India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News December 13, 2016

Sensex & Nifty Remain Marginally Higher; Tata Motors Up 2.5% on Block Deals Tue, 13 Dec 01:30 pm

The Indian share markets continue to trade range bound with a positive bias. Sectoral indices are trading on a mixed note with auto and consumer durables stocks leading the pack of gainers. Whereas, metal and realty stocks heading the losers.

The BSE Sensex is trading higher by 169 points while the NSE Nifty is trading higher by 8 points. The BSE Mid Cap index is trading down by 0.8% while BSE Small Cap index is trading down by 0.2%. Gold prices, per 10 grams, are trading at Rs 27,580 levels. Silver price, per kilogram is trading at Rs 41,563 levels. Crude oil is trading at Rs 3,567 per barrel. The rupee is trading at 67.58 to the US$.

Tata stocks are trading on a mixed note with Tata Motors and Tata Sponge leading the gains. Tata Motors' share price rose nearly 5% touching to Rs 477, after a more than 50 million shares of the company changed hands via block deals.

Reportedly, investment bank Morgan Stanley on Monday launched a block trade for a transaction for undisclosed entity who will sell 1.73% stake of the Tata Motors.

Reportedly, the total deal was estimated at Rs 25 billion, representing 1.73% of Tata Motors' equity capital. The deal comes days ahead of an extra-ordinary general meeting (EGM) called by the Tata motors to oust its current chairman Cyrus Mistry. As per media reports say the Tata Sons is likely to be the buyer to gain an edge in the EGM voting.

One must note that, Tata Sons Ltd has been stepping up the pressure on Mistry ever since he was sacked as chairman of the holding company on 24 October.

Tata Group: Some Losing Propositions

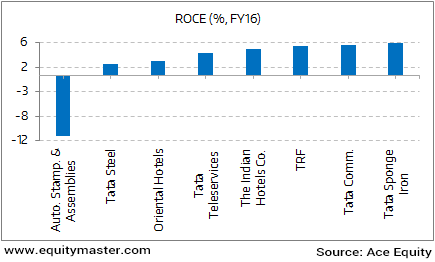

However, the real reflection of an efficient and competent management is cash flows and returns. If the management does not walk the talk, the company does not make the cut. As you can see in the chart, Tata Steel's UK operations, and a lot of other projects, offer little to support the group's claim regarding the interests of minority shareholders.

India's epic boardroom battle at Tata is gaining intensity with every passing day. Since Mistry's ouster, there has been lot of mudslinging. And the country's most trusted group's sheen has faded. However, the trouble at Tata Sons is really an issue of whether you think Corporate Philosophy guides the very existence of the Tata group as a family and a business or whether the actions of the various hired hands (from CEOs to Directors) should be determined by Corporate Governance.

Moving on to the news from stocks in pharma sector. Sun Pharma and Israel-based Moebius Medical have entered into an exclusive licensing deal to further develop MM-II, a pharmaceutical candidate for the treatment of pain in osteoarthritis. MM-II is a novel non-opioid product helps in reducing friction and wear, consequently leading to joint pain reduction.

Under the agreement, Sun Pharma will fund further development of Moebius Medical's molecule, and undertake its global commercialization. Further Moebius Medical will conduct requisite pre-clinical studies and will assume responsibility for product development and manufacturing (Subscription Required) through the end of Phase-II studies.

Global market for products used for symptomatic relief of knee osteoarthritis pain is about US$2 billion. The US alone accounts for about 40% of this market. The deal with Moebius Medical is a part of the company's effort to create a branded product pipeline and improve the worldwide portfolio in pain medicines, the reports noted.

As the M&A activity has been heating up globally, the M&A activity in the Indian pharma space has been on the rise in recent times. At the end of the day, whether the company is able to derive value from the acquisitions and augment the overall performance will be the key thing to watch out for going forward.

Sun Pharma's share price was trading up by 0.9% at the time of writing.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex & Nifty Remain Marginally Higher; Tata Motors Up 2.5% on Block Deals". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!