Our Big Prediction

This Could be One of the Exciting Opportunities for Investors

- Home

- Outlook Arena

- Best Agriculture Stocks in India

Best Agriculture Stocks in India

The agriculture industry in India is one of the oldest industries in India. It has been providing food to the people of India for centuries. It is also the largest employer of workforce within the country.

Today, it comprises of enterprises or companies that are involved in cleaning, processing, storing or packing various types of products that are mainly obtained from agricultural production.

The sector has experienced buoyant growth in the past two years. It accounted for a sizeable 18.8% (2021- 22) in GVA (gross value added) of the country registering a growth of 3.9% in 2021-22.

With its strength in agriculture, India has also become a major contributor to the global food supply.

As per figures released by the Directorate General of Commercial Intelligence and Statistics (DGCI&S), the agricultural exports have grown by 19.92% during 2021-22 to touch US$ 50.2 bn.

The growth rate is remarkable as it is over and above the growth of 17.7% at US$41.9 bn achieved in 2020-21 and has been achieved in spite of the logistical challenges during the pandemic.

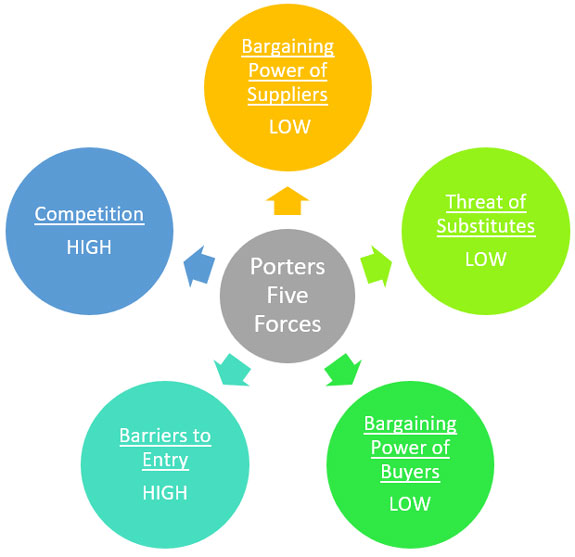

Porter’s Five Forces Analysis of the Agriculture Sector in India

Porter's Five Forces is a model that identifies and analyzes five competitive forces that shape every industry.

These are barriers to entry, bargaining power of suppliers, bargaining power of customers, threat of substitutes and competition within the industry.

A change in any of the forces normally requires a company to re-assess the marketplace.

Let us have a look at how these five forces shape the agriculture sector -

#1 Barriers to Entry

The most attractive segment is one in which barriers to entry are high as they restrict the threat of new entrants.

Conversely if the barriers are low, the risk of new companies venturing into a given market is high.

In the agriculture sector, barriers to entry are high, as it requires high capital investment, technical expertise and know-how.

#2 Bargaining Power of Suppliers

The bargaining power of customers is the ability of suppliers to put the firm under pressure. Suppliers may refuse to work with the firm or charge excessively high prices for unique resources.

This is low in the agriculture industry, due to the number of sellers in the open market.

#3 Bargaining Power of Customers

The bargaining power of customers is the ability of customers to put the firm under pressure. It is high if buyers have many alternatives and low if they have few choices.

In the agriculture sector, the bargaining power of customers is low, as there is a minimum support price set by the government for certain agriculture products. The minimum support price is a guaranteed price for the produce from the Government.

#4 Competition

For most industries, having an understanding of the competition is vital to successfully marketing a product.

The competition in the agriculture industry is high, due to a large influence of the unorganized sector in the industry.

Existence of brand loyalty in certain products towards existing firms such as Amul in case of butter, limits competition in these products.

#5 Threat of Substitutes

A substitute product uses a different technology to try to solve the same economic need.

This is low for the agriculture industry as there is no substitute for products such as milk, fresh fruits and vegetables.

Porters Five Forces Analysis of the Paper Sector in India

When to Invest in Agriculture Stocks

The best time to buy stocks from this sector is when companies that have strong fundamentals are trading at attractive valuations.

Key Points to Keep in Mind While Investing in Agriculture Stocks

Here are some key points to take note of before you invest in agriculture stocks.

#1 Weather Risk

Weather is the biggest risk where agriculture stocks are concerned.

Of the total annual crop losses in the agriculture sector, many are due to direct weather and climatic effects such as drought, flash floods, untimely rains, frost, hail, and storms.

Bad weather also interrupts business processes, supply chains and consumer movements, among other things.

This can impact the agricultural yield which in turn can impact the performance of the business and the stock price.

#2 Crude Oil Prices

Crude oil prices have a constant effect on the agriculture industry.

Rapid increases in the price for fuel can have a devastating effect on logistics costs, and a sudden fall could result in short-term boosts in profit and a surge of competition within the market to provide consumers with the lowest price.

Hence, look for companies that have the ability to pass on these costs and restructure or strategize their operations to ensure continued profit.

Also, look for companies that hedge crude prices with derivative contracts.

#3 Investment in Technology

Experts believe the technological revolution in agriculture sector might be the biggest revolution after the green revolution.

Agritech, as the word suggests, is a combination of agriculture and technology. It refers to the use of technological innovations in agriculture to increase yield, quality, efficiency, and profitability.

Therefore, when investing in agriculture stocks look for companies that are investing heavily in technology. Estimates show that India's Agritech industry has the potential to reach about US$ 24 bn in revenue by the year 2025, with current penetration being only 1%.

#4 Profitability of the company

Profitability is the primary goal of all business ventures. Without profitability the business will not survive in the long run. So, measuring current and past profitability and projecting future profitability is very important.

Here’s a list of top agriculture companies in India based on their consolidated net profit.

| Company Name | Net Profit (Rs in m) | Net Profit Margin (%) |

|---|---|---|

| Tata Consumer Products Ltd. | 8,858 | 8.7 |

| Balrampur Chini Mills Ltd. | 5,147 | 9.3 |

| Gujarat Ambuja Exports Ltd. | 4,754 | 10.2 |

| Triveni Engineering & Industries Ltd. | 3,822 | 7.8 |

| Dalmia Bharat Sugar And Industries Ltd. | 2,953 | 9.8 |

| E.I.D. - Parry (India) Ltd. | 2,835 | 6.7 |

| Kaveri Seed Company Ltd. | 2,089 | 21.9 |

| Dhampur Sugar Mills Ltd. | 1,470 | 6.7 |

| CCL Products (India) Ltd. | 1,272 | 14 |

| Dhampur Bio Organics Ltd. | 1,036 | 6.6 |

| Tata Coffee Ltd. | 1,018 | 9.9 |

Data as of March 2022

#5 Debt to equity (D/E) ratio

A company uses both equity and debt to run a business. However, the amount of debt it uses indicates its fixed obligations. Higher the leverage, higher will be the fixed charges such as interest expense which will lower the profitability.

One must look for a debt to equity ratio of one or less than one.

Here’s a list of top agriculture companies in India with a low debt to equity ratio.

| Company Name | D/E Ratio |

|---|---|

| Indag Rubber Ltd. | 0 |

| Kaveri Seed Company Ltd. | 0 |

| Tata Consumer Products Ltd. | 0.07 |

| Gujarat Ambuja Exports Ltd. | 0.13 |

| Dhunseri Tea & Industries Ltd. | 0.14 |

| E.I.D. - Parry (India) Ltd. | 0.15 |

| Andrew Yule & Company Ltd. | 0.18 |

| Warren Tea Ltd. | 0.18 |

| B&A Ltd. | 0.21 |

| Dalmia Bharat Sugar and Industries Ltd. | 0.35 |

| Kanco Tea & Industries Ltd. | 0.39 |

Data as of March 2022

#6 Return on Capital Employed (ROCE) ratio

Along with a low debt to equity ratio, a one must look for a high return on capital employed (ROCE).

Return on capital employed measures how much profits the company is generating through its capital. The higher the ratio, the better.

An ROCE of above 15% is considered decent for companies that are in an expansionary phase.

Here’s a list of top agriculture companies in India with more than 15% in ROCE.

| Company Name | ROCE (%) |

|---|---|

| E.I.D. - Parry (India) Ltd. | 39.6 |

| Gujarat Ambuja Exports Ltd. | 30.7 |

| B&A Ltd. | 29.7 |

| Bombay Burmah Trading Corporation Ltd. | 24.5 |

| Pix Transmissions Ltd. | 24.1 |

| Simran Farms Ltd. | 23.8 |

| Triveni Engineering & Industries Ltd. | 19 |

| Kaveri Seed Company Ltd. | 17.6 |

| K.M. Sugar Mills Ltd. | 17.6 |

| Harrisons Malayalam Ltd. | 15.8 |

| Balrampur Chini Mills Ltd. | 15.8 |

| CCL Products (India) Ltd. | 15.7 |

Data as of March 2022

#7 Valuations

Investing in stocks requires careful analysis of financial data to find out a company's true worth. However, an easier way to find out about a company's performance is to look at its financial ratios.

The commonly used financial ratios used in the valuation of agriculture stocks are -

Price to Book Value Ratio (P/BV) - It compares a firm's market capitalization to its book value. A high P/BV indicates markets believe the company's assets to be undervalued and vice versa.

To find stocks with favorable P/BV Ratios, check out our list of stocks according to their P/BV Ratios.

Price to Earnings Ratio (P/E) - It compares the company’s stock price with its earnings per share. The higher the P/E ratio, the more expensive the stock.

To find stocks with favorable P/E Ratios, check out our list of stocks according to their P/E Ratios.

#8 Dividend yields

There is no consistent trend of dividends across the industry, with different companies having different dividend policies.

For more details, check out our list of top agriculture stocks offering high dividend yields.

Top Agriculture Stocks in India

The top agriculture stocks in India can immensely benefit with so many factors positively affecting the industry.

Here are the top stocks in India which score well on crucial parameters.

Best Sources for Information on the Agriculture Sector

Department of Agriculture & Farmer Welfare - https://agricoop.nic.in/en

Indian Brand Equity Foundation Agriculture & Allied Industries Sector Report - https://www.ibef.org/industry/agriculture-india

So there you go. Equitymaster's detailed guide on the best agriculture stocks in India is simple and easy to understand. At the same time, it offers detailed analysis of both the sector and the top stocks in the sector.

Here's a list of articles and videos on the agriculture sector and top agriculture stocks in India. This is a great starting point for anyone who is looking to explore more about agriculture stocks and the agriculture sector.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

![]() Which Companies Manufacture Fertilizers in India?

Which Companies Manufacture Fertilizers in India?

Sep 28, 2024

Traditionally, fertilizers have been crucial for boosting crop yields and ensuring food security, but the focus is now shifting towards quality and environmental responsibility.

![]() Why RCF Share Price is Rising

Why RCF Share Price is Rising

Jun 21, 2024

Fertilizer stocks have seen a steep jump after this recent government announcement. RCF shares have shot up more than 30% in the past 5 days.

![]() Indian Agritech Stock With a Great Future

Indian Agritech Stock With a Great Future

Apr 10, 2024

Driven by AI, this stock riding a megatrend.

![]() Why Coromandel Share Price is Falling

Why Coromandel Share Price is Falling

Jan 31, 2024

Coromandel share price drags 15% in a month. Here's why?

![]() Why Fertilizer Stocks are Rising

Why Fertilizer Stocks are Rising

Oct 17, 2023

Fertilizer Stocks Surged Up to 20%. What triggered this rally?

![]() Watch Out for Upside in Agritech Stocks

Watch Out for Upside in Agritech Stocks

Aug 30, 2023

Pidilite and Polycab have multiplied 11 times and 7 times respectively. This stock could follow suit.

![]() Dolly Khanna Raises Stake in this Smallcap Fertilizer Firm

Dolly Khanna Raises Stake in this Smallcap Fertilizer Firm

Jul 7, 2023

Here's why the ace investor raised his stake in the company after paring it in the March 2023 quarter.

![]() Top 5 Fertilizer Companies in India by Growth

Top 5 Fertilizer Companies in India by Growth

Jan 24, 2023

Fertilizer stocks are trending with bullish momentum as the street is expecting bumper harvest due to normal monsoon. Watch out for these five companies which are high on growth.

![]() India's Agriculture Focus: The Top Fertilizer Companies in India to Watch Out For

India's Agriculture Focus: The Top Fertilizer Companies in India to Watch Out For

Dec 29, 2022

Top 5 fertiliser stocks that need to be in your watchlist for 2022.

![]() Invest in Fertilizer Stocks

Invest in Fertilizer Stocks

Nov 24, 2022

If you're looking to investing in fertilizer stocks, watch this video.

![]() Why Fertilizer Stocks are Rising

Why Fertilizer Stocks are Rising

Jun 21, 2024

Fertilizer stocks Chambal Fertilizers, NFL and others zoom 20% in a day. Here's what is brewing.

![]() Fertilizer and Agriculture Stocks Get a Boost in Modi 3.0. Top Stocks for Your Watchlist

Fertilizer and Agriculture Stocks Get a Boost in Modi 3.0. Top Stocks for Your Watchlist

Jun 12, 2024

These stocks will benefit from the government's farmer orientation.

![]() This Fertilizer Smallcap Stocks Forays into Crop Nutrition Segment

This Fertilizer Smallcap Stocks Forays into Crop Nutrition Segment

Feb 22, 2024

The company is first private player to foray into Nano Urea. Boosting growth or risky expansion?

![]() Nova Agritech IPO: 5 Things to Know

Nova Agritech IPO: 5 Things to Know

Jan 20, 2024

From grey market premium to price band, here's everything you need to know about the upcoming IPO of this agricultural company.

![]() Top 5 Fundamentally Strong Smallcap Stocks to Watch Out for in 2024

Top 5 Fundamentally Strong Smallcap Stocks to Watch Out for in 2024

Oct 1, 2023

These 5 small-cap stocks are well-poised to deliver strong returns in 2024 and beyond.

![]() Agritech Stock with Pidilite and Polycab like Upside

Agritech Stock with Pidilite and Polycab like Upside

Aug 16, 2023

The stocks of Pidilite and Polycab have multiplied 11 times and 7 times respectively over the past decade and since listing.

![]() This Fertilizer Company Forays into Specialty Chemical Sector. A Bold Move?

This Fertilizer Company Forays into Specialty Chemical Sector. A Bold Move?

Mar 27, 2023

After being a top player in the fertiliser industry for years, this company plans to move into the specialty chemical space. How will this new venture pan out?

![]() Why Did Dolly Khanna Sell Stake in this Fertilizer Stock?

Why Did Dolly Khanna Sell Stake in this Fertilizer Stock?

Jan 9, 2023

The Chennai based investor recently sold stake in this agriculture company. Find out why.

![]() 5 Agrochemical Stocks to Watch Out For in 2023

5 Agrochemical Stocks to Watch Out For in 2023

Nov 25, 2022

India's renewed focus on agriculture and the agrochemical sector could attract investors to these stocks.

![]() Why Deepak Fertilisers Share Price is Falling

Why Deepak Fertilisers Share Price is Falling

Nov 21, 2022

Deepak Fertilisers was on a dream run last year. However, the winds have changed in a month as the stock has come under pressure.