Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Savings of RS 6,050 on Our

Small Cap Research?

- Home

- Outlook Arena

- Growth vs Value Investing

Growth vs Value Investing

Investing is a multi-disciplinary activity.

We have investors like Benjamin Graham who believed that all forecasting exercise is useless.

The best way to make money in the stock market is to buy cheap undervalued stocks priced below book value, and let the mean reversion play.

And then there are investors like Warren Buffett who have successfully transitioned from one style to the other, from looking at present to having an idea of future, and made money from it.

Both have worked in the past.

However, in the recent years, the conventional value investors have lagged behind the growth investors.

The FAANG stocks are in fashion, and investors seem willing to pay any price for them.

This raises an interesting debate about what works - Value or Growth?

And which camp you should belong to in order to maximize your wealth.

Value Vs Growth Investing - A Comparison

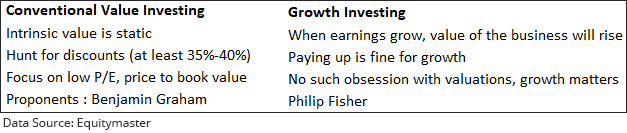

Before making such a choice, it will be good to understand the nuances of growth investing and value investing.

You see, at the center of conventional value investing is the assumption that intrinsic value of a company mostly doesn't change.

It's about buying a stock whose intrinsic value one figure out to be Rs 100 at a discount of 35% - 40%, and then sell as soon as the stock reaches intrinsic value.

Put differently, buying at Rs 60 to Rs 65 and selling when the price reaches Rs 100.

Stocks that belong to this camp include PSUs like GMDC, Coal India, ONGC, OIL India, among others.

Growth investing, on the other hand, is about investing in stocks of companies where earnings are expected to grow at a higher than normal rate.

Unlike value investors, growth investors are willing to pay up while buying growth stocks.

Stocks perceived as growth stocks include Alkyl Amines, Vinati Organics, Avanti Feeds, Moldtek Packaging Ltd, among others.

List of Value Stocks in India

Using the conventional definition of value investing, you could access the screened list of most undervalued stocks (on price to book value basis) here.

It includes stocks like, NTPC, SAIL , RICO Auto, Aegis Logistics etc.

List of Growth Stocks in India

Further, using the screener, here's the list of companies that have shown healthy growth rates in the sales and income.

It includes stocks like Bajaj Finance, Natco Pharma, Deepak Nitrite, etc.

The Selling Criteria for Value and Growth Stocks

Why selling the stock is an individual decision, value investors typically exit the stock when the stock price approaches mean or intrinsic value.

Often, it is price to book value metric used to assess relative valuation of conventional value stock.

On the other hand, growth investors are likely to continue holding the stock as long as the business witnesses growth, irrespective of returns made on the stock.

Overtime, as earnings expand in growth stocks, the P/E ratio may not look expensive with increase in the denominator. No wonder than many FMCG stocks like Nestle, Hindustan Unilever command high P/Es.

The valuation ratios used to assess relative valuation of typical growth stocks include P/E, the PEG (price to earnings growth), price to sales, Enterprise Value/EBITDA (EV/EBITDA) etc.

Value vs Growth Investing - The Pitfalls

With Sensex valuation over 30 times P/E, finding value is difficult, and markets are likely to be obsessed with growth stories.

However, the biggest blunders and costliest mistakes too are committed during these times. When liquidity is abundant, most stocks rise, irrespective of fundamentals.

And growth narratives are framed and validated temporarily by the momentum.

It's only when the liquidity wave recedes, people realise that most businesses were swimming naked. What people had thought was a growth story was actually a Ponzi scheme.

And not just that.

What price you pay matters. If you ever feel tempted to pay any price for growth, think of the lost decade for HUL.

As such, when you analyse and try to identify growth stocks, beware of these pitfalls.

Similarly, the pitfall in case of value investing is you could just get carried away by optically low /cheap valuations.

The intrinsic value, for a dying or fading business, is not constant but keeps falling. You might end up catching a falling knife if only valuations are what you are obsessed with.

Coming to the most critical question...

Which camp you should belong to in order to maximise your wealth - Value or Growth?

Both the approaches have worked in the past if you look at the history over the last few decades.

However, in the recent years, the conventional value investors have lagged behind the growth investors.

Let's see from some examples:

Here's the list of companies I believe would have looked attractive to a conventional value investor in 2015, and their returns over a period of 5 years.

Value Stocks : Performance Snapshot I

| Price to Book Value | |||

|---|---|---|---|

| Company Name | 5 Year CAGR Returns (%) | 2020 | 2015 |

| Steel Authority Of India Ltd. | -9 | 0.4 | 0.5 |

| Shipping Corporation Of India Ltd. | -8.5 | 0.3 | 0.6 |

| Gujarat State Fertilizers & Chemicals Ltd. | -0.8 | 0.4 | 0.6 |

| Reliance Power Ltd. | -44.5 | 0.1 | 0.8 |

| Noida Toll Bridge Company Ltd. | -28.1 | 0.3 | 0.9 |

| REC Ltd. | -5.7 | 0.5 | 0.9 |

| Bank Of Baroda | -24.3 | 0.3 | 0.9 |

| Vedanta Ltd. | -2.2 | 0.5 | 1 |

Had conventional value investing been your core philosophy, you would have ended up with losses on an annual basis. These stocks were sure available well before their book value 5 years ago.

But their price to book value has only slid down further

But let's not jump to any conclusions yet.

The same approach would have delivered great results with another set of value stocks. Do note that all the returns are on a CAGR (compound annual growth rate) basis.

Value Stocks: Performance Snapshot II

| Price to Book Value | |||

|---|---|---|---|

| Company Name | 5 Year CAGR Returns (%) | 2020 | 2015 |

| Gujarat Narmada Valley Fertilizers & Chemicals Ltd. | 26.8 | 0.6 | 0.3 |

| Godawari Power & Ispat Ltd. | 35.5 | 1 | 0.3 |

| Hindalco Industries Ltd. | 16.1 | 0.9 | 0.5 |

| Seshasayee Paper & Boards Ltd. | 23.7 | 0.8 | 0.7 |

| Maithan Alloys Ltd. | 41.1 | 1.1 | 0.7 |

| Manappuram Finance Ltd. | 46.7 | 2.5 | 0.8 |

| DCM Shriram Ltd. | 24.4 | 1.3 | 0.9 |

| Phillips Carbon Black Ltd. | 37.9 | 1.3 | 0.9 |

Let's compare this to the performance of 'growth investing'.

Growth Stocks : Performance Snapshot I

| Price to Book Value | Price to Earnings | ||||

|---|---|---|---|---|---|

| Company Name | 5 Year CAGR Returns (%) | 2020 | 2015 | 2020 | 2015 |

| CRISIL Ltd. | -1.4 | 16.5 | 16.7 | 48.1 | 66.4 |

| Glaxosmithkline Pharmaceuticals Ltd. | -1.7 | 13.2 | 13.7 | 239.3 | 82.9 |

| Symphony Ltd. | -3.1 | 9.1 | 21.7 | 36.6 | 56 |

| Motherson Sumi Systems Ltd. | -0.6 | 5.6 | 13.4 | 56.5 | 53.2 |

| Ajanta Pharma Ltd. | -0.3 | 5.2 | 14.3 | 31.1 | 39.9 |

| Kajaria Ceramics Ltd. | 4.8 | 5.2 | 8.6 | 40.4 | 35.5 |

| La Opala RG Ltd. | -5 | 4.3 | 14.4 | 38.4 | 61.9 |

5 years ago, these so-called 'growth stocks' were available at valuations that would disgust classic bargain hunters.

And they might feel validated looking at the returns.

I hope you agree that justifying growth investing approach would be difficult, even for its staunchest supporters, given the results it has offered.

But again, this is just half the picture.

Here's another set of stocks that might have found favour with growth investors and would have made them proud.

Growth Stocks: Performance Snapshot II

| Price to Book Value | Price to Earnings | ||||

|---|---|---|---|---|---|

| Company Name | 5 Year CAGR Returns (%) | 2020 | 2015 | 2020 | 2015 |

| Hindustan Unilever Ltd. | 22.4 | 51.7 | 29.8 | 74.6 | 39.7 |

| Astrazeneca Pharma India Ltd. | 28 | 28.1 | 21.3 | 154.7 | 150.4 |

| Asian Paints Ltd. | 18.7 | 20.5 | 17.7 | 88.1 | 56.5 |

| Relaxo Footwears Ltd. | 20.2 | 12.9 | 14.9 | 83.1 | 51.2 |

| Jubilant FoodWorks Ltd. | 23.8 | 26.9 | 14.1 | 231.8 | 87.6 |

| Pidilite Industries Ltd. | 21.6 | 17.3 | 10.8 | 89.6 | 47.7 |

| Bajaj Finserv Ltd. | 27.3 | 27.1 | 10.7 | 142.5 | 198.3 |

| DFM Foods Ltd. | 27.2 | 11.5 | 9.8 | 70 | 40.6 |

| Titan Company Ltd. | 28.4 | 16.6 | 9.2 | 124.4 | 44.3 |

| PI Industries Ltd. | 26.2 | 6.9 | 9.1 | 68.7 | 34.5 |

| Tata Consultancy Services Ltd. | 16.9 | 12.2 | 8.9 | 34.5 | 23.9 |

Value Vs Growth Investing: The Winner is...

I know what you are thinking. None of this analysis helps to come to any conclusion on which approach wins. Or is likely to deliver results in the future.

Well, I believe that's the answer.

There is no data that proves that one particular approach is superior to the other.

I believe value and growth cannot be segregated. They are not mutually exclusive.

We have seen cases where the book values have eroded overtime due to bad business models in the first place.

And buying them would have made no sense at any discount to book value, no matter how attractive. They were classic cases of value traps or falling knives.

You cannot just look at price to book value multiples, or even past growth rates and make a smart selection of stocks that could guarantee you good results.

It ultimately boils down to knowing the businesses you invest in.

A stock that has delivered poor returns on capital across cycles and continues to be heavy in debt, is unlikely to offer a good return no matter how attractive the valuations look.

Further, when you are picking growth stocks, relying on past growth numbers will not be enough. You have to be reasonably confident that the growth is sustainable and virtuous in nature i.e. the incremental growth comes with high return on invested capital.

In other words, every time one reinvests in the business, the return on incremental capital should remain high.

If you can find such businesses, it would not hurt to enter their stocks at seemingly high multiples, that a typical value investor will never even consider.

I would like to conclude this with the wise words from Charlie Munger :

Basically, all investment is value investment in the sense that you're always trying to get better prospects that you're paying for.

Here are Links to Some Very Insightful Equitymaster Articles and Videos on Value and Growth Investing

- Value Vs Growth Investing: And the Winner Is...

- The Art of Value Investing

- Is Value Investing Dead?

- Growth v/s Value Investing: Which Is Better Of The Two In Current Times?

- Basics of Value Investing

Happy Investing!