Our Big Prediction

This Could be One of the Exciting Opportunities for Investors

- Home

- Outlook Arena

- The Best Bluechip Stocks to Buy

The Best Bluechip Stocks to Buy

Until the 1990s, the fortunes of the Indian cricket team, rested on the shoulders of the star batsmen.

Be it Pataudi or Gavaskar or Tendulkar.

They were the stars who won matches. Without them the team fell like a pack of cards.

In the stock market, the fortunes of the Sensex and Nifty have come to rest on a few star performers over the years.

The bulk of investor money goes to them.

And investors firmly believe that only these stocks could create wealth over the long-term.

But the fact is the performance of index stocks will, at best, trail the index over the long-term.

If you are looking to make big gains in bluechips over the next decade, then you need to look beyond the Sensex stocks.

You see, a lot of the quality bluechips are not just restricted to the Sensex alone.

If you widen your horizon a bit and look at, let's say, the BSE 200 index, you will find quite a few bluechip stocks that are set to deliver handsome gains over the long-term.

The Search for the Next Infosys...

A few years ago, any research analyst would tell you, the Infosys results were the most happening days of the year!

I would've said the same.

The Infosys result was not an ordinary event. It was then a bellwether like no other. Its profits would literally lift the market mood.

The reverse was also true. If the company's earnings guidance was not up to expectations, the market would fall.

There was good reason for this.

Infosys did not just survive the dotcom bust. It created phenomenal wealth for shareholders ever since.

And thanks to its weightage on the index, the direction of Infosys' profits signaled the direction of the Sensex.

This was the trend for years. Infosys kept outdoing itself in terms of profitability and creating stock market wealth.

Everyone was in search for the next Infosys.

But as India's IT sector lost some shine, Infosys too lost some glory.

It was no longer the first to declare quarterly results. Nor were the results awaited by the markets with bated breath.

Corporate governance issues at the company has turned away many discerning investors.

One thing is amply clear: The next Infosys is not going to be Infosys.

Infosys results hardly move the markets anymore.

Most investors no longer dig into Infosys results to search for the next multibagger. However, the results do offer us an important cue.

Infosys is making a dramatic shift from its reliance on bread-and butter IT services such as multi-year support contracts. It has attributed its healthy profits to the focus on digital technologies.

The company is already feeling the pressure from some of its smaller peers. They are far ahead in terms of their digital capabilities. Even the attempt to catch up with them is showing a benign result on Infosys' bottomline.

So, this is what you need to take away from the Infosys result: The multibagger bluechips of the next decade will very different from the ones of the past.

Look out for these Key Characteristics of Multibagger Bluechips...

There is an easy way to track what could help stocks have a long runway of superlative returns. That is to find good qualities in their quantitative characteristics.

Here's what you should look for:

Capital efficiency

The companies able to generate consistently high returns on their shareholders' equity. The idea is the more profitable the company gets, the more value it will create.

Low leverage

Minimal debt (debt to equity ratio) is extremely important for companies to tide over periods of tight liquidity and high interest rates.

Profitability with low capex

Companies that have already done the hard work of building plants and machinery for future growth, are typically in a ripe phase to benefit from their efforts.

Scope for PE expansion

Stocks with low PE multiples tend to have a huge room for PE expansion if the business and management move in the right direction.

If I must pick just one characteristic that has been the key catalyst of these multibagger stocks, it would be their PE expansion.

Larger the PE expansion higher has been the quantum of returns for the top multibaggers.

Look at the top gainers in the table below...

| Gains (%) | No. of Companies | Avg PE 2009 | Avg PE 2019 |

|---|---|---|---|

| 4,000 to 10,000 | 6 | 6.5 | 51.1 |

| 1,000 to 3,999 | 48 | 20.4 | 60.1 |

| 500 to 999 | 50 | 25.1 | 42.2 |

| 100 to 499 | 121 | 26.5 | 32.2 |

| 10 to 99 | 61 | 22.2 | 29.9 |

The top 100 odd companies which gained up to 1000% had extraordinary fundamentals.

But what really made the difference between them and the 10,000% gainers was the difference in the expansion of the PE multiples.

The Biggest Bluechip Wealth Creators

Technology has the power to change lives over time.

There was a time when digital cameras, computers, and smart phones never existed.

But when they came into existence, these technologies brought about a tectonic shift to multiple business.

And something similar could happen with a technology called IoT (Internet of Things).

IoT allows physical things embedded with sensors, software, electronics, and connectivity, to exchange information with other connected devices.

Imagine a world in the future where an autonomous vehicle picks you up for work.

It starts your favourite music playlist the moment you're inside.

It makes a quick stop for your morning coffee.

It gets you safely to work on time.

All this, without you having to reach your wallet or your phone. This is how devices enabled with IoT, could transform our everyday lives.

This technology is important because it could transform the growth rates of multiple business.

I mean businesses as diverse as healthcare, automobiles, financial services, retail and agriculture.

Now, as an investor looking for multibaggers, you can't settle for the usual stock screener. You can't just look for tried and tested businesses or the most popular brands.

Your stock screener should tell you that the price to earnings growth (PEG) of your favourite stock could be a fraction of what it is today.

Let me explain...

If you could accurately predict their earnings growth, companies like L&T, Titan, HDFC Bank, Asian Paints, and Pidilite would have seemed dirt cheap two decades back.

And these are the kind of returns you would have fetched over past two decades...

Titan - 45,977%

HDFC Bank - 4,586%

Asian Paints - 10,255%

Pidilite - 17,514%

The PEG of each of these stocks was well below 1 then.

But they would have seemed mouthwatering if you could foresee their consistent and high double-digit profit growth.

In fact, if you consider the PEG of BSE 200 stocks a decade back, ones which were below PEG of 1 have had formidable returns.

The risk here, of course, is overestimating the earnings growth and overpaying for the stock.

Buying stocks that are currently valued below PEG of 1 reduces the risk of overpaying to quite an extent.

But buying business that are currently below PEG of 1 and where earnings could compound at faster rates, for decades, can be a jackpot.

Of course, such stocks would be the rarest of rare.

But I believe IoT could offer such an opportunity to few businesses.

Bluechips can also Destroy Wealth of You Aren't Careful

There are times when news headlines suggest that market euphoria is at its peak.

The Wall Street Journal carried similarly euphoric headlines in the early 1970s.

It talked about how the 'Nifty Fifty' were the best of the best stocks - Coca-Cola, McDonald's, GE, PepsiCo, Pfizer, American Express, Xerox, Dow Chemical, Johnson & Johnson, Merck, Disney, P&G, AT&T, Gillette, Lubrizol, Kodak...

So, no one raised an eyebrow when the journal called these 'one direction stocks'. Everyone on Wall Street agreed: They could only go up!

Investors, big and small, loaded up on them. The PE ratio reached insane levels. At the peak, the index traded at a PE multiple of 94 times!

Then, just like all bubbles before and since...the bubble burst.

Some Nifty Fifty stocks lost up to 75% of their value. Kodak eventually went bankrupt.

What about Indian stocks?

Turns out, it is rare for the NSE Nifty to trade at a valuation above 22x.

And when it does, buying even the biggest blue chips has come with a huge downside for long-term investors.

Returns from NSE Nifty at Over 22x PE Multiple

The data is clear. When the Nifty trades above 22x, there is typically a 60-70% chance of losing money even in bluechip stocks.

But wait!

You cannot buy the best blue chips by following index trends. Rather, you need to take a contrarian view on the best bluechip businesses.

For the past fifteen years, we have told subscribers to buy blue-chip stocks with a safety-first approach. Always.

In StockSelect, we recommend blue chips when the downside risk in valuations is negligible.

But there are also times when the market completely misses out on the earnings trend.

The earnings upside itself makes some stocks inherently safer. At such times, it doesn't take a genius to figure out where the odds are better.

Returns from Bluechips vs Smallcaps

Investors often wonder if they should exit bluechips whenever smallcaps are expected to rally.

That is precisely the wrong way to allocate money towards equities.

There is certainly logic in buying few attractive and sturdy smallcaps.

But chasing a whole lot of them while unduly exposing your portfolio to too much risk is never a great idea.

Plus, I believe that bluechips in certain categories, like the tech stocks I pointed out earlier, will continue to find takers despite the rally in smallcaps.

Also, like I have explained in my video, the long-term consistency of bluechips over mid and smallcaps will always help sturdy bluechips prevail.

In fact, such sturdy bluechips with consistent growth in return ratios can handsomely trounce the returns from smallcaps over decades.

Bluechips Post Covid-19

Some called the market correction in March 2020 a 'carnage'. Some called it a 'bloodbath'.

For the current generation of investors, the over 20% correction in the benchmark Sensex is 'unprecedented'.

The crash, in March 2020 was certainly the most severe in a decade.

So, finding the best coronavirus crash trade was on everyone's mind.

As if on cue, legendary Peter Lynch offered a simple advice on beating the index, in a late December 2019 interview, just before the crash began...

If you only invest in an index, you'll never beat it.

Lynch's advice was simple. Staying glued to the index can do no good during a market crash. Waiting for the index to go lower, may also not be the best strategy.

Lynch went on to say...

More people have lost money waiting for corrections and anticipating corrections than in the actual corrections. I mean, trying to predict market highs and lows is not productive.

The best way to look at a market crash, through a safety prism, is NOT how much lower the Sensex could go.

Rather, assess how much damage can it do to the moats and profitability of safest bluechips, over the long term.

It turns out that the coronavirus crisis could, in fact, be an inflection point for the irreversible Rebirth of India megatrends.

As companies across the globe seek to diversify geographic risks post this crisis, India could see a big spurt in new factory capacities and fresh fund inflows.

This trend can widen the moats of the strongest bluechips and also help multiply their profits 4 to 8 times over the next decade.

Just in case you need more proof; the profits of bluechips (BSE 200 companies) are currently at a decade low.

Therefore, a rebound in profits is overdue.

Investors who take advantage of a market crash to pick the choicest bluechips, at bargain prices, will be riding the best bluechips, over the long-term.

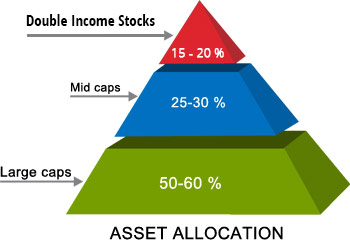

How Much Should One Invest in Bluechip Stocks?

By virtue of their size, conspicuous media presence and relative transparency of financial transactions, bluechips can be considered safer than midcaps and smallcaps.

However, you cannot take their safety for granted.

There are several bluechips that have eroded shareholder wealth and bit the dust due to poor capital allocation, lack of corporate governance, and management apathy.

So, investors should bear in mind that all bluechip stocks are NOT wealth creators...even over the long-term.

However, bluechip stocks are the safest bets for investors with a low risk appetite.

And for any equity portfolio, the allocation to bluechip stocks tends to be the least volatile across market cycles.

So, we recommend holding at least 60% of one's total equity portfolio in bluechip stocks.

Further, we believe that a single bluechip stock should ideally not comprise more than 5-6% of the total money allocated towards equities.

Which are the Best Bluechip Stocks to Buy Now?

Well, let me repeat.

Buying the best bluechip stocks does NOT mean picking a few from the Sensex or Nifty.

My safety-first approach to buying bluechips has been tried and tested over 18 years.

In the past, it has produced returns like...

- 3,309% in L&T in less than 8 years.

- 2,740% in Voltas in around 7 years.

- 1,821% in M&M in less than 7 years.

And within six months of the March 2020 crash, I have recommended booking profits on Bajaj Holdings, Cipla, Bharat Electronics, and Godrej Consumer to the tune of 29 - 41%.

I strongly believe my framework to pick pick the best bluechips offers one of the safest ways to create long-term, permanent wealth.

Happy Safe Bluechip Investing!

Tanushree Banerjee

Editor, StockSelect

Equitymaster Agora Research Private Limited (Research Analyst)

FAQS on The Best Bluechip Stocks to Buy

1. What are Bluechip stocks?

This terminology comes from the game of poker, where the blue chips carry the highest value.

A blue-chip stock is the stock of a company that is a dominant leader in its well-established business.

Usually, these companies are run by proficient leaders and reward their shareholders with high dividends.

Some of the top blue-chip stocks of India are Infosys, TCS, the HDFC and HDFC Bank etc.

2. How to identify good bluechip stocks?

Most bluechip stocks share the following common characteristics:

- They are market leaders running well-established businesses.

- They have a long history of high growth and robust returns.

- They reward their shareholders with consistently high dividends.

So you can either look for companies with these characteristics or simply log on to Equitymaster.com. They have a screener that lists out the top blue-chips stocks in the country.

Here are Links to Some Very Insightful Equitymaster Articles and Videos on Bluechip Stocks

- The Safe Stocks Series: How to Avoid Unsafe Companies Like IL&FS

- How to Grow Your Wealth with Safe Stocks: First, Don't Sell Any of Them

- Turn Off Your TV to Make Money from Sensex 100,000

- How Kotak Bank and HUL Became Crorepati Stocks

- How to Buy the Best Safe Stocks in 2020

- Will Bluechips Lose Luster After 25-25-25 Directive for Multicap Funds? (video)