India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News November 19, 2020

Sensex Ends 580 Points Lower; Banking and Finance Stocks Bleed Thu, 19 Nov Closing

Indian share markets snapped their 4-day winning streak and witnessed heavy selling pressure today to end deep in the red.

After opening the day on a negative note tracking weak global cues, benchmark indices hit record highs in mid-session. However, huge selling pressure was seen during closing hours and Indian share markets ended deep in the red.

At the closing bell, the BSE Sensex stood lower by 580 points. Meanwhile, the NSE Nifty ended down by 167 points.

SBI was the top loser in NSE. Meanwhile, the top gainers in NSE today include Power Grid and ITC.

SGX Nifty was trading at 12,780, down by 178 points, at the time of writing.

The BSE Mid Cap index ended down by 0.7%. The BSE Small Cap index ended on a flat note.

On the sectoral front, banking stocks and finance stocks were among the hardest hit. The Nifty Bank index tumbled over 850 points, or nearly 3%, after the Supreme Court deferred the hearing in the interest waiver case till next week.

Asian stock markets ended on a negative note. As of the most recent closing prices, the Hang Seng was down 0.7% and the Shanghai Composite stood higher by 0.5%. The Nikkei ended down by 0.4%.

US stock futures are trading lower today indicating a negative opening for Wall Street indices.

Nasdaq Futures are trading down by 62 points (down 0.5%), while Dow Futures are trading down by 119 points (down 0.4%).

The rupee is trading at 74.28 against the US$.

Gold prices are trading down by 0.6% at Rs 50,008 per 10 grams.

Speaking of the stock markets, in his latest video, Co-head of Research at Equitymaster, Rahul Shah discusses why he preferred a little known stock over Nestle and how he was proven right.

Tune in to the video to find out more:

In news from the finance sector, Max Financial Services (MFSL), the parent company of Max Life Insurance, has received an approval from the department of economic affairs (DEA) of the ministry of finance to swap Mitsui Sumitomo's stake in Max Life Insurance with shares of itself, thus consolidating its holding in the life insurance company.

Essentially, the transaction entails swapping Mitsui Sumitomo's 20.6% stake in Max Life Insurance with 21.9% stake in MFSL, which will result in MFSL holding more than 93% stake in the life insurance company.

MFSL will issue and allot 75.4 million shares, equivalent to 21.87% of the paid up share capital to Mitsui Sumitomo as per the agreement.

Currently, MFSL holds 72.5% stake in Max Life and MSI owns 25.5% stake in the life insurance company.

Reports state that upon completion of this share swap agreement, it would take MFSL a step closer to the fructification of its deal with private lender Axis Bank.

Axis Bank had recently announced that as per the central banks' advice, it has entered into revised agreements with MFSL to acquire up to 19% of equity stake in Max Life.

According to the revised deal, the bank will only acquire 9% of the equity share capital of Max Life Insurance, and Axis entities will acquire a further 3% of share capital of stake in Max Life.

Max Financial Services share price ended the day down by 1.1%.

In other news, Dewan Housing Finance Corporation (DHFL) share price was locked in the 5% upper circuit for the third straight day today on reports that Adani group has offered a higher price for the company's assets.

Stock of the housing finance company has surged as much as 45% in the past one month.

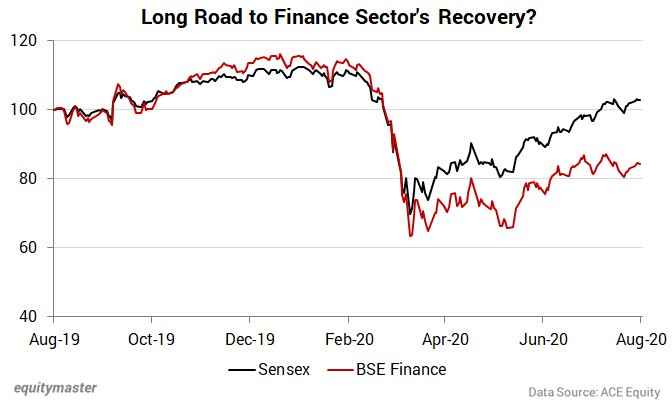

Speaking of the finance sector, note that the market crash impacted all stocks, but finance stocks took the worst hit.

Even as the Sensex made a comeback to pre-Covid levels, the slowdown and asset quality concerns amid the moratorium extension, is an overhang on the financial sector.

Richa Agarwal, lead Smallcap Analyst at Equitymaster, expects a long road to recovery for this sector.

Here's what she wrote about it in one of the editions of the Profit Hunter:

- Just to be sure, being cautious in this sector makes sense to me. However, I believe it would be folly to paint all financial stocks with the same brush.

Financials, especially NBFCs, have gone through multiple disruptions and challenges in the last few years - demonetisation, the IL&FS crisis, and now...coronavirus and moratoriums. This has led to a liquidity squeeze for these players, due to a risk aversion attitude among investors and lenders.

The streak of disruptions will force inefficient and unorganised players in this sector to scale back. I also see a consolidation happening. The survivors and beneficiaries of this shift will be the well capitalised companies with balanced growth and high asset quality.

Investors who identify these stocks now and are willing to be patient with returns, will be rewarded with huge rebound gains.

Richa recently recommended one such stock - a high quality NBFC. Subscribers can read the report here (requires subscription).

And if you are not a Hidden Treasure subscriber, here's where you can sign up.

Moving on to news from the retail sector, Titan was among the top buzzing stocks today.

The Tata group company said it saw good traction across all its businesses in the festive season and its jewellery business witnessed a "mid-teens" growth from Dussehra till Diwali.

"The jewellery business witnessed a mid-teens growth (around 15%) for the 30 day festive season starting from Dussehra till Diwali over the corresponding period last year, with a decent recovery in studded jewellery sales," the company said in a business update.

Titan said its watches and wearables business also did good business during the festive season with recovery close to last year levels.

Titan share price gained as much as 4% intraday today and neared its 52-week high.

Apart from Titan, market participants were also tracking Vodafone Idea share price.

As per media reports, a consortium backed by Oaktree Capital has offered to provide at least US$ 2 billion of funding to Vodafone Group Plc's listed Indian arm.

Oaktree teamed up with several other firms including Varde Partners for the potential deal with Vodafone Idea. The investor group made a proposal to provide around US$ 2 billion to US$ 2.5 billion of capital to Vodafone Idea.

Earlier this year in September, Vodafone Idea had said it plans to raise as much as Rs 250 billion selling shares and debt to shore up its finances as competition heats up in the Indian wireless industry.

How this all pans out remains to be seen. Stay tuned for more updates from this space.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Ends 580 Points Lower; Banking and Finance Stocks Bleed". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!