India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News December 22, 2020

Indian Share Markets Open Flat; M&M and Bajaj Finance Top Losers Tue, 22 Dec 09:30 am

Asian share markets started weak as investors worried a highly infectious new strain of Covid-19 that shut down much of Britain could lead to a slower economic recovery.

The Hang Seng is trading down by 0.1% while the Shanghai Composite is trading lower by 0.2%. The Nikkei is down 0.5%.

US stock markets ended mixed on Monday as a new strain of the coronavirus in Britain raised fears of further economic disruptions.

Both, the Dow Jones Industrial Average and the Nasdaq ended on a flat note.

Back home, Indian share markets have opened the day on a flat note.

The BSE Sensex is trading down by 113 points. Meanwhile, the NSE Nifty is trading lower by 35 points.

HCL Tech and NTPC are among the top gainers today.

The BSE Mid Cap index and the BSE Small Cap index have opened the day down by 1.1% and 1%, respectively.

Barring IT and metal stocks, all sectoral indices are trading on a negative note with stocks in the energy sector and consumer durables sector witnessing maximum selling pressure.

Aviation stocks are in focus today as India has suspended flights to and from the UK till 31 December to prevent the spread of a new strain of the coronavirus that is considered to be 70% more infectious.

The rupee is trading at 73.93 against the US$.

Gold prices are trading up by 0.1% at Rs 50,440 per 10 grams.

Gold prices edged higher as investors focused on the US fiscal stimulus package that is set to be voted on by Congress, with fresh restrictions forced by a new coronavirus strain in the UK providing further support to the metal.

To know more about gold, you can check out our detailed article on investing in gold here: How to Invest in Gold?

Note that global stock markets tumbled on Monday amid panic selling as a new strain of coronavirus emerging from the UK led to fresh travel restrictions, casting a cloud over the prospects of economic recovery.

The BSE Sensex plunged 1,407 points, or 3%, its biggest fall in percentage terms since April, while the Nifty dropped 432 points, or 3.14%, to end the session at 13,328.

Speaking of stock markets, in his latest video, India's #1 trader, Vijay Bhambwani shares a new trading opportunity to make fast profits.

Tune in here to find out more:

In latest developments from the IPO space, Antony Waste Handling Cell's initial public offering (IPO) was subscribed 1.98 times on the first day of subscription.

The company has joined the likes of Burger King India and Mrs Bectors Food Specialities to have received oversubscription in a few hours of opening for subscription.

The IPO, to raise about Rs 3 billion, received bids for 1,32,00,749 shares against 66,66,342 shares on offer, according to NSE data.

The company has fixed price band for its public issue at Rs 313-315 per share.

Ahead of the IPO, the company garnered Rs 899.9 million from 10 anchor investors at an upper end of price band. Massachusetts Institute of Technology was the top anchor investor, accounting for 44.44% of the total anchor allotments.

From the day of the price band announcement, Antony Waste Handling Cell share price has surged in the grey market. Yesterday, the shares were seen trading with 54% premium over the IPO price of Rs 315 apiece.

Note that Antony Waste Handling is launching its IPO for the second time this year, after having to withdraw its maiden attempt in April due to tepid investor response amid the Covid-19 outbreak.

In news from the automobile sector, Tata Motors is among the top buzzing stocks today.

Tata Motors on Monday said its commercial vehicle prices will be revised upward from January next year.

The steady rise in material and other input costs, impact of forex and transition to BS-VI norms, have cumulatively increased the cost of manufacturing vehicles, necessitating a price revision to partially offset the impact, the company said in a statement.

The company added the actual change in price will depend on individual model, variant and fuel type.

So far, Tata Motors has been absorbing the addition in costs but with their steady rise in line with market trend, it has become imperative to pass at least some portion of the cost increase to customers via appropriate price revisions.

Tata Motors share price has opened the day up by 0.8%.

In other news, utility vehicle maker Isuzu Motors India also said it will hike prices of its pick-up range - D-MAX Regular Cab and D-MAX S-CAB - from January 1 to offset increasing input and distribution costs.

The increase is expected to be approximately Rs 10,000 from the current ex-showroom price, the company said in a statement.

German luxury carmaker BMW too on Monday said it will increase prices of its entire model range in India by up to 2% from next month.

Rival Audi has already announced a price increase of up to 2% across its entire model range, effective from January 1.

Note that major automobile makers, including Maruti Suzuki, Renault India, Honda Cars, Mahindra & Mahindra and Ford India have also planned to increase prices from next month.

Two-wheeler major Hero MotoCorp has also announced that it will increase the price of its vehicles by up to Rs 1,500 from January 1 to offset the impact of rising input costs.

We will keep you updated on the latest developments from this space. Stay tuned.

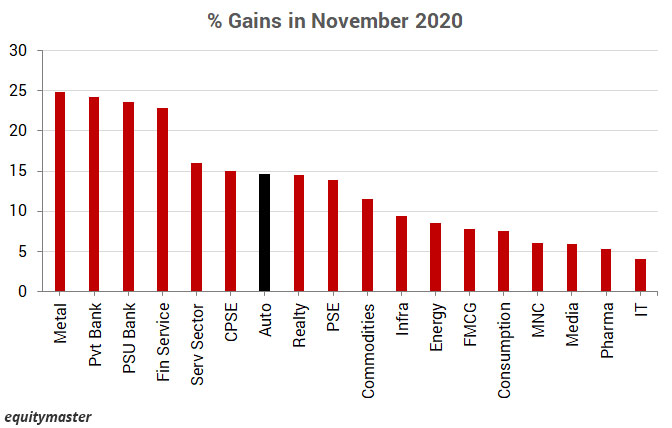

Speaking of the automobile sector, note that the sector has rebounded sharply from its March lows.

The Nifty Auto index gained as much as 15% last month.

The auto index entered the greed phase in September 2019 and will stay there until December 2021. This means there is still a lot of fuel left for auto stocks.

How automobile stocks perform in the coming months remains to be seen.

Moving on to news from the finance sector, private equity major KKR's unit Moneyline Portfolio Investments sold 3.74 million shares or 1.08% of the equity in Max Financial Services on Monday for Rs 2.5 billion, according to bulk deal data on the NSE.

Avendus Absolute Return Fund bought 1.7 million shares at an average price of Rs 653 aggregating to Rs 1.1 billion.

According to latest shareholding, Moneyline Portfolio held 13.4 million shares or 3.88% stake in Max Financial.

KKR had acquired the stake in Max Financial in February 2016 from the promoter group including Analjit Singh.

Max Financial Services share price has opened the day up by 0.1%.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Indian Share Markets Open Flat; M&M and Bajaj Finance Top Losers". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!