India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News December 15, 2016

Sensex Opens Flat as Fed Flags More Hikes Thu, 15 Dec 09:30 am

Asian markets are lower today after the Federal Reserve raised rates for the first time in a year. The Fed's rate rise of 25 basis points to 0.5-0.75 percent was well flagged but investors were spooked when the "dot plots" of members' projections showed a median of three hikes next year, up from two previously. Yields on short term U.S. debt surged to the highest since 2009.

The Nikkei 225 is off 0.15% while the Hang Seng is down 1.57%. The Shanghai Composite is down by 0.12%. Stock markets in the US and Europe also ended their previous session on a weak note.

Meanwhile, Indian share markets have opened the day on a flat note. The <>BSE-Sensex is trading lower by 16 points and the <>NSE-Nifty is trading lower by 17 points. Meanwhile, both S&P BSE Mid Cap and S&P BSE Small Cap are trading higher by 0.1% and 0.2% respectively. The rupee is trading at 67.56 against the US$. Gains are largely seen in IT and energy stocks, while FMCG and banking stocks lead the losses.

NTPC is reportedly planning to invest Rs 26.48 billion for development of three coal blocks in Odisha. The company will invest Rs 6.84 billion in the Dulanga coal block, which is linked to its Dariplalli super thermal power project that has the capacity to generate 1,600 Mw of power. The power project, which is supposed to come up in Sundargarh district, will attract an investment of Rs 125.32 billion from NTPC.

Apart from the Dulanga coal block, NTPC was also allocated the Mandakini-B coal block last year to help fuel its first 4,000-Mw power plant in Telangana. The Mandakini block will receive an investment worth Rs 15 billion.

In the same year, the firm entered into a joint venture (JV) with the Jammu and Kashmir State Power Development Corporation (JKSPDCL) to form a JV company for mining at the Kudanali-Luburi coal block, where Rs 5 billion will be invested for development purposes.

NTPC's eastern region II has an installed capacity of 3,720 MW, which includes Talcher Thermal Power Station (460 MW), Talcher Super Thermal Power Station, Kaniha (3,000 MW), and Kaniha 10 MW solar plant) in Odisha and one unit at Bongaigaon (250 MW) in Assam.

NTPC has also completed electrification of 301 out of 531 target un-electrified villages in Odisha as on date.

NTPC's share price began the trading day up by 0.1% on the BSE.

In another development, S&P Global Ratings recently stated that demonetisation and a likely GST rollout from September 2017 are likely to cast a "higher disruptive impact" on informal, rural, and cash-based segments of the economy. It further said that Indian banks and companies face short-term downside risks due to the cash crunch arising from the government's decision.

However, it was quick to point out that the move will be beneficial for the Indian economy in the long run.

The rating agency recently revised downwards its estimated economic growth rate for 2016-17 by one full percentage point to 6.9% to reflect the disruption caused by the surprise move of demonetisation. It said the government's decision to cancel the legal tender status of high-value rupee notes has caused a significant physical cash crunch.

S&P expects both demonetisation and the goods and services tax (GST) to adversely impact some sectors of the economy in the short run but have long-term benefits.

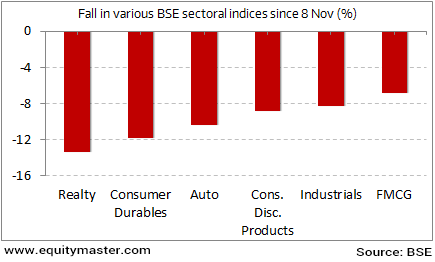

The below chart illustrates the various BSE sectoral indices that have been hit the hardest over the last month. The worst affected has been real estate. It's no hidden secret that the conduct of business in this industry here in India has for long had one of the highest proportion of black money involved. Its index is down a huge 13%.

One Month On, The Biggest Losers of Demonetisation

The report further noted that, in the long run, demonetisation and GST could result in a wider tax base and greater participation in the formal economy. This should benefit India's business climate and financial system. S&P says that as per its case scenario, the disruption from demonetisation should be short-lived, with demand revival in the next one to two quarters, limiting the impact on Indian banks and corporates.

Meanwhile, S&P's director Kyran Curry also stated that India's surprise move to abolish high-value rupee notes has undermined the central bank's reputation for competence and independence.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Flat as Fed Flags More Hikes". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!