Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Grab Our Small Cap Recommendation

Service at a 60% Discount

- Home

- Todays Market

- Indian Stock Market News November 4, 2020

Sensex Trades Over 300 Points Higher; Dow Futures Up by 57 Points Wed, 4 Nov 12:30 pm

Share markets in India are presently trading on a strong note.

The BSE Sensex is trading up by 341 points, up 0.8%, at 40,602 levels.

Meanwhile, the NSE Nifty is trading up by 88 points.

Sun Pharma and IndusInd Bank are among the top gainers today . UPL and Axis Bank are among the top losers today.

The BSE Mid Cap index is trading up by 0.2%.

The BSE Small Cap index is trading up by 0.4%.

On the sectoral front, stocks from the IT sector are witnessing most of the buying interest.

On the other hand, stocks from the realty sector are witnessing most of the selling pressure.

US stock futures are trading higher today, indicating a positive opening for Wall Street indices.

Nasdaq Futures are trading up by 253 points (up 2.2%), while Dow Futures are trading up by 57 points (up 0.2%).

The rupee is trading at 74.68 against the US$.

Gold prices are trading up 0.4% at Rs 50,900 per 10 grams.

In global markets, gold prices moved lower today amid a stronger US dollar as US elections headed towards a tight finish. Tracking global cues, gold prices in domestic markets also edged lower.

Note that gold prices are now down Rs 6,000 in Indian markets from their August highs. However, the precious metal may benefit from safe-haven buying amid increasing challenges to global economy

To know more about gold, visit our YouTube Playlist on gold investing.

Speaking of the stock markets, India's #1 trader Vijay Bhambwani talks about an important aspect about the stock market which has not received enough attention, in his latest video for Fast Profits Daily.

In the video below, Vijay shares how most small investors and traders are worried about the volatility in the market while big money is taking the markets higher.

So, why is big money behaving differently?

Tune in here to find out more:

Moving on to stock specific news...

Among the buzzing stocks today is Sun Pharma.

Indian drugmaker, Sun Pharmaceutical reported a net profit of Rs 18.1 billion, a 70% year-on-year (YoY) increase, for the quarter ended September, on the back of lower operating expenses and higher other income.

The company had reported a net loss of Rs 16.5 billion in the preceding quarter.

The company's other income rose by 28% YoY to Rs 2.5 billion while its other expenses declined 3% YoY to Rs 23.9 billion, aiding profitability. Revenue rose 5% YoY to Rs 85.5 billion.

The company also reported tax gains (exceptional) for the quarter. This was on account of the creation of a deferred tax asset amounting to Rs 2.8 billion arising out of subsequent measurement attributable to restructuring of an acquired entity.

Sales and gross profit of Taro Pharmaceutical, its U.S. subsidiary, dropped 25.7% YoY and 16.3% YoY to US$ 142.8 million and US$ 81.6 million, respectively for the quarter. However, the earnings and sales of the company improved over the preceding three months.

Taro Pharmaceutical accounts for more than 30% of Sun Pharma's overall consolidated sales.

Going forward, the company maintains a positive outlook on its specialty portfolio, a robust abbreviated new drug application (ANDA) pipeline, and increasing market share in the branded generics segment.

At the time of writing, Sun Pharma share price was trading up by 6.3% on the BSE.

Moving on to news from the shipping sector...

Adani Ports Q2FY21 Results: Consolidated Profit Up 32%

Adani Ports and Special Economic Zone reported a 32% YoY growth in its net profit for the September quarter, aided by reopening of the economy. The company's revenue from operations also grew around 3% YoY to Rs 29 billion.

The company is now hopeful of higher cargo volumes going ahead.

The company also registered a volume growth of 7% YoY during the quarter. In October alone, volumes registered a 21% YoY growth.

With progressive unlocking, cargo volume is expected to be higher in the second half of the year. The company expects cargo volumes in FY21 to be in the range of 245 to 250 million metric tonnes and has already witnessed a 300 basis points growth in the overall cargo market share to 24%, as compared to 21% in the previous quarter.

On the financial front, the company said that it is focusing on creating a liquidity buffer by conserving cash, and is recalibrating capital expenditure under the evolving situation. Operationally, it is opting for reliance on automation and technology, and plans to save costs by converting fixed costs to variable and having a stricter control on its overheads.

How this pans out remains to be seen. Meanwhile, stay tuned for more updates from this space.

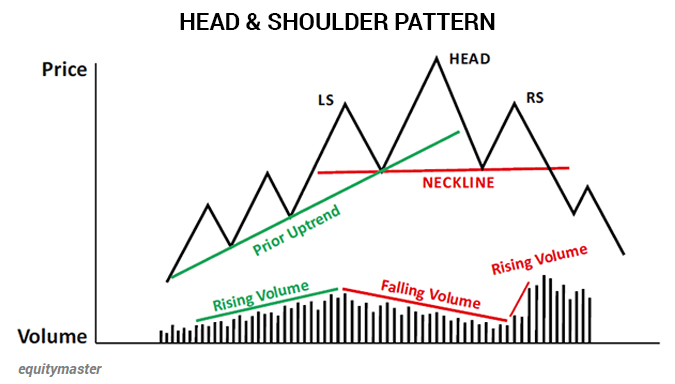

Speaking of the stock market, here's a pattern that if you see, you must sell your position. After all, exits are more important than entries.

In the chart below, we can see the head and shoulder pattern - the stock goes up, makes a high, falls a little bit, goes up to a higher high, does not make a higher low, rallies again, fails to make a new high, and then starts to break down.

This usually happens in a situation where a stock or index has typically been in a bull trend for a while.

According to Apurva Sheth, senior Research Analyst at Equitymaster, spotting this pattern correctly can help you save money.

If you're interested in trading and want to know how you can use this pattern, you can read about it in one of the recent editions of Profit Hunter here: It's When You Sell that Counts

And to know what's moving the Indian stock markets today, check out the most recent share market updates here

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades Over 300 Points Higher; Dow Futures Up by 57 Points". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!