India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News November 24, 2020

Sensex Trades Over 300 Points Higher; Dow Futures Up by 239 Points Tue, 24 Nov 12:30 pm

Share markets in India are presently trading on a strong note.

The BSE Sensex is trading up by 330 points, up 0.8% at 44,407 levels.

Meanwhile, the NSE Nifty is trading up by 98 points.

Adani Ports & SEZ and Eicher Motors are among the top gainers today. HDFC Bank and Shree Cement are among the top losers today.

The BSE Mid Cap index is trading up by 0.5%

The BSE Small Cap index is trading up by 0.8%

On the sectoral front, stocks from the automobile sector are witnessing most of the buying interest.

On the other hand, stocks from the energy sector are witnessing most of the selling pressure.

US stock futures are trading higher today, indicating a positive opening for Wall Street indices.

Nasdaq Futures are trading up by 61 points (up 0.5%) while Dow Futures are trading up by 239 points (up 0.8%).

The rupee is trading at 73.97 against the US$.

Gold prices are trading down by 0.9% at Rs 49,020 per 10 grams.

In global markets, gold prices dropped to the lowest level in four months amid optimism over Covid-19 vaccine developments.

Tracking global cues, gold prices fell sharply today in domestic markets, continuing their weak trend of recent weeks. On MCX, December gold futures fell Rs 450 or 0.9% to Rs 49,051 per 10 grams. In the previous session, gold prices had slumped Rs 750 or 1.5% per 10 grams.

To know more about gold, check out our article on how to invest in gold here: How to Invest in Gold?

Speaking of the stock markets, India's #1 trader, Vijay Bhambwani talks about how to use the basis to make trading profits, in his latest video for Fast Profits Daily.

In the video below, Vijay shares what the basis is and how this simple and reliable tool can help you in trading.

Tune in here to find out more:

Moving on to stock specific news...

Among the buzzing stocks today is Mindtree.

Mindtree has signed a five-year deal with leading wind turbine maker, The Nordex Group to simplify, modernize and transform the company's entire IT landscape globally while providing scalability to support its growth plans.

The size of the deal, however, wasn't disclosed.

Stefan Ewald, CIO of the Nordex Group said, "Demand for wind power will continue to grow and so will Nordex. Delivering to our expanding international customer base reliably and securely will require standardization and simplification of our underlying systems. We will design a scalable digital architecture that enables us to deliver with speed and agility."

To align the Nordex Group's IT infrastructure with its strategic vision across the complete value chain, Mindtree will support the full stack transformation of its current IT operations and service delivery.

The scope includes the standardization and roll out of new projects and operational processes, consolidation of existing IT services and development of a future-ready cloud platform which maintains a robust cybersecurity posture.

Mindtree will bring its digital expertise and world-class, industry-acknowledged platforms and capabilities through the use of cloud and internet of things technologies.

How this deal pans out remains to be seen. Meanwhile, stay tuned for more updates from this space.

At the time of writing, Mindtree share price was trading up by 1.8% on the BSE.

Moving on to news from the auto ancillaries sector...Motherson Sumi Announces Multiple Buyouts as Part of Vision 2025

Motherson Sumi, India's biggest auto-component manufacturer, is pursuing multiple buyout deals, some of which will be made public in the final quarter of the year.

The buyouts are a part of the company's vision of tripling revenues by FY25 to US$ 36 billion from US$ 12 billion under the Vision 2025 plan.

Since 2002, Motherson Sumi Systems (MSSL) has made 24 acquisitions in the automotive and non-automotive segments, with the latest being the business assets of Bombardier's Mexico unit.

The electrical wiring interconnection systems (EWIS) of Bombardier Transportation's Mexico plant is engaged in making rolling stock.

Nearly 90% of MSSL's revenues emerge from outside of India. Half of its revenues came from Germany, France, Spain and the United States. Daimler Group, Audi and Volkswagen are the company's biggest customers, accounting for 35% of the revenues.

In the past, MSSL's acquisitions have been propounded by its clients.

While several governments around the world have stepped in to provide financial assistance to companies hit by Covid-19 and the subsequent lockdowns, many companies continue to be in bad shape.

MSSL is waiting to get clarity on the monetary assistance provided by governments. It remains unclear whether the assistance was in the form of a grant or a loan. The UK government, for example, agreed to pay 80% of salary a month, up to 2,500 pounds for employed staff.

The company has said based on this government support it should be able to carry out at least a few buyouts in the next few months.

We will keep you updated on all the news from this space. Stay tuned.

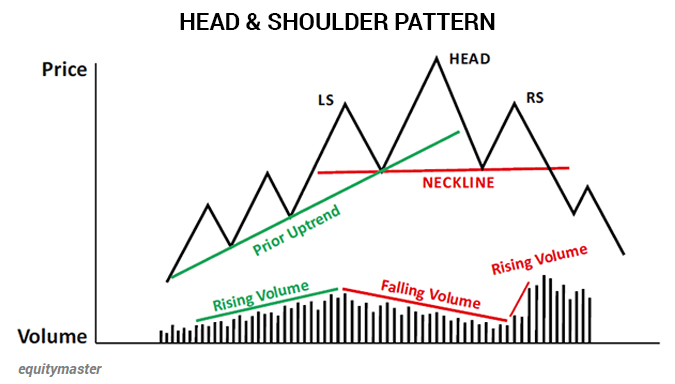

Speaking of stocks, here's a pattern that if you see, you must sell your position. After all, exits are more important than entries.

In the chart below, we can see the head and shoulder pattern - the stock goes up, makes a high, falls a little bit, goes up to a higher high, does not make a higher low, rallies again, fails to make a new high, and then starts to break down.

This usually happens in a situation where a stock or index has typically been in a bull trend for a while.

According to Apurva Sheth, Senior Research Analyst at Equitymaster, spotting this pattern correctly can help you save money.

If you're interested in knowing how you can use this pattern to trade, you can read about it in one of the recent editions of Profit Hunter: It's When You Sell that Counts

And to know what's moving the Indian stock markets today, check out the most recent share market updates here

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades Over 300 Points Higher; Dow Futures Up by 239 Points". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!