India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News December 23, 2016

Sensex Stays Flat; Metal Stocks Under Pressure Fri, 23 Dec 01:30 pm

After opening the day on a flat note with a negative, the Indian share markets are now trading marginally in the green. Sectoral indices are trading on a mixed note, with stocks in the Realty sector and IT Sector witnessing maximum selling pressure. Capital Goods Stocks are trading in the green.

The BSE Sensex is trading up 64 points (up 0.3%) and the NSE Nifty is trading up 12 points (up 0.2%). Meanwhile, the BSE Mid Cap index is trading up 0.5%, while the BSE Small Cap index is trading up 0.3%. The rupee is trading at 67.85 to the US$.

According to an article in The Economic Times, Maruti Suzuki and Hyundai Motor India, the country's two top car makers, are hopeful of meeting their annual production targets despite a slump in demand after the government's demonetisation move.

RC Bharghava, the chairman of Maruti Suzuki confirmed that the company would meet its annual target of producing over 1.5 million units despite the demonetisation move.

Commenting on the current situation the chairman said:

- We are doing better than others. After an initial blip in bookings in November there has been pick up in momentum of bookings. Brand perception, ease of maintenance, spare parts' cost, distribution and sales network, all play a big part going ahead in the future.

The article goes on to say that the company is likely to end the current fiscal with a market share of over 47%, its highest in the last 15 years. Maruti Suzuki posted a YoY sales growth of 14% in November, owing to strong retail offtake in the festive month of October.

The company said growth was on account of replenishing stock at dealerships which had thinned due to strong demand in October.

Maruti Suzuki expects a correction in the number of dispatches in December, but is projecting healthy schedules for the first three months of the new year. The incremental capacity is coming from the new Gujarat facility and stocking of Ignis, the launch of which is likely to bring in the incremental numbers.

Similarly, Rakesh Srivastava, senior VP of sales and marketing at Hyundai Motor India said demonetisation had a short-term impact, but the current ecosystem is geared up with strong offers from the company and support from financers to deliver good numbers.

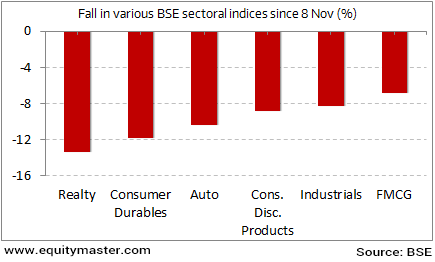

Auto stocks have borne the brunt of the demonetisation move. Stocks from the automobiles sector have fallen about 10% since 8 November, 2016 as evident from the chart below.

The Biggest Losers of Demonetisation

However, as my colleague Kunal Thanvi points out in a recent edition of the 5 Minute WrapUp, the current slump due to demonetisation is only a temporary setback.

Here's Kunal...

- Even if sales take a big blow this year, the auto growth story won't break down. Individuals and businesses will buy cars, two-wheelers, and trucks irrespective of demonetisation. A one-year hit to profitability won't change the long-term earnings power of fundamentally strong auto firms.

If anything, the recent correction in auto stocks is bringing valuations down to reasonable levels. The only thing a long-term investor has to do is wait for the market to finish 'voting'. Buying good auto stocks at the right price will likely result in healthy returns a few years later when the market begins 'weighing' them.

In other news, the shares of Welspun Enterprises fell as much as 4.7% in intra-day trade, in an otherwise range-bound market. The shares fell as the company announced plans to buy back up to 25% of its share capital at a price of Rs 62 per equity share.

In a filing to the stock exchanges the company said that its board has approved the buyback of 25% of the company's share capital with a view of utilizing the company's substantial cash reserves and to enhance shareholder value.

The Rs 2.7 billion worth buyback however, would be subject to approval from shareholders.

The promoter group, having a stake of 37.4% in the company have indicated their intention to participate in the proposed buyback. The foreign co-promoters holding 2.2% have not declared such intentions.

In a buyback, the company purchases its own shares from the market. Then it often cancels them or keeps them as treasury shares. The result of the whole buyback process is that the number of shares outstanding for the company is brought down. Buybacks can pose a tricky proposition, and many investors wonder what their course of action should be when a company announces a buyback. This begs the question: Should one tender their shares or hold on to it for further returns?

In our view, one should not pay heed to the market movements but the underlying fundamentals and the intentions of the company announcing the buyback. To get a detailed view on this topic, you can check out one of our articles explaining what a retail investor should do in case of a buyback.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Stays Flat; Metal Stocks Under Pressure". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!