India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News December 9, 2016

Sensex Remains Flat; FMCG Stocks Witness Buying Interest Fri, 9 Dec 11:30 am

After opening the day on a flat note, the Indian share markets registered marginal gains and continued to trade near the dotted line. Sectoral indices are trading on a mixed note with stocks in the FMCG sector and IT sector witnessing maximum buying interest. Metal sector stocks are trading in the red.

The BSE Sensex is trading up 59 points (up 0.2%) and the NSE Nifty is trading up 13 points (up 0.2%). The BSE Mid Cap index is trading up by 0.2%, while the BSE Small Cap index is trading up by 0.6%. The rupee is trading at 67.62 to the US$.

The European Central Bank (ECB) caught attention of global financial markets yesterday by announcing that it would trim asset buys from April next year. The central bank, in its latest monetary policy, said that it would cut its asset purchases to 60 billion euros per month from April. This compares against 80 billion euros' worth of bonds it buys every month at present.

The decision came as a surprise and dashed hopes of an extension of the stimulus at the present pace of 80 billion euros for the next six months.

However, the ECB reserved the right to increase asset purchases again if the euro zone's recovery faltered. Also, ECB president Mario Draghi said that he is not offering an outright winding-down of the programme.

Apart from the above, the ECB kept its interest rates unchanged. By that, the deposit rate stands deep in the negative territory.

The bank also maintained its inflation forecast at 0.2% this year. It raised it slightly to 1.3% next year and said it saw inflation at 1.5% in 2018.

The ECB, in its Financial Stability Review last month, warned of more near-term volatility in global markets. As per the ECB, the risk of an abrupt global market correction has intensified on the back of widespread political uncertainty that poses a threat to banks, stability, and economic growth.

The report stated that elevated geopolitical tensions and heightened political uncertainty amid busy electoral calendars in major advanced economies have the potential to reignite global risk aversion and trigger a major confidence shock.

All of this is happening in the Eurozone. And it's a mess. First came the Grexit saga. Then there was Brexit. Now it's Italexit. The Italy referendum has attracted most of the headlines. Italians voted to reject constitutional reforms. That further led Matteo Renzi to resign as the country's Prime Minister.

While the referendum wasn't about the Eurozone, could Italy be next in line after Britain to exit the Eurozone? If one has to understand the ground realities, dark days could be in store for the Eurozone. As Rahul Shah writes in one of the recent editions of The 5 Minute WrapUp Premium...

- Youth unemployment has soared over 40% since 2013. GDP growth has been mostly negative since 2008. Even worse, per capita GDP has stagnated since the 1990s. Government debt stands at 133% of GDP (only Greece and Japan are higher). Private debt stands at 117% of GDP.

Then there are the Italian banks. They are struggling with non-performing loans, the highest in the Eurozone. Contrary to what many believe, Deutsche Bank is not the weakest bank in Europe. It is Italy's third-largest bank, Monte dei Paschi di Siena. It needs five billion euros of new capital and has warned it may have to go out of business if it does not get it.

Seven other regional banks are also in serious trouble. Apparently, only one bank, Unicredit, is believed to be strong enough to weather this storm.

In short, there is a big crisis brewing within the Eurozone. And this is going to have major consequences for the global financial markets, including the Indian stock markets.

The latest issue of Vivek Kaul's Inner Circle presents an intriguing insight on Italexit from our global team of experts in London and other corners of the world. We strongly recommend you to read it.

Apart from the above developments, market participants are keeping tabs on the OPEC meeting scheduled for today.

Russia and other non-OPEC producers are going to meet with OPEC today to discuss the pace of production cuts. So far, the Organisation of Petroleum Exporting Countries (OPEC) has agreed to a production cut starting January. However, the implementation depends on Russia reliably committing to cut output.

If the decision goes through, it can have negative implications for the Indian economy. Ever since June 2014, the Modi government has received a huge tailwind from falling crude prices. But as crude oil prices start rising, this trend could reverse. Rising crude oil prices will have a pass-through effect on inflation.

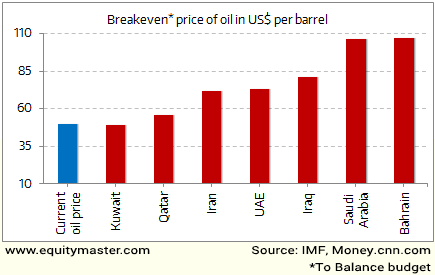

Apart from the above, the deal will also have major implications on crude oil producing countries. As far as the threat of oversupply from shale projects is concerned, the breakeven oil price for every US shale oil project is much higher than US$50 per barrel. Even the fiscal breakeven price of oil for major producers is above US$50 per barrel. This can be seen in the chart below:

Oil Price Implications for Major Oil Producers

To keep a tab on the movements in crude oil and other commodities, you can read the stock market commentary from the Daily Profit Hunter team. Their commentary tracks the developments in the global economy as well as stock, currency and commodity markets.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Remains Flat; FMCG Stocks Witness Buying Interest". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!