India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News October 22, 2021

Sensex Trades Marginally Higher, Dow Futures Down by 9 Points Fri, 22 Oct 12:30 pm

Share markets in India are presently trading on a volatile note.

The BSE Sensex is trading up by 13 points, up 0.02%, at 60,936 levels.

Meanwhile, the NSE Nifty is trading down by 34 points.

HDFC and Bajaj Auto are among the top gainers today. Hindalco and Tata Motors are among the top losers today.

The BSE Mid Cap index is trading down by 0.8%.

The BSE Small Cap index is trading down by 1.1%.

On the sectoral front, stocks from the metal sector are witnessing most of the selling pressure.

On the other hand, stocks from the real estate sector are witnessing most of the buying interest.

US stock futures are trading lower today, indicating a negative opening for Wall Street.

Nasdaq Futures are trading down by 69 points (down 0.5%) while Dow Futures are trading down by 9 points (flat)

The rupee is trading at 74.78 against the US$.

Gold prices are trading up by 0.5% at Rs 47,638 per 10 grams.

Gold prices inched higher in Indian markets today and was poised for a second weekly gain on Oct as a softer dollar provided some respite against higher US bond yields and rising expectations that central banks could begin easing economic support.

On MCX, gold contracts were up 0.3% at Rs 47,541 for 10 grams. In the previous session, gold prices had eased tracking muted global cues.

The precious metal was also pressured by a firm dollar and US treasury yields soaring above 1.7%

To know more about gold, check out our article on how to invest in gold here: How to Invest in Gold?

Moving on to stock-specific news...

Among the buzzing stocks today is Macrotech Developers.

Realty major Macrotech Developers (also known as Lodha Group) is planning to raise up to Rs 40 bn through the issue of securities.

The developer had raised Rs 25 bn through its initial public offering (IPO) in April 2021.The company will raise the additional funds in one or more tranches through any of the permissible modes.Lodha's IPO was priced in the Rs 483-Rs 486 band and the issue price was set at Rs 486 per share after witnessing a little over 1x in subscription.

The listing price was nearly 10% lower than the issue price. However, the stock has risen over 112% since its listing. The developer will seek the nod of its shareholders for the issue in an extra-ordinary general meeting on 12 November. Separately, the company also reported its results for the September 2021 quarter.

It reported a net profit of Rs 2.2 bn as against net loss of Rs 3.5 bn in the same period last year. The company's revenue from operations rose 136% year on year (YoY) to Rs 21.2 bn.

Commenting on the results, Abhishek Lodha, MD & CEO, Macrotech Developers said,

- The housing market in the last nine months has gone from strength to strength. While at the beginning of the year we were quite optimistic about the underlying growth and opportunities available, even we have been pleasantly surprised by the trends on the ground that have emerged during this period.

According to him, the long-term potential of housing as a wealth creator as well as employment generator is now being well recognized by all stakeholders and enablers for strong multi-year up-cycle in housing demand remain intact.

How the company performs in the next quarter remains to be seen. Meanwhile, stay tuned for more updates from this space.

At the time of writing, Macrotech Developers shares were trading up by 4.1% on the BSE.

Speaking of the stock markets, India's #1 trader, Vijay Bhambwani talks about how to know if your stock will fall, in his latest video for Fast Profits Daily.

Moving on to news from the energy sector...

GAIL to Build India's Largest Green Hydrogen Plant

State-owned GAIL (India) will build India's largest green hydrogen-making plant as it looks to supplement ?its natural gas business with carbon-free fuel.

The company has already floated a global tender to procure an electrolyser.

GAIL chairman and managing director Manoj Jain said it will take 12-14 months to set up the plant. The plant will have a capacity of 10 megawatts (MW), the largest announced so far in the country.

He added,

- We have on a pilot basis started mixing hydrogen in natural gas in one of the cities. The company is testing for idea mix percentage before scaling it up.

The hydrogen GAIL plans to produce can be sold to fertiliser units which as per government mandate are required to use hydrogen as fuel.

India's largest gas transporting and marketing company is also looking at newer avenues to boost business including pushing for use of LNG as fuel in long haul trucking. For India to achieve the target of raising the share of natural gas in the energy basket to 15% gas usage by 2030 from the current level of 6.2%, gas consumption has to rise three and half times to 600 million standard cubic meters per day.

The oil and gas industry plans to set up 20 LNG dispensing stations on Golden Quadrilateral by March 2022 and 500-600 outlets in 3-4 years.

The ultimate target is 1,000 LNG stations.

We will keep you posted on more updates from this space. Stay tuned.

Speaking of stocks, here's a pattern that if you see, you must sell your position. After all, exits are more important than entries.

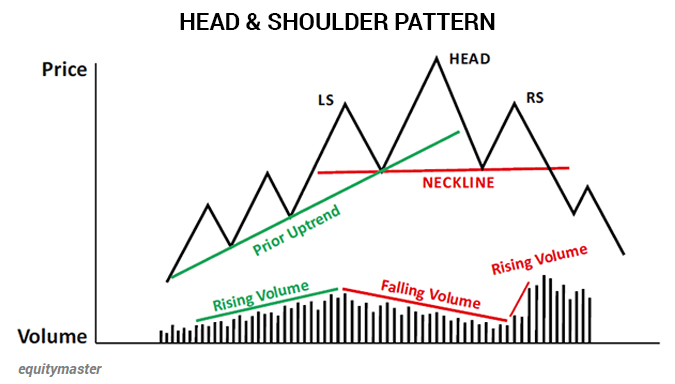

In the chart below, we can see the head and shoulder pattern - the stock goes up, makes a high, falls a little bit, goes up to a higher high, does not make a higher low, rallies again, fails to make a new high, and then starts to break down.

This usually happens in a situation where a stock or index has typically been in a bull trend for a while. Spotting this correctly can help you save money.

If you're interested in trading and want to know how you can use this pattern, you can read about it in one of the editions of Profit Hunter here: It's When You Sell that Counts

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades Marginally Higher, Dow Futures Down by 9 Points". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!