Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Grab Our Small Cap Recommendation

Service at a 60% Discount

- Home

- Todays Market

- Indian Stock Market News October 27, 2020

Sensex Trades 177 Points Higher; Dow Futures Up by 124 Points Tue, 27 Oct 12:30 pm

Share markets in India are presently trading marginally higher.

The BSE Sensex is trading up by 177 points, up 0.4%, at 40,323 levels.

Meanwhile, the NSE Nifty is trading up by 52 points.

Kotak Mahindra Bank and Nestle India are among the top gainers today . Adani Ports & SEZ and Infosys are among the top losers today.

The BSE Mid Cap index is trading up by 1%

The BSE Small Cap index is trading up by 0.2%

On the sectoral front, stocks from the banking sector and power sector are witnessing most of the buying interest.

On the other hand, stocks from the IT sector are witnessing most of the selling pressure.

US stock futures are trading higher today, indicating a positive opening for Wall Street indices.

Nasdaq Futures are trading up by 39 points (up 0.3%), while Dow Futures are trading up by 124 points (up 0.5%).

Gold prices are trading up by 0.2% at Rs 51,019 per 10 grams.

In line with the trends in international markets, gold prices rose in early trade this morning in the domestic futures market as the dollar softened.

Note that gold prices are up about 30% so far this year in Indian markets. Most of these gains are seen as gold is seen as an inflation hedge amid unprecedented pandemic-driven stimulus across the world.

To know more about gold, visit our YouTube Playlist on gold investing.

The rupee is trading at 73.77 against the US$.

Speaking of the stock markets, Senior Research Analyst at Equitymaster, Apurva Sheth, shares his view on ITC in his latest video for Fast Profits Daily.

In this video below, Apurva talks about what could be the right course of action on the company's stock using technical analysis in a market with polarized views.

So, what do the charts say about the stock of ITC?

Tune in here to find out more:

Moving on to stock specific news...

Among the buzzing stocks today is Kotak Mahindra Bank

Private sector lender, Kotak Mahindra Bank reported a 27% year-on-year (YoY) increase in net profit and a 16.8% YoY increase in net interest income for the quarter ended September, on the back of lower provisions and higher core income.

The bank's gross non-performing asset (NPA) ratio fell 0.6% quarter-on-quarter (QoQ), down 23 basis points. This improvement on asset quality was largely because of a Supreme Court interim order, which stopped banks from marking down loans to the NPA category after August 31.

Including those assets, the bank's pro-forma gross NPA ratio was at 2.7% and net NPA ratio at 0.7%. Provisions for the quarter stood at Rs 3.7 billion, as compared to Rs 4.1 billion a year ago.

The bank also saw its loan and deposit books remain flat as it continued to take a cautious approach towards new lending amid a weak economy.

According to the bank's disclosures, its credit substitutes rose up 39% YoY. The bank continues to focus on high quality instruments issued by well rated companies to grow its credit substitutes book.In its analyst presentation, the bank said that it is opening up select segments for lending, such as home loans and advances to well-rated companies. However, it would continue to remain more cautious in the retail unsecured lending segment.

At the time of writing, Kotak Mahindra Bank share price was trading up by 9.2% on the BSE.

Moving on to news from the finance sector...

Mahindra Finance Q2FY21 Results: Net Profit Jumps 34% YoY to Rs 3.5 Billion

Mahindra Finance reported a 33.7% YoY increase in consolidated net profit at Rs 3.5 billion for the quarter ended September.

The company's total income increased by 4.6% QoQ and its standalone assets under management stood at Rs 817 billion for the quarter, registering a 12% growth from Rs 727 billion a year ago.

The company also said that it has considered an additional charge of Rs 4.3 billion during the second quarter this fiscal and Rs 9.1 billion in the first half of the fiscal due to a management overlay, to reflect deterioration in the macroeconomic outlook.

The company's customer base crossed 6.9 million during the quarter as the company reported strong rural demand.

Mahindra Finance expects demand to further pick-up in the upcoming festival season. The company also expects to see an increase in digitally enabled lending and collections in rural and semi-urban markets.

We will keep you updated on all the news from this space. Stay tuned.

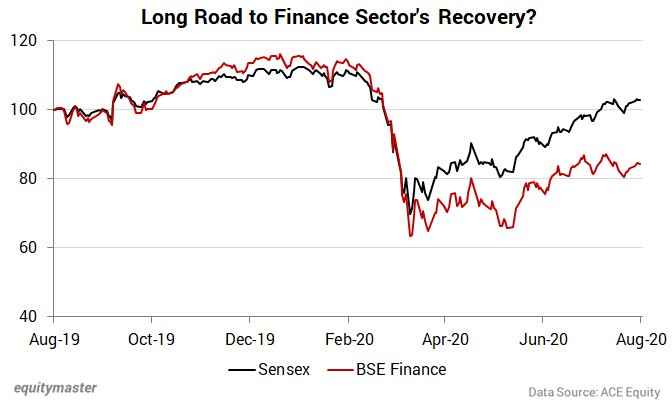

Speaking of the finance sector, note that the market crash impacted all stocks, but finance stocks took the worst hit.

Even as the Sensex made a comeback to pre-Covid levels, the slowdown and asset quality concerns amid the moratorium extension, is an overhang on the financial sector.

Richa Agarwal, lead Smallcap Analyst at Equitymaster, expects a long road to recovery for this sector.

Here's what she wrote about it in one of the editions of the Profit Hunter:

- Just to be sure, being cautious in this sector makes sense to me. However, I believe it would be folly to paint all financial stocks with the same brush.

Financials, especially NBFCs, have gone through multiple disruptions and challenges in the last few years - demonetisation, the IL&FS crisis, and now...coronavirus and moratoriums. This has led to a liquidity squeeze for these players, due to a risk aversion attitude among investors and lenders.

The streak of disruptions will force inefficient and unorganised players in this sector to scale back. I also see a consolidation happening. The survivors and beneficiaries of this shift will be the well capitalised companies with balanced growth and high asset quality.

Investors who identify these stocks now and are willing to be patient with returns, will be rewarded with huge rebound gains.

Richa recently recommended one such stock - a high quality NBFC. Subscribers can read the report here (requires subscription).

And if you are not a Hidden Treasure subscriber, here's where you can sign up.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades 177 Points Higher; Dow Futures Up by 124 Points". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!