India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News October 25, 2024

Sensex Today Tanks 663 Points | Nifty Ends Below 24,200 | 5 Reasons Why Indian Share Market is Falling Fri, 25 Oct Closing

Image source: Chunumunu/www.istockphoto.com

Image source: Chunumunu/www.istockphoto.comAfter opening the day on positive note, Indian share markets Slipped as the session progressed and ended the day weak.

Indian benchmark equity indices fell sharply on Friday, with the Sensex dropping over 900 points and the Nifty slipping below the 24,100 mark intraday amid lackluster Q2 earnings and persistent foreign outflows.

At the closing bell, the BSE Sensex stood lower by 663 points (down 0.8%).

Meanwhile, the NSE Nifty closed lower by 219 points (down 0.9%).

ITC, Axis Bank and HUL were among the top gainers today.

BPCL, M&M and Adani Enterprises on the other hand, were among the top losers today.

For a comprehensive overview of key players in the financial sector, check out list of Fin Nifty Companies.

The GIFT Nifty ended at 24,216 down by 246 points.

For impact of the Bank Nifty companies and comprehensive overview of the index, check out Equitymaster's Bank Nifty Companies list.

Broader markets ended the day negative. The BSE Mid Cap ended 1.5% lower and the BSE Small Cap index ended 2.4% lower.

Barring FMCG sector all other sectoral indices are trading on negative note with stocks in oil & gas sector, auto sector and power sector witnessing buying most selling pressure.

Shares of Coforge and Dixon Technologies hit their respective 52-week highs today.

Now track the biggest movers of the stock market using stocks to watch today section. This should help you keep updated with the latest developments...

The rupee is trading at 84.09 against the US$.

Gold prices for the latest contract on MCX are trading 0.5% lower at Rs 77,950 per 10 grams.

Meanwhile, silver prices are trading 1.1% lower at Rs 95,920 per 1 kg.

Here are three reasons why Indian Markets are falling today

#1 Weak Q2 Earnings

Benchmark indices came under pressure as several blue-chip and other companies reported disappointing Q2 results, leaving investors dissatisfied. In today's trading, IndusInd Bank fell 19%, contributing 130 points to the Sensex's loss, while NTPC dropped 4%. Both blue-chip stocks declined following disappointing quarterly results.

#2 FII Selling

Foreign investors have offloaded Indian shares for the past 19 sessions, redirecting funds to China due to Beijing's stimulus measures and relatively cheaper valuations.

This correction is attributed to sustained selling by foreign institutional investors (FIIs), which reached Rs 980.9 bn by 24 October.

#3 High bond yields and strong dollar

The 10-year Treasury yield ticked down to 4.2% on Friday, following a four-basis-point decline in the previous session. However, it remains elevated above 4%, having touched a three-month high of 4.26% on Wednesday.

Meanwhile, the dollar index, which measures the currency against six major peers, was little changed at 104.1 after retreating from Wednesday's three-month peak of 104.6. For the week, it has advanced by 0.6%.

#4 US Election

The looming US election adds to the uncertainty, with former Republican President Donald Trump and Democratic Vice President Kamala Harris engaged in a tight race for key competitive states ahead of the November 5 voting day.

#5 Aggressive rate cuts Tension Ease

Markets are currently pricing in a 95.1% chance of a 0.2% cut at the Fed's November meeting, with a 4.9% probability of the US central bank holding rates steady.

Speaking of the stock market, turnaround stocks can be a goldmine, but finding the right ones can be tricky.

In this video, Rahul Shah, Co-head of research at Equitymaster shares his strategy for identifying 'good' turnaround stocks and avoiding the 'bad' ones.

Plus, he reveals 3 picks that you can keep on your watchlist.

Watch now.

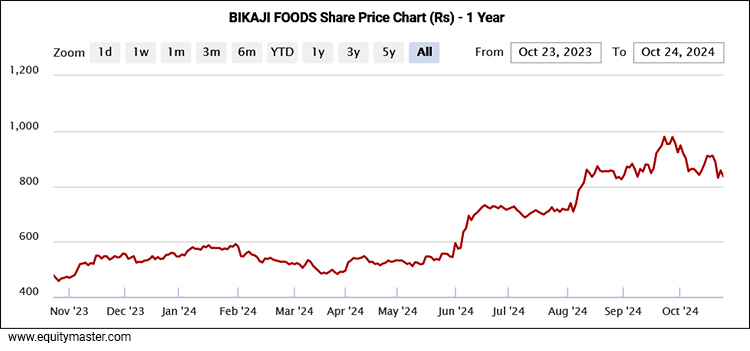

Bikaji Foods Stocks Leaps 10%. Here's Why

In news from the food and tobacco sector, shares of Bikaji Foods International surged up to nearly 10% after the company reported positive quarterly earnings for the September 2024 quarter.

The snacks manufacturer reported a net profit rise of 14.7% on-year at Rs 686 m during the quarter under review. The company's revenue surged by 19% YoY to Rs 7.2 bn during this period.

At the operation level, Bikaji's earnings before interest, taxes, depreciation, and amortisation (EBITDA) rose 22% YoY to Rs 1.1 bn, with the EBITDA margin expanding to 14.8% from 14.4 per cent a year earlier.

Bikaji Foods International is the third largest ethnic snack manufacturer in India, with an international presence selling Indian snacks and sweets. It is also the second fastest-growing company in the Indian organised snacks market.

Its product range includes six principal categories: bhujia, namkeen, packaged sweets, papad, western snacks, and other snacks, which primarily feature gift packs (assortments), frozen food, mathri, and cookies.

Segment-wise, revenue from the papad category grew by 26% YoY, while western snacks and packaged sweets saw increases of 23% and 22%, respectively.

DCB Bank Skyrockets 10%

Moving on to news from the banking sector, shares of DCB Bank surged 10% to Rs 121 apiece on 25 October after the lender reported healthy July-September quarter (Q2FY25) results.

The bank reported a 22.6% year-on-year (YoY) increase in net profit to Rs 1.6 bn for Q2FY25, while net interest income (NII) grew 7% YoY to Rs 5.1 bn.

On the asset quality front, net non-performing assets (NNPA) improved slightly to 1.2% in Q2FY25, compared to 1.2% in the previous quarter. Similarly, the gross non-performing assets (GNPA) ratio declined to 3.3%, down from 3.3% in Q1FY25.

DCB Bank has 451 branches across 20 states and 2 union territories. It is a scheduled commercial bank regulated by the Reserve Bank of India.

Incorporated in 1995, the bank was formed through the merger of Ismailia Co-operative Bank and Masalawala Cooperative Bank. It had a network of 367 branches and 353 ATMs as of December 2021.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Today Tanks 663 Points | Nifty Ends Below 24,200 | 5 Reasons Why Indian Share Market is Falling". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!