India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News December 10, 2016

Global Markets Ended on a Positive note Sat, 10 Dec RoundUp

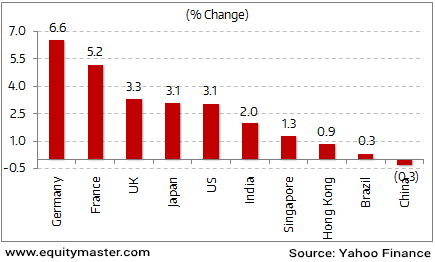

Barring China (down 0.3%), major global indices closed on a positive note. The US equity markets closed at a record on Friday as the broad indices witnessed its best winning streak since June 2014. The European shares had their best week since the beginning of the year.

The European Central Bank surprised investors by announcing that it would trim asset buys from April next year to 60 billion euros per month from April. Currently it buys 80 billion euros worth of bonds every month. But at the same time it has also extended its bond-purchase program by nine months to December 2017. The ECB action was mix of tightening and loosening measures.

The broad benchmark indices across the Asian countries closed with robust weekly gains. Asian stock market reaction to perceived policy easing by ECB was taken positive. China's stock market announced positive economic data, released on Friday. While the Shanghai stock markets surged on this news, it closed marginally lower for the week.

The global optimism, kindled rally in the Indian indices too. Indian benchmark indices completed their biggest weekly gain since September and closed higher by 2%. The ECBs move of extending stimulus is expected to bring in more FIIs inflows. During the week gone by, the Reserve Bank of India (RBI) unexpectedly kept its repo rate unchanged at 6.25%. The central bank also lowered GDP growth rate forecast for current fiscal to 7.1% and admitted to short-term disruption in economic activities due to demonetisation.So the RBI's decision to stay pat on interest rates came as a disappointment for market participants.

Key World Markets During the Week

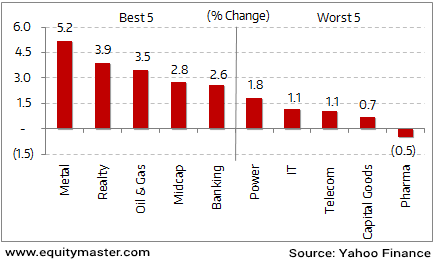

On the sectoral indices front, barring pharma stocks, all the major indices closed on a positive note. Realty and Metal stocks were the leading gainers in the pack

BSE Indices During the Week

Now let us discuss some key economic and industry developments during the week gone by.

Given the flagging state of industrial economy and falling consumption on the back of the demonetisation drive, market participants were expecting the RBI to cut rates by 0.25%. But, RBI unexpectedly kept its repo rate unchanged at 6.25%. The central bank also lowered GDP growth rate forecast for current fiscal to 7.1% and admitted to short-term disruption in economic activities due to demonetisation.So the RBI's decision to stay pat on interest rates came as a disappointment for market participants.However, that was not the case for us. Now, as you know, rate hikes and cuts never really disappoint or enthuse us. For in no way do they impact our long term views on stocks. Yes, we did expect the RBI to cut rates by 0.25% to 0.5% considering the liquidity scenario. But it seems there are reasons (which may be inflation, foreign exchange risks etc etc) for the RBI to stay cautious.What came as disappointment for us was the fact that the RBI has not only stayed away from making its stance clear on demonetization but also failed to put its policy decision in the context of its concerns. That was usually the case with erstwhile policy statements. As our recent edition of The 5 Minute WrapUp states:

- We knew that the withdrawal of the high denomination notes from the system was bound to create temporary uncertainty. However, amidst shortage of new notes the ad-hoc policy changes by RBI have added to the confusion.

In times of a currency crisis, the central banker is expected to take steps to dispel the air of uncertainty and instill confidence through regular updates and plans to tide over. But the central banker chose to remain mum.

The government has accepted that the US$48 billion target for textiles and garment exports for 2016-17, may be hard to achieve due to less demand in major markets like the US, EU and China. During 2015-16, the overall export of textiles and garments from India was US$40 billion, which was below the target of US$47.5 billion. In order to promote exports in garments sector, a special package of incentives was announced in June this year which includes relaxation in certain labour laws, income tax concession, and 100% employer's contribution to EPFO by government, rebate of state levies for exports, etc. Union Textiles Minister Smriti Irani conceded that despite various efforts by the government, it will be difficult to achieve the target for the fiscal Irani further said that the government implements various export promotion schemes to promote exports of all the segments in the sector on a sustained basis. These include, Interest Equalisation Scheme, Merchandise Exports from India Scheme, Market Access Initiative, Market Development Assistance and Duty Drawback.

According to an article in The Livemint, government's decision to ban high-value bank notes has depressed demand for commercial vehicles and two-wheelers for the month of November as automobile sales declined for the first time in 11 months.As per the reports, total sales fell 5.48% during the month, the steepest decline since March 2013. Overall passenger vehicle sales, which include cars, utility vehicles and vans, grew 1.82% to 240,979 units, the slowest since February. Also, medium and heavy commercial vehicle sales declined 13.1%, while sales of light commercial vehicles declined 10.59%. Three-wheeler sales plunged 26%.In two-wheelers, where most purchases happen through cash payments, sales have taken a massive hit. The auto industry doesn't anymore expect to post double-digit sales growth that it was hoping to achieve this fiscal year.The auto companies are suspending production for several days to correct inventory as demand is slow and their products are moving out of dealerships at a slower than normal pace.

According to an article in The Economic Times, Public sector banks (PSBs) have written off Rs 1.54 trillion of bad loans between April 2013 and June 2016. During 2013-14, all PSBs wrote off Rs 344 billion non-performing assets (NPAs). The amount increased further to Rs 490 billion in the following year.Banks wrote off NPAs of Rs 560 billion during 2015-16. Meanwhile, there were 661 NPA accounts above Rs 1 billion amounting to Rs 3.78 trillion from public sector banks as on March 31, 2016. As on September 30, gross NPAs of public sector banks rose to Rs 6.3 trillion as against Rs 5.5 trillion by June end. This works out to an increase of Rs 799 billion on quarter on quarter basis.As per the reports, most of the NPAs continue to be contributed by "the usual five-six sectors" from the industry segment that have been the cause for much of the stress in the banking system for the last few quarters. Steel, power, shipping, sugar and infrastructure are the industries which have seen the maximum amount of stress in the last few years.The government has taken specific measures like enactment of the Insolvency and Bankruptcy Code (IBC) and amendment of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act (SARFAESI) and the Recovery of Debt due to Banks and Financial Institutions (RDDBFI) Act aimed at improving resolution or recovery of bank loans.The problem of bad loans is indeed quite severe and when we compare it with other global peers it looks daunting. Out of the ten major economies facing NPA problems, India is ranked seventh.

The production of tea in the country stood at 147.64 million kgs in October, a decrease of 15.79 million kgs (9.66%) over the corresponding period, due to unfavorable weather. India is the world's second biggest tea producer and exports CTC (crush-tear-curl) grade mainly to Egypt, Pakistan and the UK and the orthodox variety to Iraq, Iran and Russia.The production of tea in North India dropped 10.69% to 129.40 million kg in October 2016 as compared to 144.89 million kg production in October last year. Tea production in South India slipped up by 1.62% to 18.24 million kg as compared to 18.54 million kg in October last year.The production in West Bengal slipped 7.68% to 41.33 million kg as compared to 44.77 million kg last year in October, while output in Assam dropped by 12.52% to 84.72 million kg in October 2016.Assam contributed majorly with a production 652.95 million kg of tea in 2015-16 helping the country with a highest ever tea production during the fiscal year of 2015-16. This even led to the breaching of exports mark of 230 million kg after 35 years. India is the second-largest tea producer in the world after China, with over 70% of the beverage produced, being consumed in the country itself.

Movers and Shakers During the Week

| Company | 2-Dec-16 | 9-Dec-16 | Change | 52-wk High/Low |

|---|---|---|---|---|

| Top Gainers During the Week (BSE Group A) | ||||

| Nalco /a | 54 | 65 | 20.0% | 72/30 |

| IFCI /a | 23 | 27 | 20.0% | 31/20 |

| Sun TV /a | 437 | 518 | 18.4% | 567/312 |

| SAIL /a | 50 | 55 | 11.4% | 56/34 |

| Coromandel International /a | 255 | 284 | 11.4% | 293/146 |

| Top Losers During the Week (BSE Group A) | ||||

| Crompton Greaves /a | 76 | 63 | -17.1% | 204/41 |

| Sun Pharma /a | 719 | 673 | -6.5% | 898/572 |

| SJVN /a | 33 | 31 | -4.3% | 204/41 |

| Ramco Cements /a | 585 | 56 | -90.4% | 898/572 |

| Ipca Labs /a | 565 | 544 | -3.7% | 35/26 |

Some of the key corporate developments in the week gone by.

Shares of Sun Pharmawitnessed sharp correction during the week. The company confirmed that its Halol facility had undergone an inspection by United States Food and Drug Administration (USFDA) recently. Reportedly, USFDA has informed Sun Pharma that the Halol facility has issued a 14-page Form 483 post inspection.Concerns over Halol resurfaced after Sun's plant at Mohali received seven observations after a re-inspection by the USFDA (Subscription Required) last month. Significantly, it is the same team of FDA executives that re-inspected the Halol plant, too. It is to be noted that Sun Pharma's plant at Mohali is one of the facilities of former Ranbaxy.As per the reports, USFDA clearance to Halol unit is key to its revenue growth, especially for US business that contributed nearly 50% to overall revenue in FY16.Sun Pharma's Halol plant received a warning letter last year from the regulator due to past violations which has prevented new product launches from the facility in the US, Sun's largest market. That has slowed revenue growth at the company and imposed new costs to make the plant USFDA compliant. The latest USFDA inspection came after the company invited the agency back to review a year's worth of remediation efforts in the hope that the warning letter would be lifted.

As per an article in The Livemint, Steel Authority of India Limited (SAIL) reported a decline in standalone net loss at Rs 7.30 billion for the quarter ended September 30, helped by a strong marketing push and cost optimization measures. The company had posted a net loss of Rs. 11.08 billion in the year-ago period. Total standalone income of the company rose by 21% to Rs 125.77 billion in July-September quarter this fiscal from Rs 103.78 billion during the same quarter in 2015-16.SAIL joins Tata Steel Ltd in posting a negative result for the period partly on weaker product prices and as Tata's operations in the UK remained a drag on earnings, while the nation's second-largest producer JSW Steel Ltd reported a third straight profit on record output.India has tightened curbs on cheaper imports from countries including China as domestic mills ramp up production on expectations that Prime Minister Narendra Modi will boost spending on infrastructure, roads and power. Indian Steel Sector contributed 2% to overall Gross Domestic Product of the country during 2015-16. India is close to acquiring the second position in crude steel production if it continues with its current growth rate. According to the latest report of World Steel Association (WSA), India's steel production during January-October 2016 grew by 6.8% to reach 79.5 million tonnes, even as global steel output saw a 0.1% contraction.

As per an article in The Economic Times, Mahindra & Mahindra (M&M) likely to shut down all its factories in the last week of December for maintenance. Mahindra is one of the automakers worst hit by demonetisation. Rural India, where cash transactions are high, accounts for a chunk of its sales, especially for the top selling Bolero. It expects December volume to fall as much as 30% from previous expectations.

Tata Steel has pledged to stay in Britain with a 10-year commitment to a one-billion-pound investment plan as part of crucial talks with steelworkers' unions to save thousands of jobs in the UK.Tata Steel offered a number of guarantees to its staff at Port Talbot steelworks in south Wales which is UK's largest steel plant, including a minimum five-year guarantee to keep both furnaces operational at the site.Tata will next week start a consultation with its employees on a proposal to close the British Steel Pension Scheme, which has liabilities of over 15 billion pound, and offer employees a "competitive defined contribution scheme" in its place.Industrial group Thyssenkrupp, which has long been seeking a solution for its ailing steel business, has insisted it is not prepared to take on Tata's pension liabilities in the event of a merger. Moreover, the company has made clear that its primary aim in merging with Tata is to combat overcapacity in the steel sector. In another development, since surprise exit of Cyrus Mistry and his surprising revelations, the group has lost around 15% of their market capitalization. In numbers, the group has lost around Rs. 1.16 trillion. TCS, Tata Motors, Titan and Tata Steel have seen maximum value erosion due this event.

According to an article in The Economic Times, demonetization has had an impact on FMCG business with primary sales declining significantly. However, Dabur India is of the opinion that the demonetization of high value currency notes would have beneficial impact on organized players in the long run. On account of scarcity of cash available with customers and trade, Dabur is foreseeing near term pressures on the its business.Dabur India said that the impact varies across channels and geographies. Moreover, the stress is highest for wholesalers and small town grocery shops, who are facing a severe liquidity crisis and are destocking. The impact is likely to be positive on modern trade outlets and plastic money enabled retailers who are likely to benefit from this change.In the meanwhile, the company is focusing more on modern retail, e-commerce and institutional sales. It is also encouraging general trade retailers to adopt cashless payment systems. This will help in mitigating the overall impact of demonetisation and pave the way for normalization in the next few months.However, to mitigate the issues of credit risk and defaults from the trade partners, Dabur is giving credit extensions in a calibrated manner. One the liquidity front, Dabur said that it is already seeing signs of liquidity improving in the Southern region compared to North and the East region.Speaking about Modi's push towards a cashless, digital economy, we have compared the quantum of cashless transactions in some of the major economies of the world. The chart shows how far India has to go to become a cashless economy. Just about 2% of the volume of economic transactions in India are cashless.

Next week, the Federal Reserve meeting is scheduledon December 13-14. There is high likelihood that Fed would announce about increase in the interest rates. Last December, the Fed raised rates for the first time in nearly a decade, and later signalled four more hikes would come in 2016. But the outlook quickly changed as the economy did not pick up as anticipated. Thus investors have long anticipated the Fed will raise rates this time around. Now this may spook the rally in the global markets including Indian indices which have on the roller coaster ride, since announcement of demonitisation.

But as we always said, the times of crisis and global chaos are best times to invest in the stock markets. So stay tuned to hear for recommendations from Equitymaster team if the markets witness sharp correction.

And here's an update from our friends at Daily Profit Hunter...

It was a volatile week for the markets. The Nifty opened the week on a positive note and inched up further on Tuesday. However, it hit a sudden roadblock on Wednesday as the RBI monetary policy spooked market participants and the index fell 100 points in two minutes. These losses were wiped out on Thursday as the Nifty opened with gap up and trended higher throughout the day. The index ended the week at 8,255 with gains of 2%. Going forward, it seems the bulls can push the index up further to 8,350. However, they need to be cautious as volumes this week were lackluster. You can read the detailed market update here...

Nifty Ends On a Positive Note

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Global Markets Ended on a Positive note". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!