India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News September 29, 2022

Sensex Rallies 400 Points, Nifty Nearing 17,000; Tata Steel & ITC Top Gainers Thu, 29 Sep 10:30 am

Asian share markets opened higher today extending gains on Wall Street, where investors were reassured by the Bank of England's intervention that helped push bond yields lower.

The Nikkei rose by 0.8% while the Hang Seng was up 1.5%. The Shanghai Composite is trading higher by 1%.

Wall Street ended sharply higher on Wednesday following its recent sell-off, helped by falling treasury yields. Stocks rallied to their first gain in more than a week, as some calm returned to markets around the world.

The Dow Jones rose by 1.9% while the tech heavy Nasdaq ended higher by 2.1%.

Back home, Indian share markets are trading on a strong note.

Benchmark indices opened on a strong note today following the trend on SGX Nifty. As the session progressed gains were extended.

At present, the BSE Sensex is trading higher by 408 points. Meanwhile, the NSE Nifty is trading up by 116 points.

ITC and Tata Steel are among the top gainers today.

Asian Paints and TCS are among the top losers today.

Broader markets are trading on a positive note. The BSE Mid Cap index is up by 0.8% and the BSE Small Cap index is trading higher by 1.3%.

Sectoral indices are trading on a positive note. Stocks in the consumer durable sector and energy sector witness buying.

Shares of Gujarat Fluorochemicals and Rites hit their 52-week high today.

Bucking the recent trend, Reliance Industries gained 1% today. Reliance share price was falling for the past few consecutive sessions.

In the commodity markets, gold prices rise. Today, gold prices are trading higher by Rs 494 at Rs 49,813 per 10 grams.

Note that gold prices have fallen and have taken a big knock in recent months.

Meanwhile, silver prices are trading higher at Rs 56,475 per kg. Silver prices too have fallen a lot.

The rupee is trading at 81.7 against the US dollar. After touching record low yesterday, the rupee stabilized.

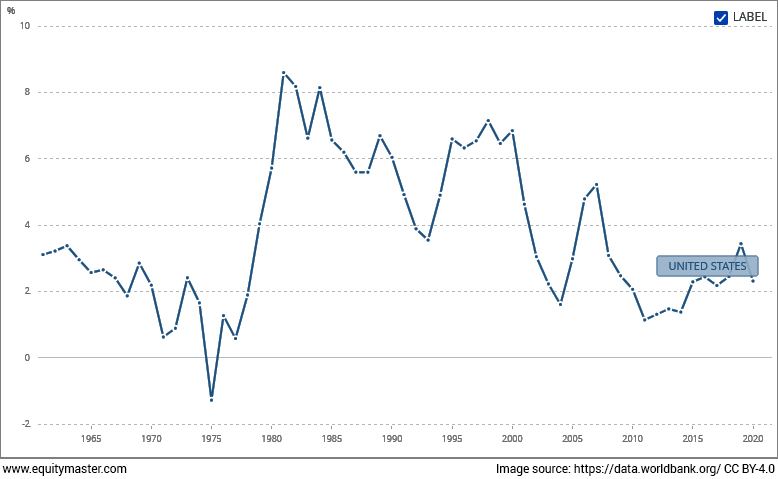

Speaking of stock markets, rising interest rates have affected the share market by a large extent. A similar rise in interest rates was also seen in 1989.

Years 1989 and 2022 both disappointed investors resultantly pushing them away. But ace investor Warren Buffett says,

- "Be fearful when others are greedy and be greedy when others are fearful,"

Warren Buffett has taught what he preached. In 1989 when everyone was running from stock market, he invested a huge amount in Wells Fargo - an American financial company.

Over the years, Fargo has gone far up and generated handsome returns for Buffett.

This begs the question: is it the right time to invest in banking stocks?

Read out editorial to know more: Bank Stocks in 2022 Mirror Warren Buffett's 1989 Wells Fargo Investment.

In news from the logistics sector, Blue Dart Express increases its shipment prices.

Yesterday, one of the supply chain stocks in India, Blue Dart Express announced its General Price Increase (GPI) which will take effect on 1 January 2023.

Depending on the shipping profile, the average shipment price increase in 2022 will be 9.6%.Blue Dart is recognised as a market leader in future-ready solutions with great service quality; these standards are also used as a benchmark by the industry's express logistics providers.Blue Dart adjusts its prices annually in order to consistently provide a resilient, reliable, and efficient solution to its customers, taking into account inflation, currency dynamics, among other reasons.

High inflation, rising interest rates, and high input prices have all taken a toll on the company's profitability.

Small GDP growth, and poor recovery due to global supply chain obstacles, all need a marginal price rise. 'Ship to Profile' will be a new derivative idea offered to help high-volume shippers while also correcting rates for other shippers.

Blue Dart has also been aggressively investing in expanding its presence in emerging regions, reducing transit times, renovating infrastructure, and developing future technology, said the company in its media release.

Blue Dart is making these strategic expenditures in order to get a first-mover advantage while being nimble and adaptable.

Speaking of stock markets, Co-head of Research at Equitymaster Rahul Shah talks whether a few Tata group stocks are in a bubble, in his latest video.

Moving on to news from the telecom sector, Indus Towers asks Vodafone Idea to pay its bills on time post November.

Mobile tower giant Indus Towers is learnt to have asked debt-ridden Vodafone Idea (VIL) to clear outstanding dues and pay every month on time for continuity of business post-November.

The development comes after independent directors expressed concerns over the mounting dues of Vodafone Idea.

Reportedly, Indus Towers has asked Vodafone to clear past dues at earliest. The company has asked VIL to clear 80% of current month dues and make the entire payment on-time from next month onwards. Post-November Indus Towers will stop access to Vodafone Idea in case of non-payment.

Another source said that American Tower Corporation (ATC), which has 75,000 mobile towers in India, is also mulling similar steps to secure its dues.

Vodafone Idea had availed services worth Rs 94.5 bn from Indus Towers. The company paid Rs 33.8 bn to the Indus Towers that it received in the form of equity investment from Vodafone.

At present, VIL is estimated to owe around Rs 68 bn to Indus Towers and Rs 24 bn to ATC.

Vodafone Idea has proposed a payment plan to Indus Towers wherein they conveyed their ability to pay part of the billed amount till December 2022 and 100% thereafter along with clearance in a phased manner between January 2023 and July 2023 of the old dues that would accumulate till December 2022.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Rallies 400 Points, Nifty Nearing 17,000; Tata Steel & ITC Top Gainers". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!