Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Grab Our Small Cap Recommendation

Service at a 60% Discount

- Home

- Todays Market

- Indian Stock Market News November 18, 2020

Sensex Trades Marginally Lower; Dow Futures Down by 145 Points Wed, 18 Nov 12:30 pm

Share markets in India are presently trading marginally lower.

The BSE Sensex is trading down by 81 points, down 0.2% at 43,871 levels.

Meanwhile, the NSE Nifty is trading down by 33 points.

Tata Motors and Mahindra & Mahindra are among the top gainers today . BPCL and Hero MotoCorp are among the top losers today.

The BSE Mid Cap index is trading up by 0.6%

The BSE Small Cap index is trading up by 0.5%

On the sectoral front, stocks from the auto sector are witnessing most of the buying interest.

On the other hand, stocks from the IT sector are witnessing most of the selling pressure.

US stock futures are trading lower today, indicating a negative opening for Wall Street indices.

Nasdaq Futures are trading down by 55 points (down 0.5%), while Dow Futures are trading down by 145 points (down 0.5%).

The rupee is trading at 74.34 against the US$.

Gold prices are trading down by 0.5% at Rs 50,515 per 10 grams.

In global markets, gold rates edged lower today even as coronavirus cases continued to surge in many parts of the world. On the domestic front, gold prices in India also edged lower, tracking muted global cues. On MCX, gold futures today fell 0.4% to Rs 50,546 per 10 grams, extending losses to the third day.

To know more about gold, check out our article on how to invest in gold here: How to Invest in Gold?

Speaking of the stock markets, India's #1 trader, Vijay Bhambwani talks about how you can end the year with trading profits, in his latest video for Fast Profits Daily.

In the video below, Vijay shares a way to find out which stocks are good for trading at this time.

Tune in here to find out more:

Moving on to stock specific news...

Among the buzzing stocks today is DHFL.

Lenders to troubled Dewan Housing Finance Ltd (DHFL) are looking at a repayment strategy for 55,000 fixed deposit (FD) holders as part of a resolution plan.

According to the minutes of a meeting of the Committee of Creditors (CoC) held last week, the lenders are looking at various scenarios to distribute the proceeds of the funds received from the new investor.

This includes distribution under the waterfall mechanism or under pari-passu distribution mechanism or setting aside some amount of the outstanding claims for small investors.

According to the waterfall mechanism under the Insolvency and Bankruptcy Code (IBC), secured creditors have to be paid fully before any payments can be made to unsecured financial creditors, who in turn, have priority over operational creditors. The pari-passu distribution mechanism gives equal priority to all creditors, and the proceeds are distributed in proportion to their debt.

Most lenders, however, favour a distribution plan where the CoC sets aside 5% of the claim amount for small investors, unsecured financial creditors and operational creditors, with the remaining resolution amount being distributed across secured creditors under the waterfall mechanism.

The consensus of all CoC members is not final as lenders remain divided over how much amount should be allocated to unsecured financial creditors that represents a small portion of CoC voting share.

How this pans out remains to be seen. Meanwhile, stay tuned for all the updates from this space.

At the time of writing, DHFL share price was trading up by 4.9% on the BSE.

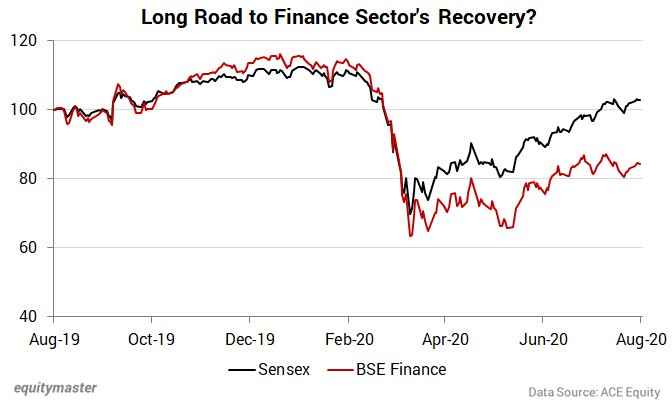

Speaking of the finance sector, note that the market crash impacted all stocks, but finance stocks took the worst hit.

Even as the Sensex made a comeback to pre-Covid levels, the slowdown and asset quality concerns amid the moratorium extension, is an overhang on the financial sector.

Richa Agarwal, lead Smallcap Analyst at Equitymaster, expects a long road to recovery for this sector.

Here's what she wrote about it in one of the editions of the Profit Hunter:

- Just to be sure, being cautious in this sector makes sense to me. However, I believe it would be folly to paint all financial stocks with the same brush.

Financials, especially NBFCs, have gone through multiple disruptions and challenges in the last few years - demonetisation, the IL&FS crisis, and now...coronavirus and moratoriums. This has led to a liquidity squeeze for these players, due to a risk aversion attitude among investors and lenders.

The streak of disruptions will force inefficient and unorganised players in this sector to scale back. I also see a consolidation happening. The survivors and beneficiaries of this shift will be the well capitalised companies with balanced growth and high asset quality.

Investors who identify these stocks now and are willing to be patient with returns, will be rewarded with huge rebound gains.

Richa recently recommended one such stock - a high quality NBFC. Subscribers can read the report here (requires subscription).

And if you are not a Hidden Treasure subscriber, here's where you can sign up.

Moving on to news from the software sector...

Tanla Platforms Shares Hit a Record High as Promoter, Investors Acquire Stake

Shares of Tanla Platforms, previously known as Tanla Solutions, jumped to a record high after its promoter and other investors acquired a stake in the cloud communications provider.

According to data available on the exchanges. Promoter Mobile Techsol acquired 1.7 million shares, or 1.3% stake of the company on November 17 at Rs 391.3 apiece.

Besides, Singapore-based Amansa Investments picked up more than 4 million shares, amounting to a 3% stake at Rs 391.3 apiece.

American Funds Insurance, too, acquired a 6.3% stake, or 8.6 million shares, at Rs 391.3 apiece, the data showed.

The shares were sold by Banyan Investments. The public shareholder sold an 11% stake, or 15 million shares, at Rs 391.3 apiece.Shares of Tanla Platforms are locked in an upper circuit of 5% at Rs 435.7 apiece. The stock is up for the fifth straight day. The rally began since Tanla Platforms was included in the MSCI India Domestic Small-Cap Index on November 12.

The stock had hit a 52-week low of Rs 37.1 on March 25, but since rebounded more than tenfold.

We will keep you updated on all the news from this space. Stay tuned.

And to know what's moving the Indian stock markets today, check out the most recent share market updates here

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades Marginally Lower; Dow Futures Down by 145 Points". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!