaining power.

However, chemical companies can negotiate better rates if they specialize in a niche segment, which leaves buyers with only a limited number of suppliers to choose from.

#3 Bargaining Power of Customers

The bargaining power of customers is the ability of customers to put the firm under pressure. It is high if buyers have many alternatives and low if they have few choices.

In the chemical sector, the bargaining power of customers is moderate.

Companies operating in the chemical sector have many end-customers and they don’t rely on one customer.

On the other hand, switching costs are high which makes companies have long term contracts.

#4 Competition

For most industries, having an understanding of the competition is vital to successfully marketing a product.

The competition in the chemical industry is high. All segments of the industry witness competition from both Indian as well as global players.

#5 Threat of Substitutes

A substitute product uses a different technology to try to solve the same economic need.

This is low for the chemical sector. Buyers usually tend to need specific chemicals as inputs and even if there are substitutes for chemicals, it will most likely be produced by the same industry players.

When to Invest in Chemical Stocks

Of late, too much price volatility in raw materials and the dependence on global and Chinese prices have given chemical stocks the characteristics of a commodity. Hence, they have become cyclical in nature.

Cyclical stocks are usually risker as their fortunes are prone to economic booms and busts.

Generally considered an offensive tactic in investing, cyclical stocks can be used to generate high returns when the economy is doing well.

However, before selecting a stock, check to see whether the industry is due for revival or not.

Key Points to Keep in Mind While Investing in Chemical Stocks

Here are some key points to take note of before you invest in chemical stocks:

#1 Cyclicality of the sectoryc

This is the most important factor one must keep in mind while investing in chemical stocks.

As explained above, chemical stocks possess the characteristics of a commodity which make them cyclical in nature.

Chemicals are used by consumer goods companies as well as automakers to build cars and manufacture tyres. They are also used in the paint industry, pharma, infrastructure, fertilizers and other products for the agriculture industry.

Therefore, the sector’s fortune is strongly correlated with the health of the overall economy.

Therefore, the best time to buy them is at the start of an economic expansion. The best time to sell them is just before the economy begins to slow down.

Investing in a chemical stock at the peak of an economic cycle could result in a huge chunk of the investment being wiped it. Nevertheless, identifying the bottom of the cycle is not an easy task.

#2 Raw material costs

The commodity nature of the chemical sector makes it susceptible to fluctuations in raw material prices and exchange rates which could impact profitability.

The chemical sector is closely linked to the oil industry.

Methanol and petroleum prices are driven by crude price movements and demand-supply dynamics in the international markets.

The availability of raw materials is another factor to look at. The industry uses raw materials that are not easily accessible in the market. They are either highly priced or unavailable in the country.

In the past, there have been instances where companies were not able to procure the key raw materials owing to closure of plants in China.

Therefore, look for companies who have a long-term contract with suppliers and which can pass on some input cost pressure.

#3 Competitve landscape

The chemical market in India is highly competitive, with competition from both Indian and global players.

While the sector is enjoying tailwinds in the form of China plus one, it’s not as easy as it is made out to be. There are other countries like Taiwan, Vietnam, and Thailand also in competition to grab market share from China.

But the opportunity is huge for Indian companies.

China commands 20% share in the global speciality chemical industry worth US$ 800 bn.

Even a 5% shift from China to India will unleash a US$ 8 bn opportunity for specialty chemical companies in India. Within five years, India could double its share in global chemical industry.

#4 Profitability of the company

Before you compare the performance of two chemical companies, say for instance, Aarti Industries vs Vinati Organics, do factor in their operating performance.

Here’s a list of top chemical companies in India based on their consolidated net profit.

| (Rs m) | Net Sales | Total Expenditure | Operating Profit | Net Profit |

|---|---|---|---|---|

| Aarti Industries Ltd. | 68,653 | 49,746 | 18,939 | 12,889 |

| Pidilite Industries Ltd. | 83,402 | 67,415 | 18,290 | 12,686 |

| Tata Chemicals Ltd. | 37,209 | 27,759 | 12,293 | 7,865 |

| Gujarat Fluorochemicals Ltd. | 38,131 | 26,829 | 12,942 | 7,741 |

| Supreme Petrochem Ltd. | 50,323 | 41,257 | 9,371 | 6,633 |

| Atul Ltd. | 49,928 | 41,313 | 9,534 | 6,075 |

| GHCL Ltd. | 37,784 | 27,969 | 9,923 | 5,745 |

| Gujarat Alkalies And Chemicals Ltd. | 37,587 | 27,726 | 10,326 | 5,620 |

| Deepak Nitrite Ltd. | 25,111 | 18,655 | 7,173 | 4,862 |

| Jubilant Ingrevia Ltd. | 48,604 | 40,474 | 8,418 | 4,523 |

Data as of March 2022

#5 Debt to equity (D/E) ratio

A company uses both equity and debt to run a business. However, the amount of debt it uses indicates its fixed obligations. Higher the leverage, higher will be the fixed charges such as interest expense which will lower the profitability.

One must look for a debt to equity ratio of one or less than one.

Here’s a list of top chemical companies in India with low debt to equity ratio.

| (Rs m) | Total Debt | Debt to Equity (x) | Free Cashflow |

|---|---|---|---|

| Balaji Amines Ltd. | 0 | 0 | -87.04 |

| Bhansali Engineering Polymers Ltd. | 0 | 0 | 2980.39 |

| Chembond Chemicals Ltd. | 0 | 0 | 54.38 |

| Chemplast Sanmar Ltd. | 0 | 0 | 2512.84 |

| Diamines & Chemicals Ltd. | 0 | 0 | 142.42 |

| Elantas Beck India Ltd. | 0 | 0 | 326.7 |

| Foseco India Ltd. | 0 | 0 | 159.83 |

| GFL Ltd. | 0 | 0 | 132.36 |

| Heubach Colorants India Ltd. | 0 | 0 | 57.48 |

| India Gelatine & Chemicals Ltd. | 0 | 0 | 55.81 |

Data as of March 2022

#6 Return on Capital Employed (ROCE) ratio

Along with a low debt to equity ratio, one must look for a high return on capital employed (ROCE).

Return on capital employed measures how much profits the company is generating through its capital. The higher the ratio, the better.

An ROCE of above 15% is considered decent for companies that are in an expansionary phase.

Here’s a list of top chemical companies in India with more than 15% in ROCE. We have also mentioned other return rations for reference.

| Company Name | ROA (%) | ROE (%) | ROCE (%) |

|---|---|---|---|

| Andhra Petrochemicals Ltd. | 41.6 | 56.2 | 75.9 |

| Jyoti Resins & Adhesives Ltd. | 13.4 | 54.2 | 72.4 |

| Supreme Petrochem Ltd. | 32.9 | 51.4 | 69.4 |

| Tanfac Industries Ltd. | 32.1 | 49.1 | 68.2 |

| Manali Petrochemicals Ltd. | 37.2 | 46.5 | 62.2 |

| Bhansali Engineering Polymers Ltd. | 37.1 | 42.1 | 56.9 |

| INEOS Styrolution India Ltd. | 25.3 | 37 | 49.9 |

| Punjab Alkalies & Chemicals Ltd. | 15.5 | 38.7 | 47.6 |

| Clean Science and Technology Ltd. | 28.8 | 34.9 | 46.6 |

| Balaji Amines Ltd. | 20.6 | 29.5 | 41.2 |

Data as of March 2022

#7 Valuations

Two commonly used financial ratios used in the valuation of chemical stocks are -

Price to Earnings Ratio (P/E) - It compares the company's stock price with its earnings per share. The higher the P/E ratio, the more expensive the stock.

To find stocks with favorable P/E Ratios, check out our list of stocks according to their P/E Ratios.

Price to Book Value Ratio (P/BV) - It compares a firm's market capitalization to its book value. A high P/BV indicates markets believe the company's assets to be undervalued and vice versa.

To find stocks with favorable P/BV Ratios, check out our list of stocks according to their P/BV Ratios.

For chemical sector, valuations have always remained a concern. Time and again, the specialty chemical segment has been given FMCG-like high PE ratios.

Consider this example. The amines industry in India is a sort of duopoly with Balaji Amines and Alkyl Amines being the only 2 major players. The industry is a niche when it comes to products.

Post Covid, Balaji Amines reported fabulous performance in financial year 2021 and saw its PE ratio expanding from 10-12 to 50 at its peak. A 50x PE ratio for a B2B chemical company.

The stock was trading at life-time highs and the PE ratios weren't justified. It did not make sense to give a chemical maker such high PE, whose products are used as intermediaries.

What followed was a sharp fall in its stock price in the coming months.

Balaji Amines Share Price - 2017 to 2022

This was a sign the market took note of the froth in valuations.

#8 Dividend yields

There is no consistent trend of dividends across the chemical industry, with different companies having different dividend policies.

Here’s a list of top chemical companies in India that score well on dividend yield and dividend payout.

| Company | DPS (Rs) | Dividend Payout (%) | Dividend Yield (%) |

|---|---|---|---|

| INEOS Styrolution India Ltd. | 297 | 161.9 | 30.5 |

| Narmada Gelatines Ltd. | 10 | 49 | 4.8 |

| Andhra Petrochemicals Ltd. | 3 | 11.2 | 3.2 |

| Chembond Chemicals Ltd. | 5 | 76.9 | 2.8 |

| GHCL Ltd. | 15 | 24.9 | 2.7 |

| The Andhra Sugars Ltd. | 4 | 33.5 | 2.6 |

| Alkali Metals Ltd. | 2 | 58.5 | 2.6 |

| Mysore Petro Chemicals Ltd. | 2.5 | 18.8 | 2.4 |

| Bhansali Engineering Polymers Ltd. | 3 | 14.2 | 2.4 |

| Manali Petrochemicals Ltd. | 2.5 | 11.4 | 2.3 |

Data as of March 2022

For more details, check out the top stocks offering high dividend yields.

List of Chemical Stocks in India

The details of listed chemical companies can be found on the NSE and BSE website. However, the overload of financial information on these websites can be overwhelming.

For a more direct and concise view of this information, you can check out our list of chemical stocks.

You can also check out the latest chemical sector results.

Best Sources for Information on the Indian Chemical Sector

Indian Brand Equity Foundation Chemical Sector Report - https://www.ibef.org/industry/chemical-industry-india

Department of Chemicals and Petrochemicals - https://chemicals.nic.in/

Dyestuffs Manufacturers Association of India - https://dmai.org/

So there you go. Equitymaster's detailed guide on the best chemical stocks in India is simple and easy to understand. At the same time, it offers detailed analysis of both the sector and the top stocks in the sector.

For more details, you can check out our list of chemical stocks.

Here's a list of articles and videos on the chemical sector and top chemical stocks in India. This is a great starting point for anyone who is looking to explore more about chemical stocks and the chemical sector.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

![]() Most Wanted Chemical Stocks of 2024

Most Wanted Chemical Stocks of 2024

Nov 13, 2024

These chemical stocks have been fund managers' top picks for the last four quarters. More details inside...

![]() Why Sudarshan Chemical Share Price is Rising

Why Sudarshan Chemical Share Price is Rising

Oct 14, 2024

The volume ramp-up from the recent capex on top of healthy domestic demand could improve the company's margins further.

![]() Top Specialty Chemical Shares in India 2024: Specialty Chemical Companies to Add to Your Watchlist

Top Specialty Chemical Shares in India 2024: Specialty Chemical Companies to Add to Your Watchlist

Jun 25, 2024

As global economic conditions improve; India's specialty chemical sector is poised for significant growth in 2024. Here are top companies in this space for potential investment opportunities.

![]() Top 5 Specialty Chemical Stocks Poised for A Rebound

Top 5 Specialty Chemical Stocks Poised for A Rebound

Apr 13, 2024

Despite near term headwinds, these five chemical stocks are primed for growth.

![]() 5 Beaten Down Speciality Chemical Stocks Poised to Make a Comeback Soon

5 Beaten Down Speciality Chemical Stocks Poised to Make a Comeback Soon

Mar 13, 2024

It's high time these speciality chemical stocks get out of their consolidation phase and make a big comeback.

![]() JG Chemicals IPO: 5 Things to Know

JG Chemicals IPO: 5 Things to Know

Mar 2, 2024

From grey market premium to price band, here's everything you need to know about the upcoming IPO of this leading chemical company.

![]() Top 10 Chemical Stocks that Could Benefit from the Booming EV Battery Supply Chain

Top 10 Chemical Stocks that Could Benefit from the Booming EV Battery Supply Chain

Jan 4, 2024

These chemical companies are vying for a major slice of the pie of the EV battery supply chain.

![]() Capitalize on Specialty Chemical Boom with these Top 5 Mutual Funds

Capitalize on Specialty Chemical Boom with these Top 5 Mutual Funds

Dec 10, 2023

The market for specialty chemicals in India has grown to be an essential part of the country's economic development. To benefit from this sector's growth potential one may consider mutual funds with high exposure to specialty chemical stocks.

![]() The EV Battery Race is Speeding up with this Multibagger Stock's Entry

The EV Battery Race is Speeding up with this Multibagger Stock's Entry

Dec 7, 2023

Indian companies, big and small, are scrambling to figure out how they can make the most of the EV battery technology in differentiated ways.

![]() Top Performing Chemical Stocks of 2023. Take a Look...

Top Performing Chemical Stocks of 2023. Take a Look...

Nov 24, 2023

These chemical stocks have delivered multibagger returns so far in 2023. What does 2024 have in store?

![]() Why Aarti Industries Share Price is Falling

Why Aarti Industries Share Price is Falling

Nov 12, 2024

Here's how weak quarterly results are dragging down this specialty chemical company's share price.

![]() Which Company Manufactures Speciality Chemicals in India?

Which Company Manufactures Speciality Chemicals in India?

Aug 11, 2024

Speciality chemicals industry in India are experiencing rapid growth. Here are top manufacturing stocks to track.

![]() Best Chemical Stock: Deepak Nitrite vs SRF

Best Chemical Stock: Deepak Nitrite vs SRF

May 4, 2024

The Indian chemical sector is finally out of the woods and these two companies are all set to ride the growth wave.

![]() Why India Pesticides Share Price is Falling

Why India Pesticides Share Price is Falling

Mar 18, 2024

India Pesticides tanks 45% in a month. More pain down the road?

![]() Why Rallis India Share Price is Rising

Why Rallis India Share Price is Rising

Mar 8, 2024

Shares of the agrochemical company surged over 13% in yesterday's trading session to hit a yearly high.

![]() Best Specialty Chemical Stock: Alkyl Amines vs Balaji Amines

Best Specialty Chemical Stock: Alkyl Amines vs Balaji Amines

Jan 22, 2024

The China plus one strategy and 'Make in India' initiatives are pushing the growth of the specialty chemicals industry. Which company stands to benefit the most?

![]() Why PI Industries Share Price is Falling

Why PI Industries Share Price is Falling

Dec 13, 2023

Despite growth in the agrochemical sector, PI Industries share price fell over 10% in two trading sessions. Here's why.

![]() Beaten Down Smallcap Stock Joins the Green Hydrogen Race

Beaten Down Smallcap Stock Joins the Green Hydrogen Race

Dec 9, 2023

From commodity chemicals to green energy, this smallcap company could stage a turnaround with its recent foray.

![]() Why Fine Organic Share Price is Falling

Why Fine Organic Share Price is Falling

Nov 30, 2023

Shares of Fine Organic Industries continue to trade lower in 2023, tumbling around 26% so far. Find out why.

![]() Why Sigachi Industries Share Price is Rising

Why Sigachi Industries Share Price is Rising

Nov 16, 2023

Shares of the company hit a new 52-week high after it reported Q2 results. Find out other reasons driving the rally.