India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Outlook Arena

- Auto Ancillary Sector Stocks in India

Auto Ancillary Sector Stocks in India

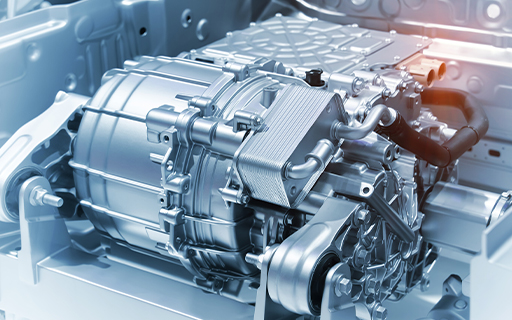

The auto ancillary industry in India is over US$ 50 bn in size as per IBEF. It's quite large and as such, is critical part of the Indian economy.

The industry is about 7.1% of India's GDP and employs about 5 million people in the country.

It's also one of the biggest exporting industries in India. The industry exports over 25% of its annual output.

India has emerged as a global auto component hub and the industry has set an ambitious export target of US$ 80 bn by 2026.

The auto ancillary eco-system in India is fairly robust and mature with a large number of companies operating in various niches. Some of these firms are world class. Within the industry, India has a competitive advantage globally in areas such as fasteners, bearings, and shafts.

India also has a labour cost advantage of about 15-20% over western nations in the global auto component market.

Government policies toward the industry over the years have been favourable. 100% FDI is allowed under the automatic route.

The recent trend towards electric vehicles had brought opportunities as well as challenges to the industry. Many firms will face a disruption in their business models while others will be relatively unaffected.

A large domestic market, solid advantages in the export market, a rising middle class in India with growing spending power, are the main driving forces of the Indian auto ancillary industry.

For a list of auto ancillary stocks in the Indian stock market please click here.

Also do read Equitymaster's auto ancillary sector report.

![]() Cash in on Stocks Pivoting to Ride the EV Era

Cash in on Stocks Pivoting to Ride the EV Era

Oct 15, 2024

Traditional companies in auto ecosystem could pivot to a profitable EV future.

![]() Top 5 Stocks to Play the Long-Term Upside in India's Auto Ancillary Exports Megatrend

Top 5 Stocks to Play the Long-Term Upside in India's Auto Ancillary Exports Megatrend

Sep 22, 2024

With the government's increased attention on auto ancillary exports, let's look at the top 5 stocks in this sector.

![]() Top 5 Auto Ancillary Stocks Witnessing Massive Growth

Top 5 Auto Ancillary Stocks Witnessing Massive Growth

Sep 1, 2024

These five automotive component stocks offer promising growth opportunities, driven by the robust Indian automotive market and the global trend towards electric vehicles.

![]() Not Another Kodak. Bharat Forge and Castrol Could Thrive in the EV Era

Not Another Kodak. Bharat Forge and Castrol Could Thrive in the EV Era

Aug 14, 2024

Traditional companies in the auto ecosystem could pivot to a profitable EV future.

![]() Hi-Tech Gears: The Auto Ancillary Stock That's Growing Like Tesla, up 87% in a Month

Hi-Tech Gears: The Auto Ancillary Stock That's Growing Like Tesla, up 87% in a Month

Apr 14, 2024

Nemish Shah, the man who took Infosys public, holds around 7.2% stake in this company.

![]() Bulk Deal Alert: Sunil Singhania Buys Fresh Stake in this Multibagger EV Stock

Bulk Deal Alert: Sunil Singhania Buys Fresh Stake in this Multibagger EV Stock

Dec 21, 2023

According to the latest bulk deal data, Sunil Singhania recently acquired a substantial stake in this auto-ancillary stock.

![]() Why Munjal Auto Share Price is Rising

Why Munjal Auto Share Price is Rising

Nov 24, 2023

Munjal Auto is on a winning streak of hitting new 52-week highs in the last five trading sessions.

![]() Craftsman Automation is Gearing up to Lead India's Futuristic Auto Industry

Craftsman Automation is Gearing up to Lead India's Futuristic Auto Industry

Nov 10, 2023

This midcap company is making the most of the disruption in the automobile sector.

![]() ASK Automotive IPO: 5 Things to Know

ASK Automotive IPO: 5 Things to Know

Nov 6, 2023

From grey market premium to price band, here's everything you need to know about one of the leading auto ancillary players.

![]() Ashish Kacholia's Block Deal Spurs 20% Rally in this Multibagger Auto Ancillary Stock

Ashish Kacholia's Block Deal Spurs 20% Rally in this Multibagger Auto Ancillary Stock

Aug 25, 2023

This microcap stock has rallied over 50% in the past five days. Apart from Kacholia's bullish stance, what's driving the rally?

![]() Vijay Kedia Buys Almost 1% Stake in this Underperforming Auto Ancillary Stock

Vijay Kedia Buys Almost 1% Stake in this Underperforming Auto Ancillary Stock

Oct 15, 2024

In a surprising stance, the ace investor has doubled down on this stock.

![]() 2 EV Stocks with Good Potential

2 EV Stocks with Good Potential

Sep 4, 2024

These two fundamentally strong stocks can thrive in the era of electric vehicles.

![]() Hero Motors: Auto Ancillary Major Files for Rs 9 Billion IPO

Hero Motors: Auto Ancillary Major Files for Rs 9 Billion IPO

Aug 27, 2024

Hero Motors, India's e-bike tech leader, independent of Hero MotoCorp, gears up to transform the auto ancillary space.

![]() Multibagger Midcap Stock Secures Big Contract to Supply Critical Components to Tesla

Multibagger Midcap Stock Secures Big Contract to Supply Critical Components to Tesla

Apr 22, 2024

Tesla diversifies its supply chain with second Indian EV partnership. What next?

![]() Vijay Kedia and Dolly Khanna Trim Stake in this Multibagger Auto Ancillary Stock

Vijay Kedia and Dolly Khanna Trim Stake in this Multibagger Auto Ancillary Stock

Jan 10, 2024

Find out why the seasoned investors turned bearish on this multibagger stock despite robust earnings.

![]() Bulk Deal Alert: Rakesh Jhunjhunwala Adds 1% Stake in this Auto Ancillary Stock, Triggering 20% Rally

Bulk Deal Alert: Rakesh Jhunjhunwala Adds 1% Stake in this Auto Ancillary Stock, Triggering 20% Rally

Nov 30, 2023

Three reasons why Rekha Jhunjhunwala acquired 90,006 shares of this company via a bulk deal on 29 November 2023.

![]() The #1 Investment Theme for 2024

The #1 Investment Theme for 2024

Nov 17, 2023

This industry is poised for significant growth in the coming years, especially in 2024 with elections just around the corner.

![]() Smallcap Auto-Ancillary Stock Down 15% in 2 Days After Ashish Kacholia Pares Stake

Smallcap Auto-Ancillary Stock Down 15% in 2 Days After Ashish Kacholia Pares Stake

Nov 9, 2023

The company makes a wide range of aesthetic products catering to segments including two-wheelers, passenger vehicles, commercial vehicles, consumer durables, and appliances.

![]() Rakesh Jhunjhunwala & Associates Increase Stake in this Multibagger Realty Stock

Rakesh Jhunjhunwala & Associates Increase Stake in this Multibagger Realty Stock

Sep 22, 2023

Rekha Jhunjhunwala recently picked up additional stake in this multibagger realty company. What's brewing?

![]() Why Talbros Automotive Share Price is Rising

Why Talbros Automotive Share Price is Rising

Jul 7, 2023

Shares of this auto ancillary firm are up over 90% in the past three months. A healthy order book suggests the company is all set to win the race against its peers.