India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News December 8, 2020

Sensex Opens in Green; UltraTech Cement & Maruti Suzuki Top Gainers Tue, 8 Dec 09:30 am

Asian stock markets came under pressure in early trade today as investors struggled to balance hopes for more economic stimulus and vaccines with anxiety over the growing number of Covid-19 cases.

The Hang Seng is trading down by 0.6% while the Shanghai Composite is trading lower by 0.3%. The Nikkei is down 0.4%.

In US, the Nasdaq closed at a record high on Monday after investors moved into mega-cap growth stocks even as a new round of Covid-19 restrictions underscored the continuing economic impact of the pandemic on the United States.

The Dow Jones Industrial Average fell 0.5% while the Nasdaq added 0.5%.

Back home, Indian share markets have opened the day on a positive note.

Investors are tracking banking and financial stocks as the Supreme Court is set to resume hearing in the Interest Waiver/Loan Moratorium case.

Tata Group and Shapoorji Pallonji Group stocks will also be in focus as the SC is expected to deliver its verdict in the Tata vs Mistry case later today.

The BSE Sensex is trading up by 127 points. The NSE Nifty is trading higher by 39 points.

UltraTech Cement and Sun Pharma are among the top gainers today.

Both, the BSE Mid Cap index and the BSE Small Cap index have opened the day up by 0.6%.

Barring metal and energy stocks, all sectoral indices are trading on a positive note with stocks in the auto sector and realty sector witnessing maximum buying interest.

The rupee is trading at 73.80 against the US$.

Gold prices are trading up by 0.3% at Rs 50,100 per 10 grams.

To know more about gold, you can check out our detailed article on investing in gold here: How to Invest in Gold?

Speaking of stock markets, in his latest video, Brijesh Bhatia, Research Analyst of Fast Profits Reports, shares his learnings from 15 years in the market.

In the video, he explains what separates the few successful traders from every other trader in the market.

Tune in to the video to find out more:

In case you missed his very first Equitymaster video, you can watch it here.

In news from the automobile sector, Goodyear India is among the top buzzing stocks today.

The board of Goodyear yesterday approved an interim dividend of Rs 80 per equity share of face value of Rs 10 each, for the financial year 2020-21.

The interim date of the dividend has been fixed on December 15, 2020 for the purpose.

Shares of the company surged as much as 16.5% yesterday after the announcement.

In the September quarter, the company had reported net profit of Rs 485.6 million as compared to Rs 377.9 million a year ago.

US-headquartered tyre major Goodyear has recently forayed into automotive lubricants segment in India. The company has collaborated with Assurance International, a part of Satya Group, for a new line of engine oils that will be manufactured, sourced and distributed in the country to complement Goodyear's tyre product portfolio in the region.

Goodyear India share price has opened the day up by 13.4%.

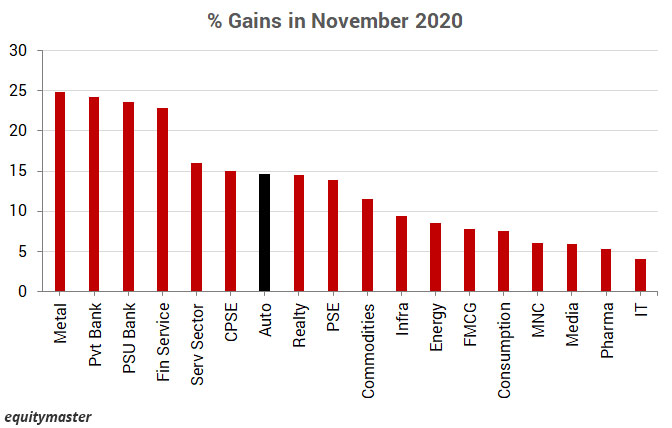

Speaking of the automobile sector, note that the sector has rebounded sharply from its March lows.

The Nifty Auto index gained as much as 15% last month.

The auto index entered the greed phase in September 2019 and will stay there until December 2021. This means there is still a lot of fuel left for auto stocks.

How automobile stocks perform in the coming months remains to be seen.

Moving on to news from the aviation sector, as per a leading financial daily, Jet Airways, the full-service airline which went bankrupt last year, could be back in the skies as early as the summer.

Its new promoters, Murari Lal Jalan and Kalrock Capital, plan to start domestic and international flights with all the slots that were available to the airline before it stopped operations.

The promoters contemplated starting a new airline but chose to stick with the Jet brand due to its continuing value, connect with customers and important flight slots at various airports.

According to the resolution plan, Jet Airways intends to operate all of its historic domestic slots in India and restart international operations.

If everything goes according to plan, and the new consortium receives the National Company Law Tribunal's and other regulatory approvals on time, Jet Airways will be back in the skies by the summer of 2021, a statement issued by the company said.

On 18 October, lenders approved a resolution plan submitted by a consortium comprising UK-based Kalrock Capital and UAE-based entrepreneur Murari Lal Jalan to revive and operate the airline, which was forced to shut operations in April last year due to a severe fund crunch and heavy debt burden.

Jet Airways share price has opened the day up by 5%.

Moving on to news from the insurance sector, General Insurance Corporation of India (GIC Re) said it has exposure totaling Rs 14.5 billion in IL&FS group, DHFL, Reliance Capital and Reliance Home Finance as of March 2020 and it has made provisions over and above the regulatory norms.

The company's exposure stood at Rs 7.9 billion as of March 31, 2020 by way of investments in debentures of IL&FS group.

GIC Re has made total 100% provision on both secured and unsecured portion of these investments, it said.

Exposure in bonds of Dewan Housing Finance (DHFL) was to the tune of Rs 2 billion, for which the provisions are 100% on both secured and unsecured portion, the state-owned firm said.

In Reliance Capital and Reliance Home Finance, GIC Re had exposure of Rs 3.7 billion and Rs 0.9 billion, respectively, by the end of March 2020.

GIC Re said it has made provisions to the tune of 15% on secured portion of investments in Reliance Capital and Reliance Home Finance, while that for unsecured portion is 100% in each case.

GIC of India share price has opened the day up by 1.2%.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens in Green; UltraTech Cement & Maruti Suzuki Top Gainers". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!