India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 11, 2022

Sensex Sheds 773 Points, Nifty Settles Below 17,400; Grasim, Infosys & Tech Mahindra Top Losers Fri, 11 Feb Closing

Indian share markets witnessed negative trading activity throughout the day today and ended deep in the red.

Benchmark indices cracked in-line with global peers and snapped three-day gaining momentum as a multi-decade high inflation in the US jolted investor confidence who feared bulkier rate hikes by the world's biggest economy.

US inflation came in at an annual 7.5% in January, fresh data revealed on Thursday showed. This was far ahead of expectations and marked the highest YoY rise in consumer prices since 1982.

At the closing bell, the BSE Sensex stood lower by 773 points (down 1.3%).

Meanwhile, the NSE Nifty closed lower by 231 points (down 1.3%).

IOC and IndusInd Bank were among the top gainers today.

Grasim and Tech Mahindra, on the other hand, were among the top losers today.

The SGX Nifty was trading at 17,345, down by 262 points, at the time of writing.

The BSE Mid Cap index and the BSE Small Cap index ended down by 1.8% and 1.9%, respectively.

Sectoral indices ended on a negative note with stocks in the IT sector, consumer durables sector and realty sector witnessing selling pressure.

Shares of Hindalco and Gujarat Narmada hit their respective 52-week highs today.

Asian stock markets ended on a mixed note today.

The Hang Seng and the Shanghai Composite ended down by 0.1% and 0.7%, respectively. The Nikkei ended up by 0.4% in today's session.

US stock futures are trading on a negative note today with the Dow Futures trading down by 146 points.

The rupee is trading at 75.38 against the US$.

Gold prices for the latest contract on MCX are trading down by 0.4% at Rs 48,780 per 10 grams.

Speaking of stock markets, India's #1 trader Vijay Bhambwani explains how you can protect yourself against being scammed when buying gold, in his latest video for Fast Profits Daily.

The below video is all about how to safeguard yourself from being cheated by unscrupulous people and ensure peace of mind.

In news from the pharma sector, Divi's Laboratories was among the top buzzing stocks today.

Hyderabad-based drug maker Divi's Laboratories reported a consolidated profit after tax (PAT) of Rs 9 bn for the third quarter ended December 2021, up by 92% from the profit of Rs 4.7 bn reported in the same quarter a year ago.

On a sequential basis, the profit is higher by 49% from a PAT of Rs 6.1 bn reported in the previous quarter.

Consolidated revenues for the company that manufactures and custom-synthesizes generic active pharmaceutical ingredients (APIs), intermediates and nutraceutical ingredients stood at Rs 24.9 bn, up by 47% compared to Rs 17 bn reported a year-ago. Revenues in the preceding quarter stood at Rs 19.9 bn.

The growth was driven by a strong traction in contract manufacturing as well as higher contribution from molnupiravir, an oral anti-viral treatment for Covid-19 and nutraceuticals or nutritional supplements.

Operationally, it was a good quarter for the company as it was able to reap the benefits of operational efficiency and better product mix.

The cost of raw materials as percentage of operating revenues reduced by 380 bps on year and by 796 bps quarter on quarter (QoQ) to 36.1%.

Divi's Laboratories share price ended the day down by 0.7% on the BSE.

Speaking of stocks, here's a pattern that if you see, you must sell your position. After all, exits are more important than entries.

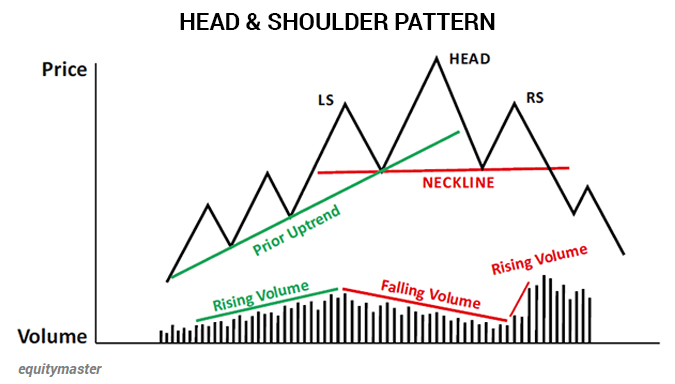

In the chart below, we can see the head and shoulder pattern - the stock goes up, makes a high, falls a little bit, goes up to a higher high, does not make a higher low, rallies again, fails to make a new high, and then starts to break down.

This usually happens in a situation where a stock or index has typically been in a bull trend for a while. Spotting this correctly can help you save money.

If you're interested in trading and want to know how you can use this pattern, you can read about it in one of the editions of Profit Hunter here: It's When You Sell that Counts

Moving on to news from the auto sector...

Automobile Sales Decline in January 2022

Total automobile sales in January 2022 have seen a year on year (YoY) decline of 23.2% as compared to the same period last year, said the Society of Indian Automobile Manufacturers (SIAM).

According to the auto industry body, 1.4 m vehicle units, including passenger, commercial and two and three-wheelers, were sold in January this year, against 1.7 m units sold in January 2021.

'Sales in January 2022 again declined compared to January 2021, due to both Omicron-related concerns and semiconductor shortage. There is clearly a demand issue for two-wheelers due to lower rural off-take of entry-level models,' said Rajesh Menon, the director-general of SIAM.

Due to the cumulative dip, passenger vehicle dispatches from factories to dealers in India fell by 8% in January. The semiconductor shortage is also said to be responsible for it.

The total passenger vehicle wholesales dropped to 2.5 lakh units in January 2022 as compared to 2.8 lakh units in the same month of last year.

Last month, passenger car dispatches stood at 1.3 lakh units as compared to 1.5 lakh units in the year-ago period. Similarly, van dispatches declined to 10,632 units in the period under review from 11,816 units in January 2021.

According to Menon, the passenger vehicle segment is unable to meet the market demand due to supply-side challenges.

Total two-wheeler dispatches declined 21% to 1.1 m units from 1.4 m units in the year-ago period.

Similarly, three-wheeler wholesales dropped to 24,091 units last month as against 26,794 units in January 2021.

We will keep you updated on the latest developments from this space. Stay tuned.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Sheds 773 Points, Nifty Settles Below 17,400; Grasim, Infosys & Tech Mahindra Top Losers". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!