India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News December 2, 2016

Indian Indices Continue Downtrend; FMCG Stocks Witness Selling Pressure Fri, 2 Dec 11:30 am

After opening the day on a weak note, the Indian share markets have continued to trade in the red. Sectoral indices are trading on a negative note with stocks from the FMCG sector and the realty sector witnessing maximum selling pressure.

The BSE Sensex is trading down 233 points (down 0.9%) and the NSE Nifty is trading down 73 points (down 0.9%). Meanwhile, the BSE Mid Cap index is trading down 0.6%, while the BSE Small Cap index is trading down 0.7%. The rupee is trading at 68.35 to the US$.

In the news from the initial public offering (IPO) space, the IPO of mattress maker Sheela Foam received bids five times the issue size on the last day of the bidding process.

As per the news, the IPO attracted brisk buying by qualified institutional investors (QIBs), whose quota limit was subscribed over 14.5 times.

The price band for IPO stood at Rs 680 to 730. The company is one of the leading manufacturers of mattresses in India marketed under its flagship brand 'Sleepwell'. In addition, it manufactures other foam-based home comfort products targeted primarily at Indian retail consumers, as well as technical grades of polyurethane foam ("PU Foam") for end use in a wide range of industries. As part of its international footprint, it manufactures PU Foam in Australia through its wholly owned subsidiary, Joyce Foam Pty Ltd. To know our view on this IPO, please refer to the recent edition of 5 Minute Wrap Up Premium: HYPERLINK "https://www.equitymaster.com/5MinWrapUp/detail.asp?date=11/30/2016&story=7&title=Is-Demonetisation-Modis-Act-of-Creative-Destruction&utm_source=homepage&utm_medium=website&utm_campaign=Content&utm_content=featured-posts" Sheela Foam IPO: Should You Subscribe?

In case of IPOs, listing gains and over subscription of the issues have caught the eye of market participants. In our view, one should not get swayed away by the buoyancy surrounding IPOs. Instead, what one should look for in IPOs is the fundamentals of the business and the attractiveness of valuations.

The bottomline: One needs to evaluate each IPO on its merits by considering its fundamentals and most importantly the valuations, particularly when the hype and mania surrounding an IPO is at its peak.

One of our editions of The 5 Minute WrapUp offers two ways to think about IPOs and explains how to profit from them. Further, in case you wish to run IPOs through a handy checklist, we have something for you. Download our Handbook of IPOs to be able to pick only the right ones for you.

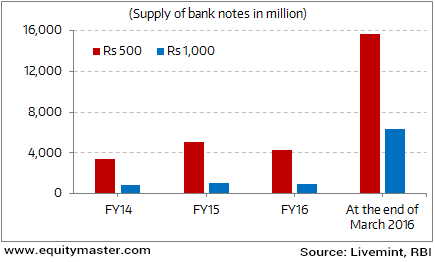

On the news from demonetisation drive, one of the biggest grouse has been the acute shortage of the Rs 500 note. With this, people are questioning whether the government was well prepared to execute the demonetisation?

Ankit Shah answers this question in one of our recent editions of The 5 Minute WrapUp. As he writes...

- If reports are to be believed, then the government planned to bring the Rs 2000 notes first to expedite the replacement of the void 500 and 1,000 rupee notes. This is because four 500 rupee notes would have to be printed for every one 2000 note. Even the government resources for printing do not seem adequate. The two printing presses, The Security Printing and Minting Corp. of India Ltd (SPMCIL) and Bharatiya Reserve Bank Note Mudran Pvt. Ltd (BRBNMPL) have a combined capacity of 24 billion pieces a year or roughly 2 billion pieces a month. The SPMCIL has printed only 15 million pieces of the new Rs 500 note. And with 22 billion of Rs 1,000 notes and Rs 500 notes to be replaced, it will be a while before the money supply is restored.

As the chart below suggests, inadequate capacity to print new Rs 500 notes will continue be the sore point of demonetisation.

The All Too Ubiquitous Rs 500 Note

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Indian Indices Continue Downtrend; FMCG Stocks Witness Selling Pressure". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!