India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News December 10, 2020

Indian Share Markets Open Lower; UPL & IRCTC Fall 10% Thu, 10 Dec 09:30 am

Asian share markets are trading lower today, taking cues from their North American peers. The Nikkei is trading down by 0.3% and the Hang Seng is trading down by 0.4%.

In US stock markets, Wall Street indices took a bit of a hit as investors awaited further news on economic stimulus and Covid-19 vaccines while ongoing Brexit negotiations added another dash of uncertainty for investors.

The Dow Jones Industrial Average fell 0.5%, while the S&P 500 lost 0.9% after hitting a record high intra-day. The tech-heavy Nasdaq dropped 2%.

Back home, Indian share markets have opened on a negative note, tracking weak global cues.

The BSE Sensex is trading down by 162 points. Meanwhile, the NSE Nifty is trading lower by 56 points.

Maruti Suzuki is among the top gainers today. Tata Steel, on the other hand, is among the top losers today.

The BSE Mid Cap index has opened down by 0.4%. The BSE Small Cap index is trading down by 0.2%.

Sectoral indices are trading on a mixed note with stocks in the IT sector and metal sector witnessing most of the selling pressure. Healthcare stocks are trading in green.

The rupee is trading at 73.68 against the US$.

Gold prices are trading up by 0.1% at Rs 49,262 per 10 grams.

To know more about gold, you can check out our detailed article on investing in gold here: How to Invest in Gold?

Speaking of the current stock market scenario, note that the Sensex on Wednesday topped the 46,000-mark for the first time while the Nifty surpassed 13,500 mark.

Both the indices have logged record highs in 14 of the last 21 trading sessions and are up over 4% in December, extending last month's 11.5% gain.

As many as 273 stocks hit their 52-week highs yesterday.

In his latest video, Brijesh Bhatia, Research Analyst of Fast Profits Reports, shares his learnings from 15 years in the market.

In the video, he explains what separates the few successful traders from every other trader in the market.

Tune in to the video to find out more:

In case you missed his very first Equitymaster video, you can watch it here.

In news from the commodity space, crude oil prices rose in early trade today, buoyed by a Covid-19 vaccine rollout in Britain and the imminent approval of a vaccine in the United States, which could spur a rebound in fuel demand, despite a large build in US crude stocks last week.

US West Texas Intermediate (WTI) crude futures rose 23 cents, or 0.5%, to US$ 45.75 a barrel, while Brent crude futures climbed 21 cents, or 0.4%, to US$ 49.07 a barrel.

Crude oil prices were also supported by some nervousness after two wells at a small oilfield in northern Iraq were set ablaze in what the government called a "terrorist attack", though production was not affected.

Crude inventories rose by 15.2 million barrels in the week to December 4, the Energy Information Administration said, compared with a Reuters poll for a 1.4 million barrel drop.

Note that the coronavirus pandemic, coupled with the collapse of an OPEC-led output pact sent crude oil prices crashing in March.

After the collapse of that output pact led to a brief Saudi Arabia-Russia price war, the Organization of the Petroleum Exporting Countries and allies agreed a new deal on record production cuts to support prices.

We will keep you updated on the latest developments from this space. Stay tuned.

Speaking of crude oil, in one of his videos, Vijay Bhambwani explains why crude oil prices and natural gas prices are moving in opposite directions.

You can check the same here: Why Are Crude Oil and Natural Gas Prices Moving in Opposite Directions?

Moving on to stock specific news...

Maruti Suzuki is among the top buzzing stocks today.

Maruti Suzuki India on Wednesday said it will increase prices of its vehicles from January to offset the adverse impact of rising input costs.

Over the past year, cost of the company's vehicles have been impacted adversely due to increase in various input costs, Maruti Suzuki India said in a regulatory filing.

"Hence, it has become imperative for the company to pass on some impact of the above additional cost to customers through a price increase in January 2021. This price increase shall vary for different models," it added.

The above announcement comes at a time when Maruti is recovering from the lockdown induced disruptions. In November, it had posted a 2.4% decline in total domestic passenger vehicle sales at 1,35,775 units as against 1,39,133 in the same month last year.

Its overall sales, including exports, were at 1,53,223 units as against 1,50,630 in November 2019, a growth of 1.7%.

Maruti Suzuki share price has opened the day up by 1.5%.

Speaking of the automobile sector, note that the sector has rebounded sharply from its March lows.

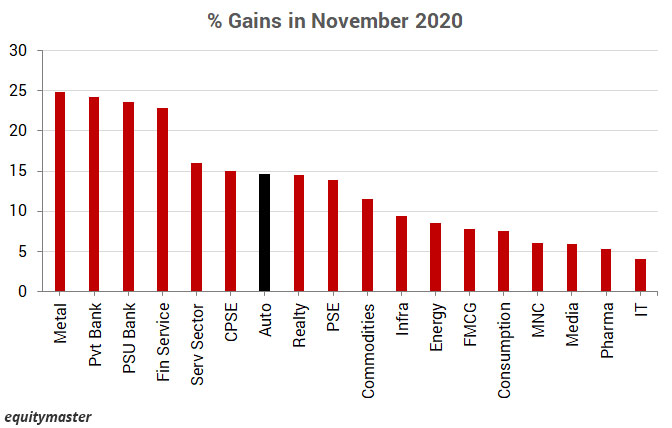

The Nifty Auto index gained as much as 15% last month.

The auto index entered the greed phase in September 2019 and will stay there until December 2021. This means there is still a lot of fuel left for auto stocks.

How automobile stocks perform in the coming months remains to be seen.

Moving on to news from the IT sector, India's largest IT services firm Tata Consultancy Services (TCS) on Wednesday said its up to Rs 160-billion share buyback programme will commence on December 18 and close on January 1, 2021.

TCS' smaller rival Wipro has also announced a buyback plan for up to Rs 95 billion at Rs 400 per equity share.

Last month, TCS shareholders had approved a proposal to buy back up to 5,33,33,333 equity shares of the company at Rs 3,000 per scrip for an aggregate amount not exceeding Rs 160 billion.

The company's CEO and Managing Director Rajesh Gopinathan had earlier said the company is focused on its policy to return capital to shareholders.

Last year, TCS had offered a special dividend and this time it is undertaking a buyback, he had noted. In October last year, TCS' board had declared a special dividend of Rs 40 per equity share.

In 2018, TCS had undertaken a share buyback of about Rs 160 billion, while it had conducted a similar share purchase exercise in 2017.

TCS share price has opened the day down by 0.5%.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Indian Share Markets Open Lower; UPL & IRCTC Fall 10%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!