Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Grab Our Small Cap Recommendation

Service at a 60% Discount

- Home

- Todays Market

- Indian Stock Market News November 4, 2020

Sensex Ends 355 Points Higher ahead of US Election Outcome; IT Stocks Witness Buying Wed, 4 Nov Closing

Extending gains to the third straight session, Indian share markets witnessed positive trading activity during closing hours and ended today's volatile session higher.

After opening the day on a positive note, benchmark indices turned volatile and slipped into the red in the afternoon session as Electoral College vote trends showed Democratic candidate Joe Biden and Republican Donald Trump fighting neck and neck. Biden was leading with 238-213 votes, latest tally by Bloomberg showed.

Losses were erased thereafter as Indian stock markets turned bullish, tracking gains in IT stocks.

At the closing bell, the BSE Sensex stood higher by 355 points (up 0.9%).

The NSE Nifty closed higher by 95 points (up 0.8%).

IndusInd Bank and Sun Pharma were among the top gainers today.

The SGX Nifty was trading at 11,912, up by 87 points, at the time of writing.

The BSE Mid Cap index ended up by 0.4%. The BSE Small Cap index ended up by 0.3%.

On the sectoral front, gains were largely seen in the energy sector and IT sector.

Realty stocks, on the other hand, witnessed selling pressure.

Asian stock markets ended on a positive note. As of the most recent closing prices, the Hang Seng ended down by 0.2% and the Shanghai Composite ended up by 0.2%. The Nikkei ended up by 1.7%.

US stock futures fluctuated after President Donald Trump called for Supreme Court to intervene in the counting of votes.

Trump declared that he had won re-election against Joe Biden and said he would ask the Supreme Court to intervene, even as several battleground states in the US continue to count votes.

Nasdaq Futures are trading up by 309 points (up 2.8%), while Dow Futures are trading down by 35 points.

The rupee is trading at 74.74 against the US$.

The domestic currency weakened to its lowest level since late August, tracking a decline in other emerging market currencies, after the dollar pared losses.

Gold prices are trading down by 0.8% at Rs 51,188 per 10 grams.

In the previous session, gold crossed the key level of Rs 51,000 amid uncertainty over results of US Presidential election and rise in coronavirus cases across the globe.

Speaking of stock markets, India's #1 trader Vijay Bhambwani talks about an important aspect about the stock market which has not received enough attention, in his latest video for Fast Profits Daily.

In the video, Vijay shares how most small investors and traders are worried about the volatility in the market while big money is taking the markets higher.

So, why is big money behaving differently?

Tune in here to find out more:

In news from the finance sector, as per a leading financial daily, the Reserve Bank of India (RBI) is looking at diversifying its foreign exchange reserve investments amid the fall in global interest rates caused by the Covid-19 pandemic.

The article stated that RBI is likely to increase its gold investments, as well buying dollars and exploring investing in AAA-rated corporate bonds for the first time.

The RBI's foreign exchange reserves stand at a record US$ 560.63 billion. The central bank, which mostly invests in gold, sovereign debt and other risk-free deposits, has seen returns fall as monetary policy loosened globally.

The RBI has already started increasing its investment in gold gradually. Gold reserves stand at US$ 36.86 billion as on October 23 compared with US$ 30.89 billion at the end of the last fiscal year in March.

In other news, Cholamandalam Financial Holdings on Tuesday reported a 55.5% jump in its consolidated net profit to Rs 5.1 billion for the second quarter of the current fiscal (Q2FY21).

The company had posted a net profit of Rs 3.3 billion in the same quarter a year ago.

Sequentially, profit was down from Rs 5.9 billion in first quarter ended June 30, 2021.

Total income during the quarter rose to Rs 35 billion from Rs 33.4 billion in the same period a year ago.

Assets under management (AUM) grew by 16% to Rs 744.7 billion as on September 30, 2020, as compared to Rs 644.1 billion as on September 30, 2019.

Cholamandalam Financial Holdings share price ended the day down by 2.2%.

Moving on to news from the banking sector, State Bank of India (SBI) was among the top buzzing stocks today.

SBI's Q2FY21 standalone net profit jumped 52% year-on-year (YoY) to Rs 45.7 billion as the bank's provisions declined.

SBI's net interest income (NII) came in at Rs 281.8 billion compared with Rs 246 billion earned in Q2FY20.

Sequentially, it logged an improvement of 5.7% from Rs 266.4 billion NII reported in June quarter of FY21.

Operating profit increased 12% to Rs 164.6 billion in Q2FY21 from Rs 147.1 billion reported in Q2FY20.

The bank's gross non-performing assets (GNPA) declined to Rs 1.25 trillion during the quarter under review, as against Rs 1.29 trillion in Q1FY21.

Net NPAs declined to Rs 364.5 billion from Rs 427 billion sequentially.

SBI extended moratorium to loans worth Rs 8.2 trillion as on August 31, 2020. Besides, it has reclassified loans worth Rs 113.6 billion as on September 30, 2020.

SBI share price ended the day up by 1.1%.

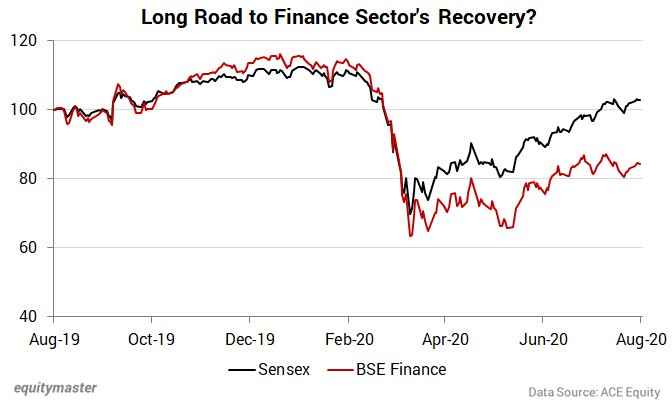

Speaking of the finance and banking sector, note that the market crash impacted all stocks, but finance stocks took the worst hit.

Even as the Sensex made a comeback to pre-Covid levels, the slowdown and asset quality concerns amid the moratorium extension, is an overhang on the financial sector.

Richa Agarwal, lead Smallcap Analyst at Equitymaster, expects a long road to recovery for this sector.

Here's what she wrote about it in one of the editions of the Profit Hunter:

- Just to be sure, being cautious in this sector makes sense to me. However, I believe it would be folly to paint all financial stocks with the same brush.

Financials, especially NBFCs, have gone through multiple disruptions and challenges in the last few years - demonetisation, the IL&FS crisis, and now...coronavirus and moratoriums. This has led to a liquidity squeeze for these players, due to a risk aversion attitude among investors and lenders.

The streak of disruptions will force inefficient and unorganised players in this sector to scale back. I also see a consolidation happening. The survivors and beneficiaries of this shift will be the well capitalised companies with balanced growth and high asset quality.

Investors who identify these stocks now and are willing to be patient with returns, will be rewarded with huge rebound gains.

Richa recently recommended one such stock - a high quality NBFC. Subscribers can read the report here (requires subscription).

And if you are not a Hidden Treasure subscriber, here's where you can sign up.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Ends 355 Points Higher ahead of US Election Outcome; IT Stocks Witness Buying". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!