India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News December 17, 2020

Sensex Opens Flat; ONGC & Power Grid Among Top Nifty Gainers Thu, 17 Dec 09:30 am

Asian share markets are trading on a positive note today as progress toward a long-awaited US stimulus package and a pledge by the Federal Reserve to keep interest rates low improved sentiment.

The Hang Seng is trading up by 0.2% while the Shanghai Composite is trading higher by 0.8%. The Nikkei is flat.

In US markets, Wall Street indices ended mixed, with the Nasdaq hitting a record high as investors awaited a potential fiscal economic stimulus package after the Federal Reserve repeated a pledge to keep its benchmark interest rate near zero.

The Dow Jones Industrial Average ended down by 0.2%, while the Nasdaq gained 0.5%.

Back home, Indian share markets have opened the day on a flat note.

The BSE Sensex is trading up by 42 points. Meanwhile, the NSE Nifty is trading higher by 19 points.

ONGC and Power Grid are among the top gainers today.

The BSE Mid Cap index has opened up by 0.2%. The BSE Small Cap index is trading higher by 0.5%.

Sectoral indices are trading mixed with stocks in the energy sector and telecom sector witnessing buying interest. FMCG stocks, on the other hand, are trading in red.

Airline stocks are in focus today after the Aviation turbine fuel (ATF) price was raised by a steep 6.3% on Wednesday.

The rupee is trading at 73.51 against the US$.

Gold prices are trading up by 0.4% at Rs 49,784 per 10 grams.

To know more about gold, you can check out our detailed article on investing in gold here: How to Invest in Gold?

Bitcoin smashed through US$ 20,000 for the first time yesterday, its highest ever.

The cryptocurrency extended gains and jumped as much as 13% to move as high as US$ 22,184.

So far this year, it has gained more than 170%, buoyed by demand from larger investors attracted to its potential for quick gains, purported resistance to inflation and expectations it will become a mainstream payment method.

Speaking of stock markets, in his latest video, India's #1 trader, Vijay Bhambwani, talks about the chances of a market correction in January.

In his previous video, Vijay had said December is likely to be a bullish month. And that has turned out to be true, at least so far.

But what about next month? Can the market fall at the start of the new year?

Tune in to the video to find out more:

In news from the financial markets, the markets regulator on Wednesday, tightened the public shareholding norms for listed companies and eased the rules for entities that wish to launch mutual fund business in the country.

Following a board meeting, the regulator amended norms related to minimum public shareholding norms for listed companies that are going through corporate insolvency resolution process (CIRP).

The market watchdog said that CIRP-bound companies need to maintain a public shareholding of at least 5% to be able to qualify for trading of their shares on stock exchanges.

At present, during CIRP, if the public shareholding falls below 10%, they can continue to have their shares traded on exchanges but are required to bring the public shareholding to at least 10% within a period of 18 months and to 25% within 36 months.

In another move, the regulator has eased the eligibility norms for entities who intend to launch mutual fund companies.

In a bid to enhance the penetration of MFs in the country, the regulator said that even loss-making entities can launch or become sponsors of mutual fund companies as long as such entities have a net-worth of at least Rs 1 billion.

This net-worth of the AMC has to be maintained till the time the AMC makes profit for five consecutive years, it added.

The regulator has also directed all mutual funds to segregate and ring-fence all assets and liabilities of each MF scheme from other schemes of the mutual fund.

Mutual funds are no longer required to issue physical unit certificates.

In another move, the market regulator has done away with the applicability of minimum promoters' contribution and the lock in requirements for companies making further public offers (FPOs).

The regulator said that such an exemption will be available to a company only if its shares have been frequently traded on a stock exchange for at least three years, and if it has redressed at least 95% of the complaints received from the investors.

What effects the above norms have on Indian stock market remains to be seen.

In news from the automobile sector, Hero MotoCorp is among the top buzzing stocks today.

The country's largest two-wheeler maker on Wednesday said it will increase prices across its products by up to Rs 1,500 in the new year to offset partially increase in commodity costs.

"There has been a steady rise in commodity costs across the spectrum, including steel, aluminium, plastics, and precious metals. We have already accelerated our savings programme under the Leap-2 umbrella, and will continue to work on mitigating the impact, with the objective to reduce the burden on the customers and protect our margins", the company said in a statement.

The increased prices of its products will come to effect from January 1, 2021.

Note that earlier this week, Mahindra & Mahindra (M&M) also announced it will increase the price of its passenger vehicles (PVs) and commercial vehicles (CVs) from January 1, 2021, citing same reasons.

Earlier this month, the country's largest carmaker Maruti Suzuki had also announced that it will be increasing prices across its model range from January 2021.

The automaker said that cost of vehicles severely impacted due to various input costs and it's necessary to pass on some of the impacts to customers.

Ford India has also earlier stated that it would be increasing prices of its respective vehicles from January.

Hero MotoCorp share price has opened the day up by 0.5%.

Speaking of the automobile sector, note that the sector has rebounded sharply from its March lows.

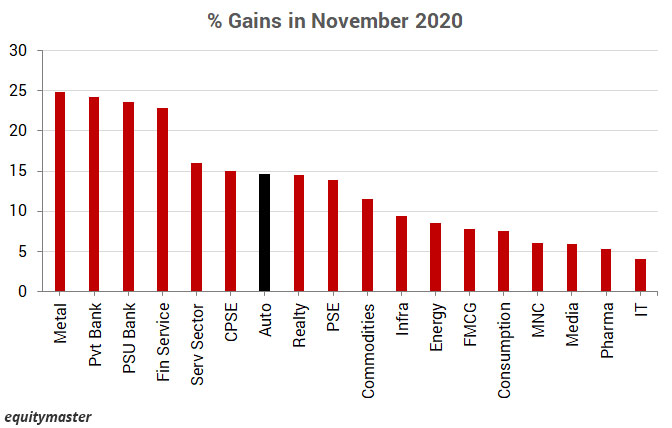

The Nifty Auto index gained as much as 15% last month.

The auto index entered the greed phase in September 2019 and will stay there until December 2021. This means there is still a lot of fuel left for auto stocks.

How automobile stocks perform in the coming months remains to be seen.

Moving on to news from the pharma sector, pharma major Cipla announced its partnership with the Premier Medical Corporation for commercialization of the rapid antigen test kits for COVID-19 in India.

"In this collaboration, Cipla will be responsible for the marketing and distribution of the Rapid Antigen Detection Test for the qualitative detection of SARS-CoV-2 antigen that will be manufactured by Premier Medical Corporation Pvt Ltd," Cipla said in a regulatory filing.

The company said it will commence supply of rapid point-of-care nasopharyngeal swab tests from this week.

The test will be marketed under the brand name 'CIPtest'.

Cipla share price has opened the day up by 0.3%.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Flat; ONGC & Power Grid Among Top Nifty Gainers". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!