India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News December 29, 2016

Sensex Opens Flat, Cadila Healthcare Slumps 1.7% Thu, 29 Dec 09:30 am

Asian markets are lower in morning trade as Japanese and Hong Kong shares fall. The Nikkei 225 is off 0.98% while the Hang Seng is down 0.06%. The Shanghai Composite is trading flat. Stock markets in US closed their previous session on a negative note.

Meanwhile, Indian share markets have opened the day on a flat note. BSE Sensex is trading higher by 19 points and NSE Nifty is trading lower by 6 points. Meanwhile, S&P BSE Mid Cap and S&P BSE Small Cap are trading higher by 0.2% respectively. The rupee is trading at 68.23 against the US$. Barring realty sector, all the sectoral indices are trading in green with oil & gas and PSU stocks leading the gains.

According to an article in The Economic Times, Tata Steel is in discussion with foreign companies for investments in heavy industries over the next five years at the Special Economic Zone project at Gopalpur in Odisha.

Tata Steel signed a definitive agreement to acquire 100% equity in Brahmani River Pellets Ltd. This would give the company a vertical start up to enabling facilities.

For Tata Steel, the year 2016 would be remembered for the successful commissioning of Kalinganagar Steel Plant. After successful trials, the plant has made record production of 1 million tonnes (MT) of Hot Metalwithin six months of commissioning.

Meanwhile, Tata Steel's managing director recently stated that demonetisation has impacted the business of the company but oozed confidence that the situation would improve soon.

In another development, domestic steelmakers may increase prices by up to Rs 4,000 per tonne in January for both long and flat products to partially offset the inflated coking coal cost push. Long and flat products are used for construction and automotive sector.

Coking coal is hurting the Indian steelmakers hard since they largely depend on imports to meet their demand. Though India has over 300 billion tonnes of coal reserves, coking coal constitute just about 10% of the total kitty and a large chunk of that remains unexplored till date.

Imports of coking coal in the country have been on the rise for the last few years. While India imported 19.5 MT of coking coal in the 2010-11 fiscal, the imports went up to 43.5 MT in the last fiscal, up 123%. There has been a 2.5% import duty on coking coal.

Tata Steel's share price began the trading day up by 0.3% on the BSE.

Moving on to news from stocks in pharma sector. According to a leading financial daily, Cadila Healthcare's subsidiary Zydus Healthcare Ltd has bought six brands from MSD Pharmaceuticals India Pvt. Ltd, the local arm of US-based Merck & Co. Inc., for distribution in the Indian market. The deal includes transfer of distribution and commercialization rights and assignment of trademarks of all the six brands to Zydus Healthcare Ltd in India.

The move, seen as an acquisition of strategic brands, will strengthen Zydus' portfolio in key therapeutic segments. The acquired portfolio had clocked sales of Rs 840 million in 2015.

Cadila Healthcare recently stated that it would transfer its India human formulations business to Zydus Healthcare Ltd on a slump sale basis for Rs 693 million. Cadila Healthcare's India human formulations business accounted for 21% of the company's total turnover.

Meanwhile, Zydus Discovery DMCC, a research subsidiary of Cadila Healthcare, has been pulled up by the US Food and Drug Administration (USFDA) for misbranding saroglitazar durg.

From a public health perspective, FDA noted, the claims and presentations are concerning because they include representations in a promotional context regarding safety and efficacy of an investigational new drug that has not been approved by the FDA.

Cadila Healthcare's share price began the trading day down 1.7% on the BSE.

In another development, the demand for most essential items including lifesaving drugs has taken a hit due to demonetisation.

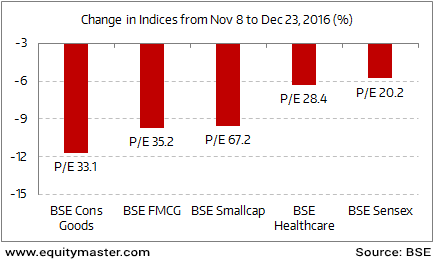

FMCG companies have seen big drop in semi urban and rural areas. And pharma companies are also seeing a dip in the domestic demand. The Consumer Goods, FMCG and Healthcare indices have corrected by 6% to 12% since November 8, 2016.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Flat, Cadila Healthcare Slumps 1.7%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!