India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News October 7, 2021

Sensex Zooms 488 Points, Nifty Settles Near 17,800; Tata Motors & Titan Rally Over 10% Thu, 7 Oct Closing

Indian share markets witnessed positive trading activity throughout the day today and ended on a strong note.

Benchmark indices witnessed sharp gains today as cooled off energy prices ebbed fears of a stagflation in the global economy.

Crude oil prices fell from multi-year highs reached the day before, while US Treasury rates and key currencies remained stable amid the calmer tone.

At the closing bell, the BSE Sensex stood higher by 488 points (up 0.8%).

Meanwhile, the NSE Nifty closed higher by 144 points (up 0.8%).

Tata Motors and Titan were among the top gainers today.

ONGC and Dr. Reddy's Lab, on the other hand, were among the top losers today.

The SGX Nifty was trading at 17,828, up by 201 points, at the time of writing.

The BSE Mid Cap index and the BSE Small Cap index ended up by 1.7% and 1.4%, respectively.

Sectoral indices ended on a positive note with stocks in the realty sector, consumer durables sector and auto sector witnessing most of the buying interest.

Oil & gas stocks, on the other hand, witnessed selling pressure.

Shares of Page Industries and Bata India hit their respective 52-week highs today.

Asian stock markets ended on a positive note today.

The Hang Seng and the Nikkei ended the day up by 3.1% and 0.5%, respectively.

US stock futures are trading on a positive note today with the Dow Futures trading up by 172 points.

The rupee is trading at 74.78 against the US$.

Gold prices for the latest contract on MCX are trading up by 0.1% at Rs 46,851 per 10 grams.

Speaking of the stock market, India's #1 trader Vijay Bhambwani explains what the energy crisis is about, in his latest video for Fast Profits Daily.

Tune in to the video below to find out more:

Titan Becomes Second Tata Group Company to Enter Rs 2 Tn Market-Cap Club

In news from the retailing sector, Titan was among the top buzzing stocks today.

Titan became the second firm in the Tata group to hit the market capitalisation of Rs 2 Tn after Tata Consultancy Services (TCS).

Titan shares surged today after the company said it witnessed a strong across-the-board recovery in demand after the second wave of the pandemic.

Most stores are now fully operational barring a few in select towns, having localised restrictions, with overall store operation days exceeding 90% for the quarter.

Apart from its thrust on the digital channel, Titan has accelerated its retail network expansion during the quarter.

In terms of revenue, in the jewellery segment, which contributes a larger portion of its turnover, it has reported 78% growth in quarter two of the financial year 2022 compared to the same period last year.

The demand postponement triggered by the second wave of the pandemic in avenues like gift purchases, occasions, milestone buying, weddings, investments in gold etc. witnessed a strong comeback in quarter two.

Both plain and studded segments grew in double digits, however, much stronger growth in the plain segment led to studded mix being below pre-pandemic levels.

According to Titan, now digital gold is a new pilot offering that helps customers purchase gold online and lock in the gold prices with an ability to convert it into jewellery at a later stage.

The early response has been good with the enrolment of many digitally-savvy young customers. The Golden Harvest Scheme (GHS) enrollments have surpassed the pre-pandemic levels.

In watches and wearables, its revenue was up 73% compared to the July-September quarter of the previous fiscal.

In eyewear, Titan's quarter two revenue was up 74%. It added 24 new stores in the quarter.

Its other business segment, which includes - Taneira, Fragrances and Accessories, reported 121% growth during the quarter.

Titan share price ended the day up by 10.6% on the BSE.

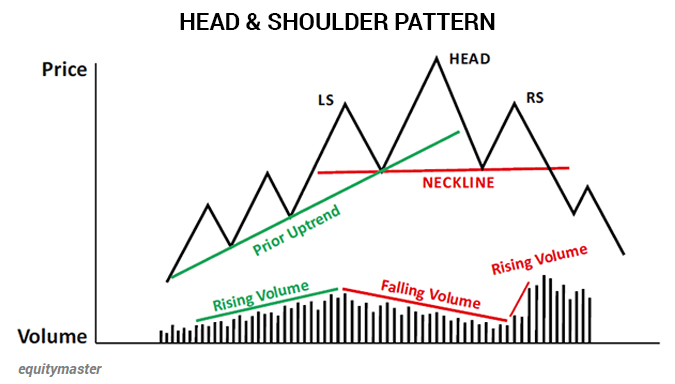

Speaking of stocks, here's a pattern that if you see, you must sell your position. After all, exits are more important than entries.

In the chart below, we can see the head and shoulder pattern - the stock goes up, makes a high, falls a little bit, goes up to a higher high, does not make a higher low, rallies again, fails to make a new high, and then starts to break down.

This usually happens in a situation where a stock or index has typically been in a bull trend for a while. Spotting this correctly can help you save money.

If you're interested in trading and want to know how you can use this pattern, you can read about it in one of the editions of Profit Hunter here: It's When You Sell that Counts

Moving on to news from the IPO space...

Paytm in Talks with Sovereign Wealth Funds, Blackrock for IPO Stakes

India's Paytm is in talks with sovereign wealth funds and financial firms to become anchor investors in its upcoming initial public offering (IPO), according to people familiar with the matter.

State-backed wealth investors Abu Dhabi Investment Authority and Singapore's GIC Pte are among those weighing bidding to participate in the IPO.

Global financial firms such as BlackRock Inc. and Nomura Holdings Inc. are also in discussions to bid, according to the sources.

One97 Communications, as Paytm is formally known, is considering seeking a valuation of around US$20 bn to US$22 bn based on initial investor feedback, they said.

There are already more than enough bids to cover the shares allocated for anchor investment in the IPO.

Paytm, backed by SoftBank Group Corp., Berkshire Hathaway Inc. and Jack Ma's Ant Group Co., plans to raise as much as Rs 166 bn from its share sale, according to its draft prospectus.

How the IPO sails through remains to be seen. Meanwhile, stay tuned for more updates from this space.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Zooms 488 Points, Nifty Settles Near 17,800; Tata Motors & Titan Rally Over 10%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!