Our Big Prediction

This Could be One of the Exciting Opportunities for Investors

- Home

- Outlook Arena

- How to Invest in the Share Market

How to Invest in the Share Market

The stock market has fascinated people for over a century now. Stocks are even seen by many as the quickest way to get rich.

However, there are indeed very few investors who see the stock market and stocks in the right perspective.

To most, these are just tickers of prices going up and down. If your ticker goes up, you make money. If it goes down, you lose. That's both the start and the end of the story.

But the thoughtful investor is more discerning than that.

He looks at stocks not just as quotes going up and down, but as real, live businesses in action.

Go one step further and one realise that stocks can be one of the most fabulous asset classes to invest in.

They are a vehicle and mechanism that provides ordinary individual investors with some amazing advantages and opportunities. These advantages are unparalleled by any other asset class.

Let us take this subject one topic at a time. Let's start with why you should be investing in stock markets.

Why Invest in Stock Markets?

Here are six reasons why, if you've not invested in stocks yet, you will definitely want to start this year:

- Opportunity to Own an Existing Business: When you buy a stock, you get to buy a stake in an already existing business with the huge advantage that business already has all its employees and infrastructure in place, and is already up and running. You straightaway get a claim on the businesses future profits (in your proportion of ownership) without any of the headache or effort involved in running it.

- Liquid Asset: Buying stocks, you instantly rid yourself of all the above problems. You can instantly buy and sell your stake in the business with a single phone call or a few clicks on your computer.

- A Basket of Choice: You can buy only if you really like something. It would be a truism to say that you will try to find the most profitable business being sold at the cheapest price. The point is the stock market enables you to make such a choice.

- Low Capital Investment: Think about this. Even if you plan to start a small grocery store in your neighborhood, you will have to stake a substantial amount of money on the success of just one venture that may or may not take off as planned. Compare this to buying a stake in a business in the stock market. You can get a piece of the action with even just a few hundred rupees, let alone lakhs and crores.

- Less Hassles: With stocks, the price is right there for you to see. No hassles of negotiating with the opposite party. The brokerage is usually pretty low too. This helps ensure that a substantial part of your investment is not eaten up by frictional costs.

- Prospect of Higher Returns: One thing at the very core of choosing to run a business instead of investing your money in a bank fixed deposits the expectation of higher returns on your investment. Thus, businesses usually strive to earn returns much higher than your run-of-the- mill investments. The trick is to buy a stock that has shown that it can accomplish this with reasonable certainty, and to buy it at a good price.

So those were some of many reasons why you should start considering investing in stock markets.

The next questions are...

Is the stock market a good place to park your hard earned money?

And is there any way to navigate the investing world successfully?

Let us answer these questions...

Is the Stock Market a Good Place to Invest These Days?

The stock market is like a maze. You need a blueprint to navigate it successfully.

Without a blueprint in hand, investors must rely on hearsay. Usually, from other uninformed investors.

It's a case of blind leading the blind!

And none of them even recognize they're lost.

This is the worst way to invest in the stock market.

There is a better way...

You must first find a successful, tried-and-tested blueprint for stock investing. Spend some time understanding this blueprint. Then, and only then, take the plunge.

You need to know what to do. You need to know how to do it. You need to know when to do it. Only then can you expect to make money in the market, and keep it too.

As long as you keep investing purely with reference to value and cut out all the other noise, there's no question you will make big money in the stock market.

The Blueprint for Investing in Stock Market

With the Indian stock market at their volatile best (or worst), these are indeed difficult times for investors.

At every rise, market participants take the opportunity to book profits, with sentiment being as yet apprehensive.

In such times, what could be the best strategy to use as a long-term investor?

We are of the firm belief that if by following a disciplined process of investing, you can accumulate significant wealth over the long-term.

Here are some pointers and questions one can answer before entering the stock markets...

- Assessing your time horizon - are you a trader or an investor?

- If you are an investor, do you have the patience and the ability to keep emotions in check?

- Have you done your homework before investing your hard-earned money in stocks?

- Keep on following up...

This is an indicative process to use while going about investing in equities.

We certainly believe it is necessary to invest according to a disciplined process. This is the best way to make money in any market, bull, or bear, across economic and market cycles.

Checklist for Making an Investment Decision

Here are some factors that long-term investors must look at while taking an investment decision:

Understanding the Business Model

Undoubtedly, the very first thing that any investor must look at is the business/sector that the company operates in.

The real intrinsic value of a business could only be found by researching the business model thoroughly.

Management of the Company

The management is another extremely important factor to consider before investing in any company. At the end of the day, it is the management that will be the driving force behind the future direction and success (or failure) of the company.

To identify the best stocks, management quality plays a vital role in a company's success. It's not just about stocks. It's just as true for any organisation, however small or large it may be.

Competition in the Industry

The company's competition is another major factor an investor should look at before deciding to buy (or not to buy) that company's stock.

Look for companies with strong moats.

Having a strong moat enables a company to command higher profit margins and superior return on capital.

The stronger these advantages are, the more difficult it is for competitors to take the market share away from the company and put pressure on prices.

Financial Analysis

This, of course, is one of the major factors that most investors already look at. It includes doing a detailed study about the company's financial position and performance over a reasonably long period of time.

Such a study is commonly known as 'fundamental analysis'.

Knowing that the company you are investing in is fundamentally sound is so comforting. You know there aren't going to be any negative surprises. Even if there are some uncertainties you can be rest assured the company will bounce back sooner or later.

Dividend Yield

Dividends are a form of income from shares and regular dividend-paying companies do provide some comfort that their profits and cash flows are stable enough for them to keep paying dividends each year.

Dividend income is one of the most desirable passive income source. Along with strong corporate governance and good growth prospects, a healthy dividend policy is crucial for investing well.

Valuations of the Company

Finally, the last step in deciding whether or not to buy a stock - the valuation phase.

While the business model, management, fundamentals, and market positioning of the company may be the best, if the stock is trading at valuations that are unwarranted, then it is not worth buying the stock.

If you've studied the company well enough and have a good handle on its valuations, there's little else you need.

At the end of the day, we believe that investing in shares is all about conviction. If you are not convinced about the company, then do not stake your hard-earned money.

To conclude, you should look at metrics like long term ROEs, robust operating cash flows, lean balance sheets, managements credibility and transparency in the books of accounts to judge 'Safety & Quality'.

Sources of Information for Investing in Share Markets

You have probably received stock tips and recommendations from your brokers, friends, and family.

Often, when asked for the rationale behind his decision, the person making the recommendation would state the source of the tip as some 'reliable' source.

Investors make decisions based on certain factual information. Subsequently, they make future assumptions based on, and in support of, those facts.

As such, knowing how an industry and a company functions is very important. In addition, it is equally important to gain such information from proper and reliable sources.

We present here a basic idea of where you can go about looking for information on companies you wish to invest in.

Sources of Information on Companies:

- Offer Documents: One of the best sources for understanding a particular sector or industry is the offer document of the company, if one can get hold to one.

- Annual Reports: In case you cannot get hold of the company's offer document, given that the company has been listed on the stock exchanges for long, the annual report comes in handy.

- BSE/NSE Announcements and Company Press Releases: Apart from annual reports, it is the official company documents such as press releases, announcements, and presentations which are released in regular intervals. The source for such information is the BSE or NSE websites and the company's website.

- Business Dailies and Other Media: Newspapers and news channels are a great medium for gaining updates on companies. Interviews with managements provide good information on the company's views, plans and strategies.

- Equitymaster Database: You can also visit Equitymaster's database by clicking on this link. Here you will be able to view information relating to companies' historical numbers and business profile. You will also be able to view reports on key sectors.

Now that we know where one can gather information before investing in stock markets, it's also important to understand the various aspects of a stock and a company.

From profit and loss account to balance sheets and cash flow statements, let us go back to basics and understand each of these in more detail...

Studying the Basics of Investing

To bring about a change in approach towards investing, one needs to go back to basics and study them deeply.

The lost art of carefully studying a stock before making the purchase, we believe, needs to make comeback.

Understanding the nuances of profit and loss accounts, balance sheets, and cash flow statements has always been pertinent, more now than ever before.

In the below links to articles, we try to bring to you the basics of investing. They act as guideposts to unraveling the mystery behind the financial statements.

Here they are:

Introduction to Financial Statements

Introduction to Balance Sheets

Introduction to Cash Flows from Operations

Key Ratios Related to the Cash Flow Statement

To know more, you can check out the entire series on this topic here: Investing: Back to Basics Series

Value Investing Approach to Invest in Stock Markets

Warren Buffett's glorious investing journey started from the basics of value investing.

We believe you too can start your investing journey here...from the very basics of value investing.

Value investing is an investment approach that seeks to profit from identifying undervalued stocks.

It is based on the idea that each stock has an intrinsic value, i.e. what it is truly worth.

Through fundamental analysis of a company, we can determine what this intrinsic value is. The idea in value investing is to buy stocks that trade at a significant discount to their intrinsic values (i.e. they are cheaper than their true value).

Once we buy an undervalued stock, the stock price eventually rises towards its intrinsic value, and makes a profit for us in the process.

Value investing is conceptually simple, though requires effort to implement. Research process focuses on finding out the intrinsic value of a company and the primary tool for researching a company is called fundamental analysis.

To understand these bits of value investing more closely, you can check out our page: Basics of Value Investing.

Warren Buffett Principles for Investing in Stock Markets

In his letters to shareholders, especially from the earlier years, Warren Buffett had followed the practice of putting out a list of key points that a company needs to satisfy if it wished to get acquired by his investment vehicle - Berkshire Hathaway.

He looks to invest in companies, which have...

- Demonstrated consistent earning power. Future projections are of little interest to Warren Buffett, nor are 'turnaround' situations.

- Businesses earning good returns on equity while employing little or no debt.

- Management in place. Warren Buffett says that he can't supply it.

- Simple businesses. If there is lots of technology, Warren Buffett says he will not understand it.

- An offering price. Warren Buffett won't waste his time or that of the seller by talking, even preliminarily, about a transaction when the price is unknown.

You can know more about Warren Buffett, his style of investing, and how you can go about following it in Indian markets here: Warren Buffett - The Value Investor

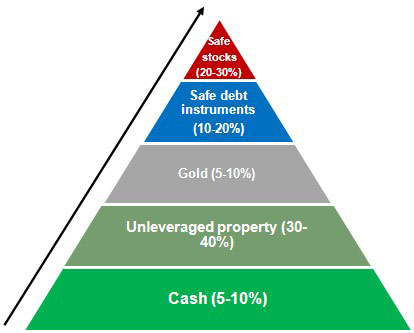

Investments Allocation for Different Asset Classes

An individual's Asset Allocation needs to ensure that the most important and most basic needs of his family are taken care of in the most secure manner.

And what better way to do this than to invoke the hierarchy of needs theory by the famous psychologist Abraham Maslow? People familiar with his work would know that his need hierarchy pyramid ensures that our most basic needs are given topmost priority.

The bottom of the pyramid denotes the means to satisfy most basic and elementary needs. As one moves up the pyramid, elementary needs being taken care of, once can afford a slightly higher risk profile to seek better returns to satisfy tertiary needs.

What Will Keep Your Wealth Intact?

There are different asset classes that help individuals safeguard and grow their wealth...provided the allocation is as per the individuals' risk appetite. We suggest the following allocation keeping an average investor in mind.

- Cash - It a good idea to keep cash in hand to buy good bargain stocks in the event of a market collapse. As such investors could keep about 10 to 40% of their portfolios in cash.

- Gold - Having at least 5% of your assets in gold will give you that insurance policy that will protect your portfolio when things go bust.

- Property - Property will ensure that when times turn bad, most of your income does not go towards meeting the EMI expenses on your loan. Clearly, there's no bigger relief than watching the roof on our heads become debt free.

- Bonds - To protect your wealth against inflation and to earn a fixed rate of return, it is worthwhile having debt instruments in your portfolio. It helps you get the assured returns while taking on lower risk as compared to stocks.

- Safe stocks - Finally, we come to stocks. Not just any stock, but safe stocks. These are stocks that have strong fundamentals and capable managements.

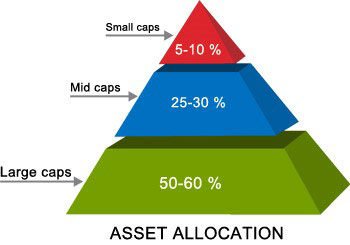

Such stocks can be found in every category of market capitalization - large caps, mid-caps, and small-caps. The important point to remember here is the risk profile of each category.

Asset Allocation for Stocks

As your experience will tell you, stock markets tend to be very volatile. Putting too much money in a single stock or sector can be very risky.

Based on their relative riskiness, we have created an asset allocation pyramid that can help you in deciding how much money you should invest in a stock.

However, it must be noted that the allocation levels could differ from person to person depending on individual risk appetite.

Here's the asset allocation pyramid for your equity portfolio:

Setting the Foundation for Equity Allocation - Portfolio Building with Large Cap, Mid Cap, and Small Cap Stocks

Now that you have understood the bits and pieces, we can get into the more specific need of building a portfolio that fits your needs.

Along with keeping your risk appetite in mind, it is firstly important to identify your age factor, earnings, and objectives for creating wealth.

Keeping in mind that we can't have a 'one-size-fits-all' strategy, we have broadly discussed the different scenarios for an investor for setting the foundation for equity allocation.

Here they...

Being Single

As the old saying goes, what the wise man does in the beginning, fools do in the end. When you're young and without a care in the world, life seems perfect.

If you haven't crossed the 30 mark, and are still single, planning for your retirement or even your future seems a distant thought.

But wise are those who start planning from the start!

Here's how you can go about allocating your portfolio investments:

Asset Allocation Portfolio for a Singleton

| Single | ||||

|---|---|---|---|---|

| <30 years | 30-45 years | 45-55 years | >55 years | |

| Carefree | Building Wealth | Adding To Wealth | Carefree Retirement | |

| Large cap | 70-80% | 60-70% | 70-80% | 80-90% |

| Mid cap | 5-10% | 10-15% | 10-15% | 0-5% |

| Small cap | 5-10% | 10-15% | 0-5% | 0-5% |

Two's Company

There are those who enjoy their single status in life, and then there are those for whom life is about having someone to share it with.

Sharing joys and sorrows, sharing health and wealth, it's all become about being a couple for some. This is also for those DINKs: Double Income, No Kids.

Here's how you can go about allocating your portfolio investments:

Asset Allocation Portfolio for a Married Person with No Kids

| Married-No kids | ||||

|---|---|---|---|---|

| <30 years | 30-45 years | 45-55 years | >55 years | |

| Property Top Priority | Building Wealth | Planning Retirement | Carefree Retirement | |

| Large cap | 70-80% | 60-70% | 70-80% | 80-90% |

| Mid cap | 5-10% | 10-15% | 10-15% | 5-10% |

| Small cap | 5-10% | 10-15% | 0-5% | 0-5% |

Family Matters

There is a famous line - 'Small family, happy family', but where exactly is that line drawn today? Would it end at being a happy couple, or would it end with the proverbial husband-wife-and-child scenario?

If we were to go by the population of India, it would most definitely be a family inclusive of kids. Yes, there are the rare exceptions to the norm, but on an average the idea of a happy family consists of a set of parents with 2 kids.

Here's how you can go about allocating your portfolio investments:

Asset Allocation Portfolio for a Married Person with Two Kids

| Married-2 kids | ||||

|---|---|---|---|---|

| <30 years | 30-45 years | 45-55 years | >55 years | |

| Property Top Priority | Planning Children's Future | Property For Children | Retired/Children On Own | |

| Large cap | 70-80% | 50-60% | 70-80% | 80-90% |

| Mid cap | 5-10% | 25-30% | 10-15% | 0-5% |

| Small cap | 5-10% | 5-10% | 0-5% | 0-5% |

Conclusion

There's a saying "Boulders we cross, it's the pebbles that we stumble over".

That is exactly what happens as we strive hard to build our wealth. We work hard, scrimp, save, adjust, and finally save money - for us, our dreams, our children, and their dreams.

Somewhere, however, we are so busy trying to survive in our race against time that the money we work so hard to earn is invested quite quickly. We don't give it thoughtful consideration.

'Are our investments in tandem with our current and future needs?' This is where the mantra of asset allocation comes handy.

Asset allocation ensures that our expectations from our investments, our dreams for our future, and the way we invest money are all in sync with each other.

Best Stocks to Invest in Indian Share Markets

Now that you have read about Investing in Stock Markets and investing basics, here's the million dollar question - Which stocks in Indian share markets make for the best investment?

Indeed, this is a difficult question to answer but we are here to help you get started!

Find your answer right away with Equitymaster's Advanced Stock Screener.

Multibagger Stocks in 2021 to Invest in Indian Stock Markets

What if we told you there's a method to easily identify potential multibaggers while investing in Indian stock markets?

You probably won't believe us.

That's okay. We understand the skepticism.

But it is possible. There is a way.

It's not a guaranteed method. But given enough time, it works.

And more importantly, it's simple to understand.

Dive in to the guide below and know the simplest way to find safe multibagger stocks:

Pick the Best Multibagger Stocks in 2021

Stocks to Buy, Sell, and Hold Right Now

With coronavirus spreading far and wide, countries across the globe have started implementing second wave lockdown.

Global financial markets are witnessing brunt of this situation. The up and down nature of Indian stock markets will continue amid the coronavirus crisis.

One month we see a sharp decline followed by a sharp up move the next month.

One day we hear positive news of a vaccine for the virus. Another day, a WHO scientist says we might have to live with this virus for years.

Naturally, investors are confused as to what they should do? Buy, Hold or sell their stocks.

In the video below, we explain the current scenario and what are the type of stocks investors should Buy, Hold or sell in the current crisis.

Happy Investing!

FAQs on How to Invest in the Share Market

1. What are the Basics of Investing in Stocks?

The first thing to understand about stocks is what they are. In simple words, a stock are pieces of ownership of a business.

If you buy shares in Infosys stock, you are buying a tiny part Infosys.

It's important to understand that stocks are not ticker symbols that move up and down making profits and losses for traders. They are real businesses.

When you invest in a stock, you become a part owner of the business as a shareholder. You receive a share of the profits i.e. dividends. You also profit from the rising share price in the stock market.

If the company you've invested in goes bankrupt, as a common shareholder, you will be the last in line to receive any compensation from the bankruptcy proceedings.

That is the risk, along with the risk of share price volatility, you take on when investing in stocks.

On the positive side, if the company you've invested in does well over time, you will be rewarded with a soaring share price along with handsome dividends.

If the company grows strongly and consistently, you may end up with a multibagger stock. These are stocks that rise many times in price thus multiplying your original investment.

This is the main reason why people invest in stocks. In the case of fundamentally strong companies, the potential returns on investment far outweigh the potential risks.

2. How can I start investing in share market?

Getting started in the share market is easy. These days most stock brokers have mobile apps which make the process quick and simple.

One of the most important things to be clear about when getting started in the stock market is how you will invest your hard-earned money.

You can start by asking yourself these questions.

- What is your goal in the stock market? People invest for different reasons. Some invest to make some income on the side. Some invest to create long term wealth. Some are only looking to get rick quick (pro tip: this is very dangerous).

- Will you be a trader or an investor? In other words are you buying to sell quickly for a profit or are you looking for substantial long term gains?

- For how long will you hold a stock? Your time horizon per trade/investment is very important. It could range from minutes to decades. It's a personal choice.

- What investing/trading strategy will you use? Without one, you are guaranteed to lose your money.

- How will you study potential investments? You must have a solid method to research stocks.

- How will you narrow down your choices? There are thousands of listed stocks. You can't research all of them. You need to pick the best ones to analyse further. You can do this by using Equitymaster Stock Screener.

We also suggest reading this Equitymaster article - How to Invest in the Share Market.

3. How do beginners invest in the share market?

The one word answer would be 'carefully'.

As a beginner, you should be mindful of the fact that your lack of knowledge will be a big disadvantage.

To counter this you can start by picking only the safest bluechips. These stocks are unlikely to crash suddenly. They are typically stable, mature companies. Thus, these stocks are great when it comes to getting your feet wet in the market.

Read up on these companies. Find out the big, recent developments. Pick up the latest annual report and investor presentation. Find out what the company's management is focused on. Read about the latest quarterly results. Were they good or bad or along expected lines?

If you like the stock, check the valuations before buying. Don't buy stocks that are overpriced in terms of price to earnings and price to book value.

Keep these points in mind...

- Never overpay for stocks.

- Don't buy a stock just because everyone else is.

- Stay away from hot tips. Do your own research.

- Don't buy more stocks than you can handle. One or two should be fine to begin with.

- After buying a stock, track it carefully. By that we mean, track the business developments not just the share price.

This will get you started on your investing journey in a safe manner.

We highly recommend you check out Equitymaster's Stock Screener and its segments.

Here are Links to Some Very Insightful Equitymaster Articles on Investing in Share Market

- Understanding Equities - Large Cap, Mid Cap and Small Cap Stocks Allocation

- The Investing Process with the Best Possible Returns

- Here's How You Should Trade This Rally

- What Makes Stock Markets Move?

- A Zero Loss Strategy that Also Maximizes Returns in Volatile Stock Markets

- Are You Waiting for the Perfect Time to Invest?

- Where Can You Find Safe Quality Stocks in This Market?

- 3 Main Criteria Before You Pick a Stock

- Why ITC and not HUL is my Idea of a Good Investment Right Now

- Three Charts on One of the Quickest Bull Markets in History