India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News December 23, 2020

Sensex Trades Over 200 Points Higher; Dow Futures Down By 50 Points Wed, 23 Dec 12:30 pm

Share markets in India are presently trading on a strong note.

The BSE Sensex is trading up by 288 points, up 0.6% at 46,295 levels.

Meanwhile, the NSE Nifty is trading up by 77 points.

Wipro and Bajaj Finance are among the top gainers today. ONGC and Divi's Laboratories are among the top losers today.

The BSE Mid Cap index is trading up by 1.5%

The BSE Small Cap index is trading up by 2.2%.

On the sectoral front, barring the oil & gas sector, all sectors are trading in green with stocks from the real estate sector witnessing most of the buying interest.

US stock futures are trading mixed today.

Nasdaq Futures are trading up by 3 points (flat) while Dow Futures are trading down by 50 points (down 0.2%).

The rupee is trading at 73.81 against the US$.

Gold prices are trading down by 0.3% at Rs 49,955 per 10 grams.

In domestic markets, gold prices slipped today tracking a muted trend seen in international spot prices. In early trades, February gold contracts traded lower by 0.1% on the MCX, at Rs 50,050 per 10 grams.

Note that even though gold has recovered from lows of below Rs 48,000, it remains significantly lower than the August highs of Rs 56,200.

To know more about gold, check out our article on how to invest in gold here: How to Invest in Gold?

Speaking of the stock markets, India's #1 trader, Vijay Bhambwani talks about a new all-time high for silver, in his latest video for Fast Profits Daily.

In the video below, Vijay shares the reason behind the recent rally in silver prices and how you can profit from this opportunity.

Tune in here to find out more:

Moving on to stock specific news...

Among the buzzing stocks today is Bajaj Auto.

Bajaj Auto, the country's third-largest two-wheeler manufacturer, has announced the signing of a memorandum of understanding (MoU) with the Maharashtra government for setting up a factory that will make the Chetak and KTM, Husqvarna and Triumph motorcycles.

The proposed investment for this new facility, which will come up next to Bajaj's existing facility at Chakan near Pune, will be Rs 6.5 billion. The unit is expected to commence production in 2023.

The announcement by Bajaj Auto comes at a time when its rivals like Honda Motorcycle and Scooter India and Suzuki Motorcycle have adopted a 'go-slow' approach as far as new investments are concerned.

Market leader Hero MotoCorp, however, had announced a Rs 100 billion investment over 5-7 years towards new products and manufacturing facilities.

Under the arrangement, the government of Maharashtra will facilitate Bajaj Auto in obtaining necessary permissions, approvals, clearances, and fiscal incentives from the concerned departments of the state, as per the existing policies, and rules and regulations.

The existing Chakan facility produces the same brand of two-wheelers except the proposed motorcycles under the Triumph brand. Bajaj Auto and Triumph Motorcycles are working together on a range of mid-capacity bikes the first of which will debut in 2022.

The Indo-British collaboration will explore the 200-750cc bike category to offer multiple product options across different segments. The starting price range of these bikes could be below Rs 200,000.

At the time of writing, Bajaj Auto share price was trading up by 1.3% on the BSE.

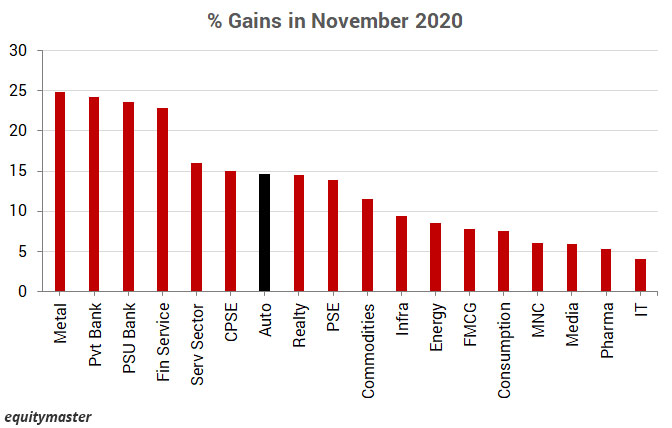

Speaking of the automobile sector, note that the sector has rebounded sharply from its March lows.

The Nifty Auto index gained as much as 15% last month.

The auto index entered the greed phase in September 2019 and will stay there until December 2021. This means there is still a lot of fuel left for auto stocks.

How automobile stocks perform in the coming months remains to be seen.

Moving on to news from the engineering sector...

EIL Shareholders Approve Rs 5.8 Billion Share Buyback Plan

Shareholders of state-owned Engineers India (EIL) have approved buyback of nearly 70 million shares for about Rs 5.8 billion with a view to return surplus cash to shareholders, the largest being the Government of India.In a stock exchange filing, EIL said it got the support of 99.9% voting shareholders for the resolution seeking approval for buyback of equity shares at Rs 84 apiece.

The buyback will help the company to return surplus cash to its members holding equity shares broadly in proportion to their shareholding, thereby, enhancing the overall return to members.Note that he offer price of Rs 84 per share is at a premium of 20.5% on BSE and 19.6% on NSE over the volume-weighted average price of the equity share for 26 weeks preceding the November 12 board approval.The government intends to participate in the buyback and tender up to such extent that the minimum shareholding of the promoter post buyback remains at 51% of the post buyback equity share capital of the company.EIL said since the buyback is more than 10% of the total paid-up equity share capital and free reserves of the company, an approval of the shareholders by way of a special resolution was sought.

The government has asked at least eight state-run companies to consider share buybacks as it scours for ways of raising funds to rein in its fiscal deficit. The firms asked to consider share buybacks include miner Coal India, power utility NTPC, and minerals producer NMDC.The government wants public sector undertakings to either meet their targets for capital expenditure or "reward the shareholder in the form of a dividend" or share buyback.

We will keep you posted on more updates from this space. Stay tuned.

And to know what's moving the Indian stock markets today, check out the most recent share market updates here

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades Over 200 Points Higher; Dow Futures Down By 50 Points". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!