India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News November 29, 2016

Sensex Gains Momentum; Auto Stocks Surge Tue, 29 Nov 11:30 am

After opening the day on a positive note, the Indian share markets continued their momentum and are presently trading in the green. Sectoral indices are trading in the green stocks in the automobile sector and telecom sector witnessing maximum buying interest.

The BSE Sensex is trading up 188 points (up 0.7%) and the NSE Nifty is trading up 59 points (up 0.7%). The BSE Mid Cap index is trading up by 0.8%, while the BSE Small Cap index is trading up by 1.2%. The rupee is trading at 68.66 to the US$.

The demonetisation saga rolls on. People are busy gauging the impact of this move on the economy. And the government is seen announcing new amendments to the demonetisation move.

In a recent move, the government has given another chance to people hoarding black money with them. As per the news, the government has asked people holding black money to come clean at a cost of 50% and having a quarter of their unaccounted wealth locked up for four years.

Also, while doing so, the government has warned that black money holders will be slapped with a penal 85% charge if they don't take advantage of the above relaxation and get caught subsequently.

The above move by the government is a step in the right direction. The end result of the same will mean more black money being accounted for and finding its way in the banking system. Further, the increased flow of money into the banking system would mean more loans extended by banks to the general public. And in order to stimulate the lending, banks may reduce their interest rates. If this happens to be the case, there would be increased spending and an overall benefit for the Indian economy.

However, the above scenario is just a part of the puzzle. While demonetisation is being hailed as the panacea to suck out the black money from the system, the move comes at a cost to the economy in many terms. As one of our latest editions of The 5 Minute WrapUp says, 'We have all been caught up in what is seen. There's not enough attention being paid on what is unseen.' The article explains some of the unseen effects of demonetisation on corporate profitability, real estate, interest rates, stock markets, etc.

The current economic situation in India is unprecedented. The need of the hour is competent, honest and unbiased views on the government's war on cash aka demonetisation.

We believe, Vivek Kaul has done an excellent job in this regard. You could do no better than read Vivek Kaul's insightful little report on this subject, Demonetisation: The Good, Bad and Ugly. It has some great information on how demonetisation could impact things like your investment and your property.

Indian stock markets will watch out for macroeconomic data releases during this week. The list includes gross domestic product (GDP) for third quarter, manufacturing PMI, and September quarter earnings from blue-chip companies. Apart from this, announcements in the global financial markets regarding the US Fed rate hike, US GDP numbers, and OPEC meet will also influence Indian share markets.

However, we believe that it would be unwise to hit the panic button in case of increased volatility fuelled by the above developments. Rather, the question should be: What can I do to sail safely through this volatility and uncertainty?

Asad Dossani has developed a trading strategy that - looking at the back-test results - can be highly profitable during volatile times. Asad believes trading is possibly the best secondary source of income on the planet. In his recent article, Asad discusses how the VMS strategy was used to earn a profit of Rs 8,925 in just two days. You can learn more about his strategy here.

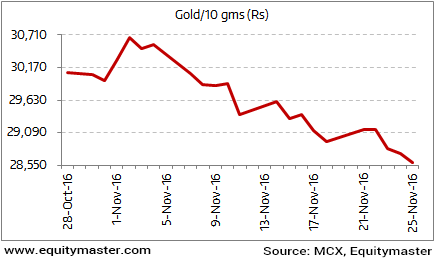

On the news from commodity markets, gold is witnessing selling pressure this week. The yellow-metal opened its session on a negative note this week and continued to witness downtrend later on.

Most of the above losses were seen on the back of the ongoing volatility in global financial markets. Also, a firm dollar overseas weighed on gold.

The above fall is followed by losses witnessed last week. Last week, gold dropped to its nine month lows on speculations over an US interest rate hike by the Fed in December. As you can see in the below chart, gold has declined for three consecutive weeks in a row.

Gold Extends Downtrend

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Gains Momentum; Auto Stocks Surge". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!