India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News December 14, 2016

Sensex Remains Flat; Metal Stocks Witness Selling Pressure Wed, 14 Dec 11:30 am

After opening the day on a flat note, the Indian share markets have continued to trade near the dotted line. Sectoral indices are trading on a mixed note with stocks in the realty sector and energy sector witnessing maximum buying interest. Metal sector stocks are trading in the red.

The BSE Sensex is trading flat and the NSE Nifty is trading down 10 points (down 0.1%). Both, the BSE Mid Cap index and the BSE Small Cap index are trading up by 0.1%. The rupee is trading at 67.56 to the US$.

Speculations as to what impact the US president-elect Donald Trump's presidency will have on various countries are doing the rounds. This comes as Trump has announced to withdraw from the Trans-Pacific Partnership (TPP) after assuming office in January.

As per a leading financial daily, the impact of the above announcement is being felt in India's trade pact talks with 15 other countries under the Regional Comprehensive Economic Partnership (RCEP).

In our view, US's withdrawal from the TPP will mean a big blow to US trade deals with Asia. In fact, it could even influence India's trade pact talks with 15 other countries under the Regional Comprehensive Economic Partnership (RCEP). RCEP is a proposed free trade agreement between 10 Asean countries besides China, Japan, South Korea, Australia, New Zealand and India.

But irrespective of these macro events, there are businesses in India that will continue to do well. And that would create shareholder wealth in the long term when invested in at right levels. So our message to all value investors is this: Focus on the business fundamentals, and use short term corrections due to global economic events to add such businesses to your portfolio.

In fact, we are keeping a close watch and will use any crash opportunity such as above to recommend great businesses that look good but do not allow action due to valuation concerns. Meanwhile, you take care at your end to stay clear of profit killers, irrespective of how tempting the valuations look.

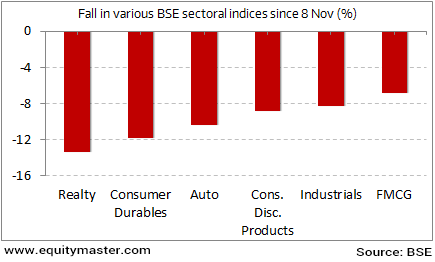

Demonetisation has indeed been a big shocker for the real estate sector. It's one of the biggest losers of the demonetisation drive. This is evident in the chart below:

One Month On, The Biggest Losers of Demonetisation

But this isn't the end. The sector has Real Estate Regulation and Development Act, 2016, or RERA, kicking in. The introduction, while good for the end consumer, will mean more formalities for the real estate companies. Apart from this, the recent decision of the Reserve Bank of India (RBI) to not cut interest rates has impacted the sentiments in the real estate sector. Furthermore, high debt in the sector could impact the performance of banks as well. As Richa Agrawal stated in HYPERLINK "https://www.equitymaster.com/5MinWrapUp/detail.asp?date=11/25/2016&story=5&title=Demonetisation-Could-Trigger-a-Subprime-Crisis-in-India"one of the recent editions of The 5 Minute WrapUp...

- We already have 60% of the banks burdened with non-performing loans that are at historic highs. The banks and NBFCs may claim that their loan to value ratios are within limits. But most of them are over exposed to the realty sector thanks to the system of dual financing. With sector already reeling under the bad debt crisis, this could be the proverbial last straw to break the camel's back.

So, there is no denying that the months ahead could be times of chaos and uncertainty for the real estate sector. That said, the correction in prices of real estate stocks could also offer some bargain buying opportunities for investors. In fact, the HYPERLINK "https://www.equitymaster.com/outlook/archivesvi.asp" \t "_blank" ValuePro team just recommended a stock from the real estate sector. And considering how different this company and its management are from typical real estate businesses, the team believes even Buffett would consider buying this stock.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Remains Flat; Metal Stocks Witness Selling Pressure". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!