India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News October 30, 2024

Sensex Today Ends 426 Points Lower | Nifty Below 24,350 | Capri Global Rallies 15% Wed, 30 Oct Closing

Image source: ChakisAtelier/www.istockphoto.com

Image source: ChakisAtelier/www.istockphoto.comAfter opening the day lower, Indian benchmark indices continued the downtrend as the session progressed and ended the day on negative note.

Benchmark equity indices, BSE Sensex and NSE Nifty50, ended their two-day winning streak, settling in the red on Wednesday amid mixed global cues.

At the closing bell, the BSE Sensex stood lower by 426 points (down 0.5%).

Meanwhile, the NSE Nifty closed lower by 125 points (down 0.5%).

Cipla, Trent and HDFC Life among the top gainers today.

Tata Motors, Maruti Suzuki and IndusInd Bank on the other hand, were among the top losers today.

The GIFT Nifty was trading at 24,366 down by 84 points at the time of writing.

For a comprehensive overview of key players in the financial sector, check out list of Fin Nifty Companies.

For impact of the Bank Nifty companies and comprehensive overview of the index, check out Equitymaster's Bank Nifty Companies list

The BSE MidCap index ended flat and BSE SmallCap index ended 1.5% higher.

Sectoral indices were trading mixed today with socks in capital goods sector and telecom sector witnessing buying. Meanwhile stocks in power sector and finance sector witnessing selling pressure.

Coforge, Crisil and Indigo Paints hit their respective 52-week highs today.

Now track the biggest movers of the stock market using stocks to watch today section. This should help you keep updated with the latest developments...

The rupee is trading at 84.09 against the US$.

Gold prices for the latest contract on MCX are trading 0.5% higher at Rs 79,628 per 10 grams.

Meanwhile, silver prices were trading 0.1% lower at Rs 98,654 per 1 kg.

Speaking of the stock market, the market can stay irrational longer than you can stay solvent.

This oft-cited quote, or versions of it, is attributed to famous economist John Maynard Keynes.

However, its significance is often lost on investors who like to believe that market downsides always come with loud warnings. Or that a market index cannot correct 30% after having gained 50%.

Tanushree Banerjee, Research Analyst at Equitymaster talk about market correction in her latest video.

Watch now.

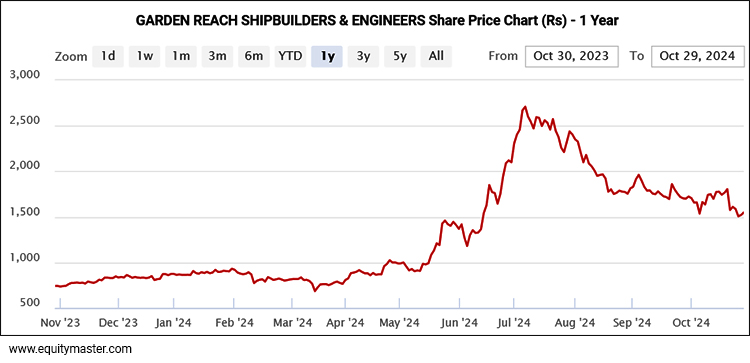

Why Garden Reach Shipbuilder's Share Price is Rising

In news from the shipbuilding sector, shares of Garden Reach Shipbuilders and Engineers rose over 4% after the company secured an order worth Rs 4.9 bn to design an Acoustic Research Ship for the Defence Research and Development Organisation (DRDO).

This rise on 30 October marked the third consecutive session of gains for the company, though it has experienced negative monthly returns from August to October.

On 29 October, Graden Reach announced that it received a Letter of Intent from the Naval Physical and Oceanographic Laboratory (NPOL), part of the Ministry of Defence in Kochi. This contract involves the design, development, construction, integration of equipment, testing, certification, commissioning, and supply of one Acoustic Research Ship (ARS).

The project is expected to be completed within 36 months from the signing of the contract and does not involve any related party transactions.

Garden Reach specialises in building warships for the Indian Navy and Coast Guard, producing a variety of vessels including frigates, corvettes, landing ship tanks, patrol vessels, and fleet tankers. The company also provides ship repair services for both the defence and commercial sectors.

Incorporated in 1934, Garden Reach became a public company in 2017 and operates under the administrative control of the Ministry of Defence.

Capri Global Shares Rally 13%. Here's Why

Moving on to news from the finance sector, shares of diversified NBFC Capri Global rose by more than 13% in early trade on 30 October on the back of a strong NII and profit growth.

The Net Profit rose 49% on the year to Rs 970 m, while the Net Interest Income rose by 27% on the year to Rs 3 bn.

The NBFC recorded a strong growth momentum with Q1FY25 AUM reaching Rs 174.6 bn, a growth of 56% on the year, driven by home loan and gold loan categories.

The retail AUM now makes up over 80% of Capri Global's portfolio, and the NBFC said it is on track to achieve Rs 300 bn AUM by FY27.

Capri credited branch expansions to the growth in the gold loan AUM, which has increased by 55% QoQ to cross Rs 54 bn. Capri's Gross NPA and Net NPAs have stayed flat at 2% and 1.1%, respectively.

The board also approved an enabling provision for a fund raise of Rs 20 bn by way of equity, debt, or convertible securities through rights issue or a preferential allotment, or QIP.

The NBFC said it has tempered down its branch expansion, and may add about 50 branches in this fiscal year to cater to the gold loan segment, which will not be as aggressive as seen earlier.

Honeywell Automation Tank 8%. Here's Why

Moving on to news from the auto sector, hares of Honeywell Automation dropped as much as 8% on 30 October after the company reported a decline in its Q2 net profit amid sluggish demand.

The engineering firm reported a 5.6 percent decline in its September quarter net profit to Rs 1.2 bn (US$ 13.7 m), down from Rs 122 crore in the same period last year, primarily impacted by slowing demand.

Honeywell Automation India specialises in providing building automation solutions to industrial clients, along with designing products aimed at emissions reduction and energy transition. A recent business survey indicated a slowing growth trend in India's manufacturing sector during August and September.

Honeywell Automation India's parent company- Honeywell, also projected annual sales below Wall Street expectations and missed quarterly revenue estimates last week.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Today Ends 426 Points Lower | Nifty Below 24,350 | Capri Global Rallies 15%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!