India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News December 21, 2016

Sensex Remains Flat; Realty Stocks Witness Buying Interest Wed, 21 Dec 11:30 am

After opening the day on a flat note, the Indian share markets registered marginal gains and continued to trade near the dotted line. Sectoral indices are trading on a mixed note with stocks in the realty sector and power sector witnessing maximum buying interest. FMCG sector stocks are trading in the red.

The BSE Sensex is trading up 36 points (up 0.1%) and the NSE Nifty is trading up 10 points (up 0.1%). The BSE Mid Cap index is trading up by 0.3%, while the BSE Small Cap index is trading up by 0.4%. The rupee is trading at 67.84 to the US$.

The recent move of the Reserve Bank of India (RBI) on demonetisation regarding the strict curbs imposed on depositing old notes in bank accounts has led to chaos amongst depositors as well as bankers. This is seen as bankers are asked by the government to demand explanations from customers for late deposits.

The above amendment was announced by the RBI this week and stated that deposits of more than Rs 5,000 in old Rs 500 and Rs 1,000 notes can be made only once per account until December 30. We are not sure to what extent and if at all the move will seriously address the black money issue, but it will indeed lead to hassle. The move is another flip flop in the changing narrative of demonetisation and will seriously undermine people's trust in Mr Modi who had suggested that one could deposit old Rs 500 and Rs 1000 notes till close of banking hours on 30th December 2016 without any limit.

The above move coupled with the current strain on liquidity would mean that it would take longer for things to go back to normal that are affected by the demonetisation drive. As we stated in our recent edition of The 5 Minute WrapUp... 'Given the bottleneck in printing Rs500 notes, some believe it may take another six months. However, if SBI is to be believed, normalcy would return by the end of February 2017.'

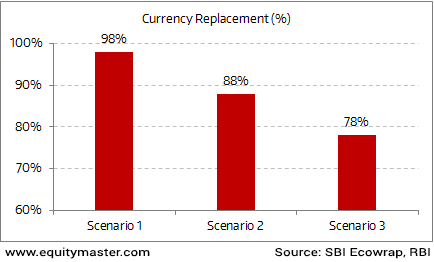

Demonetisation: Expected Currency Replacement by Feb 2017

We will keep you posted on developments regarding demonetisation and its impact on the Indian economy as well as companies and sectors. Stay tuned...

For all those who want to truly understand demonetisation, Vivek Kaul has written an insightful report, Demonetisation: The Good, Bad and Ugly. We believe it is a must read.

On the news from commodity markets, gold is witnessing volatility. The yellow-metal has been witnessing selling pressure this week on the back of a firm dollar overseas. Also, the hike in US interest rates by the Fed last week has weighed on gold.

Speaking of gold, Asad Dossani, editor at Profit Hunter, has already made some predictions on gold in 2017. Here is what he wrote recently...

- Lower commodities prices will be one of the big trends in 2017. This is especially true for gold. Gold is the ultimate hedge against easy money. And as the Fed raises interest rates, gold will lose its shine.

As a trader, how do you take advantage of this? Remember that fundamentals create the trends. If gold prices fall for a sustained period, there's a reason for it.

But fundamentals aren't going to help you make money in the short term. Because trading isn't just about direction. It's about timing. We have to get the timing right. We have to catch the trend before it occurs. We have to avoid the reversal when it occurs. We have to cut short our losses.

And to do this, you need a solid trading system. I like to use a quantitative approach to trading. Focus on a few indicators best placed to capture the big moves. My system has the potential to do just that.

To keep a tab on the movements in gold and other commodities, you can read the stock market commentary from the Daily Profit Hunter team. Their commentary tracks the developments in the global economy as well as stock, currency and commodity markets.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Remains Flat; Realty Stocks Witness Buying Interest". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!