Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Savings of RS 6,050 on Our

Small Cap Research?

- Home

- Outlook Arena

- Best Stocks to Buy Today

Best Stocks to Buy Today

Have you received stock tips from your brokers, friends, and family?

If you ask them for their rationale they will probably say the source of the tip is someone 'reliable'.

Is this the best way to go about putting your hard-earned money into stocks?

Most of these tips are just passed on as messages without any background checks. Investors who rely on these sources often end up losing their money.

What if there was a way to identify the best stocks out there on your own?

Is there a way to invest wisely in the stock market?

The answer is yes, and you've come to the right place.

Here's a detailed guide on how you can go about buying the best stocks in the Indian stock markets today.

We will take this subject one topic at a time. Let's start with the allocation you should keep in mind when you buy stocks.

The Allocation to Keep in Mind When You Buy Stocks Today

Investors have a number of queries related to investing in stocks.

The topmost being, "How and where do I allocate my money in equities so as to get the best results?"

Usually, brokers are of little help. They spout some well-rehearsed statement involving jargon and heavy words. Well-meaning friends too, don't always give you a clear picture.

Stock markets tend to be very volatile. Putting too much money in a single stock or sector can be very risky.

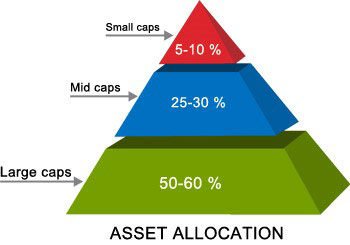

Based on their relative riskiness, we have created an asset allocation pyramid that can help you in deciding how much money you should invest in a stock.

However, please note that the allocation levels could differ from person to person depending on individual risk appetite.

Here's the asset allocation pyramid for your equity portfolio:

Here are some more useful links to set your equity allocation foundation when you buy stocks today:

- Importance of Asset Allocation Before You Buy Stocks Today

- Portfolio Building with Large Cap, Mid Cap, and Small Cap Stocks

- Planning for Stocks to Buy According to Your Needs

How to Decide Which Stocks to Buy Today?

With the Indian stock market at their volatile best (or worst), these are indeed difficult times for deciding which stocks to buy today.

At every rise, market participants take the opportunity to book profits, with sentiment being as yet apprehensive.

In such times, what could be the best strategy to use as a long-term investor?

We are of the firm belief that if by following a disciplined process of investing, you can accumulate significant wealth over the long-term.

Here are some pointers and questions to answer before buying stocks today...

- Assessing your time horizon. Are you a trader or an investor?

- If you are an investor, do you have the patience and the ability to keep emotions in check?

- Have you done your homework before investing your hard-earned money in stocks?

- Keep on following up...

This is an indicative process to use while deciding to buy stocks.

We certainly believe it is necessary to invest according to a disciplined process. This is the best way to make money in any market, bull, or bear, across economic and market cycles.

Checklist to Use Before Buying Stocks Today

Here are some factors that long-term investors must look at while buying stocks today and taking an investment decision:

Understand the Business Model

The very first thing any investor must look at is the business/sector that the company operates in.

The real intrinsic value of a business could only be found by researching the business model of the company thoroughly.

Management of the Company

The management is another extremely important factor to consider before investing in any company.

To identify the best stocks, management quality plays a vital role in a company's success. It's not just about stocks. It's just as true for any organisation, however small or large it may be.

Competition in the Industry

The company's competition is another major factor an investor should look at before deciding to buy (or not to buy) that company's stock.

Look for companies with strong moats. Having a strong moat enables a company to command higher profit margins and superior return on capital.

Financial Analysis

This, of course, is one of the major factors that most investors already look at before buying a stock.

It includes doing a detailed study about the company's financial position and performance over a reasonably long period of time.

Knowing that the company's stock you are investing in is fundamentally sound is so comforting. You know there aren't going to be any negative surprises. Even if there are some uncertainties, you can be rest assured the company will bounce back.

Dividend Yield

Dividends are a form of income from stocks. Regular dividend-paying companies provide some comfort that their profits and cash flows are stable enough to keep paying dividends each year.

A healthy dividend policy should be looked at before buying a stock.

Valuations of the Company

Finally, the last step in deciding whether or not to buy a stock - the valuations.

The business model, management, fundamentals, and market positioning of the company may be the best.

But if the stock is trading at valuations that are unwarranted, then it is not worth buying.

If you've studied the company well enough and have a good handle on its valuations, there's little else you need.

To conclude, you should look at metrics like long term ROEs, robust operating cash flows, lean balance sheets, managements credibility, and transparency in the books of accounts to judge 'Safety & Quality'.

The Equitymaster Way to Buy Stocks Today

'What courses should students take if they want to become successful investors?'

This was a question put forward to the value investing legend Warren Buffett during one of his company's AGMs.

And as is the case with most of the things he does, the Oracle's answer was all simplicity.

He was of the view that in order to be a successful investor there are only two things that matter. These are the ability to value businesses and an understanding of how the markets work.

Value investing - The Style We Are Devoted To

If investing isn't about buying a stock at a discount from the determinable intrinsic value of the company, then it can't be anything else.

This cardinal principle propounded first by Benjamin Graham, the father of value investing. It stands as strong today as when it was first introduced about 7-8 decades ago.

In fact, if anything, its appeal has only increased, reinforced by the numerous success stories that the discipline has spawned.

None bigger than that of Warren Buffett, who is one of the richest men in the world, solely on the basis of few value investing principles handed down to him by Benjamin Graham and the ones that he steadfastly stuck to.

At Equitymaster, we are totally devoted to value investing to buy stocks and would not ever give up this approach for anything else.

Our sole aim is to find stocks to buy with strong competitive advantages, impressive past track record and an honest and capable management team that are trading at a discount from their intrinsic value. We then recommend these stocks to our subscribers.

We firmly believe that investing is a marathon and not a sprint. In other words, we have no place for tricks or methods that encourage short term thinking and promise investors multi-fold returns in a very short period of time.

We are all about sensible long-term investing.

Given that businesses evolve over time and take years to prove themselves, how can it be any different?

Here's more on value-investing approach to buy stocks...

Value Investing Approach to Buy Stocks Today

Warren Buffett's glorious investing journey started from the basics of value investing.

We believe you too can start your investing journey here...from the very basics of value investing.

Value investing is an investment approach that seeks to profit from identifying undervalued stocks.

It is based on the idea that each stock has an intrinsic value, i.e. what it is truly worth.

Through fundamental analysis of a company, we can determine what this intrinsic value is. The idea in value investing is to buy stocks that trade at a significant discount to their intrinsic values (i.e. they are cheaper than their true value).

Once we buy an undervalued stock, the stock price eventually rises towards its intrinsic value, and makes a profit for us in the process.

Value investing is conceptually simple, though requires effort to implement.

The research process focuses on finding out the intrinsic value of a company and the primary tool for researching a company is called fundamental analysis.

To understand these bits of value investing more closely, you can check out our page: Basics of Value Investing.

10 Books to Help You Buy the Best Stocks Today

The guys over at farnamstreetblog.com, a blog some of us regularly follow, ran a very interesting survey.

Since the blog is all about gaining wisdom, it surveyed people on the book they believed had the most page-for-page wisdom of all the books they've read in their lifetimes.

You can get the list from here.

Some books on the list are indeed absolute gems!

However, the survey did another thing for us. It triggered a thought in us. What if we conduct a similar survey about books on investment only?

Well, we did just that and asked each of our team members to reveal their all-time favourite investment book.

Before we reveal the list to you, we would also like to guess what investment book would be on the list of some of the greatest contemporary value investors in the world.

Although we haven't done a survey on this, we are pretty sure that the book 'The Intelligent Investor' by Benjamin Graham will be a cinch to be in the top 10 if not the highest ranked book.

At least we are making it as one of our recommended reads.

In fact, Warren Buffett, arguably the best investor the world has ever seen, feels that his investing education started and ended with this gem of a book by Benjamin Graham.

Buffett argues that had it not been for Graham's work, he would have gone another 100 years still trying to figure out the stock market.

So smitten he is by the book that he calls the book's chapters 8 and 20 as the two most important essays ever written on investing.

And not just him, there are scores of other very successful value investors who speak of the book in equally glowing terms.

If you haven't read the book yet, we believe you should pick up a copy as soon as you can.

Now, to the list that our research team feels are a must-read for investors, both experienced as well as the ones who are just starting out:

- The Intelligent Investor - Benjamin Graham

- Security Analysis - Benjamin Graham

- One Up on Wall Street - Peter Lynch

- Common Stocks and Uncommon Profits - Philip Fisher

- The Little Book that Builds Wealth - Pat Dorsey

- Buffett: The Making of an American Capitalist - Roger Lowenstein

- Value Investing: From Graham to Buffett and Beyond - Bruce Greenwald

- 100 to 1 in the Stock Markets - Thomas Phelps

- Poor Charlie's Almanac - Peter Kaufman

- Accounting for Value -Stephen Penman

So, there it is.

A treasure trove of books whose principles, if closely adhered to, can help you in understanding stock markets and in buying stocks, and make you grow your wealth enormously over the long-term.

Top Resources to Identify Which Stocks to Buy Today

Investors make decisions on which stocks to buy based on certain factual information. Subsequently, they make future assumptions based on, and in support of, those facts.

As such, knowing how an industry and a company functions is very important. In addition, it is equally important to gain such information from proper and reliable sources.

We present here a basic idea of where you can go about looking for information on stocks you wish to invest in.

Sources of Information on Companies:

- Offer Documents: One of the best sources for understanding a particular sector or industry is the offer document of the company, if one can get hold to one.

- Annual Reports: In case you cannot get hold of the company's offer document, given that the company has been listed on the stock exchanges for long, the annual report comes in handy.

- BSE/NSE Announcements and Company Press Releases: Apart from annual reports, it is the official company documents such as press releases, announcements, and presentations which are released in regular intervals. The source for such information is the BSE or NSE websites and the company's website.

- Business Dailies and Other Media: Newspapers and news channels are a great medium for gaining updates on companies. Interviews with managements provide good information on the company's views, plans and strategies.

- Equitymaster Database: You can also visit Equitymaster's database by clicking on this link. Here you will be able to view information relating to companies' historical numbers and business profile. You will also be able to view reports on key sectors.

Now that we know where one can gather information before investing in stocks, it's also important to understand the various aspects of a stock and a company.

From profit and loss account to balance sheets and cash flow statements, let us go back to basics and understand each of these in more detail.

In the below links to articles, we try to bring to you the basics of investing. They act as guideposts to unraveling the mystery behind the financial statements which help you in deciding which stocks to buy.

Here they are...

Introduction to Financial Statements

Introduction to Balance Sheets

Introduction to Cash Flows from Operations

Key Ratios Related to the Cash Flow Statement

To know more, you can check out the entire series on this topic here: Investing: Back to Basics Series

Equitymaster's Screener Reveals the Best Stocks to Buy Today

Now that you have read about how you can go about buying stocks, here's the million-dollar question - Which are the cheapest stocks to buy in the Indian share market today?

Indeed, this is a difficult question to answer...but we are here to help you get started!

Find your answer right away with Equitymaster's Advanced Stock Screener!

Here are links to some of these screeners:

Cheapest PE Stocks to Buy Today

Best Dividend Yield Stocks to Buy Today

Cheapest P/BV Stocks to Buy Today

Best Earnings Yield Stocks to Buy Today

Top BSE Sensex Stocks You Can Buy Today

Top NSE Nifty Stocks You Can Buy Today

Multibagger Stocks to Buy in Indian Stock Markets Today

What if we told you there's a method to easily identify potential multibaggers while investing in Indian stock markets?

You probably won't believe us. That's okay. We understand the skepticism.

But it is possible. There is a way.

It's not a guaranteed method but given enough time, it works.

And more importantly, it's simple to understand.

Dive in to the guide below and know the simplest way to find safe multibagger stocks:

Pick the Best Multibagger Stocks in 2021

The Wealth-Building Secret to Stock Picking

What is better 'Buy and Hold' or moving in and out of the stock market?

Given how the stock markets work and that no one has a crystal ball, 'Buy and Hold' looks like a much better strategy to invest in stocks over the long run.

However, moving in and out of the stock market can give you much better returns provided you take care of this one important principle.

In fact, if successfully implemented, this principle can outperform Buy and Hold many times over.

What exactly is this principle and how does one go about successfully implementing it?

Do take a look...

Stocks to Buy, Sell, and Hold Today

With coronavirus spreading far and wide, countries across the globe have started implementing second wave lockdown.

Global financial markets are witnessing brunt of this situation. The up and down nature of Indian stock markets will continue amid the coronavirus crisis.

Naturally, investors are confused as to what they should do? Buy, Hold or sell their stocks today.

In the video below, we explain the current scenario and what are the type of stocks investors should Buy, Hold, or Sell in the current crisis.

FAQs on Best Stocks to Buy Today

1. How to pick the best stocks to buy in India?

Here's the checklist you should use to pick the best stocks to buy in India:

- Understand the company's business model

- Evaluate the company's management

- Check competition in the industry

- Study the company's financial performance over a reasonably long period of time

- See how the company treats dividend

- Last but not least, check valuations of the company

These are some factors that long-term investors must look at while buying the best stocks in India today.

You can visit Equitymaster's database where all this information is readily available.

2. How do I decide what shares to buy?

Before buying shares, you should ask yourself whether you are a trader or an investor and assess your time horizon.

If you are an investor, have the patience and the ability to keep emotions in check. Do your homework before investing your hard-earned money in stocks and keep following up.

Check out Equitymaster's Advanced Stock Screener. This tool will help you get started on which stocks to buy.

3. Stocks to buy for the long term?

The stock market is like a maze. You need a blueprint to navigate it successfully.

When you're looking for stocks to buy for the long term, look for safe stocks. These stocks have strong fundamentals and capable managements.

Identify safe stocks and hold on to them for the long term.

Safe stocks can be found in every category of market capitalization -large caps, mid-caps and small-caps. The important point to remember here is the risk profile of each category.

As your experience will tell you, stock markets tend to be very volatile. And putting too much money in a single stock or sector can be very risky.

We have created an asset allocation pyramid that can help you in deciding how much money you should invest in a stock. However, it must be noted that the allocation levels could differ from person to person depending on individual risk appetite.

Here are Links to Some Very Insightful Equitymaster Articles on Best Stocks to Buy Today

- Why ITC and not HUL is my Idea of a Good Investment Right Now

- Stocks that Could Shine More than Gold After Diwali

- Rakesh Jhunjhunwala's Rs 500 Crore Bet on Tata Motors: A Sixer or a Hit-Wicket?

- The Real Upside in Kotak - IndusInd Bank Merger

- Richa's #1 Stock Pick for 2021

- Don't Let Brokerages Fool You into Buying HUL & Nestle. The Real Money is in These Stocks Right Now...

- Why This Attractive 'Silver' Stock With 9% Dividends Is Not a Buy

- My 5 Best Trading Ideas for Diwali

- Stocks to Ride the Covid-19 Rebound

- What to Expect from Stocks during Covid Second Wave?

- The Best Trading System

- How Smart Traders Could Have Made 1.25 Lakh in Just 22 Days