India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News September 26, 2015

Global Markets Remain Volatile Sat, 26 Sep RoundUp

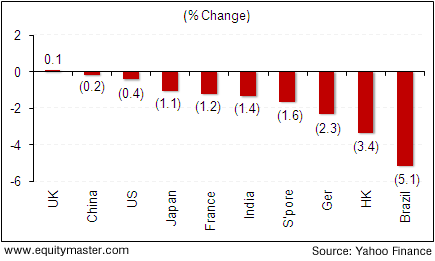

The week started with a sigh of relief as the US Federal Bank did not hike interest rates on 17th September. However, China posted weak manufacturing data, with PMI at 47. A number below 50 indicates contraction in manufacturing activities.

European and US markets rose on Friday to end a rocky week on an upbeat note. The European stock markets surged upwards on Friday after Federal Reserve Chair Janet Yellen said that the US central bank was on track to raise interest rates this year. The US economy grew more than previously estimated in the second quarter on stronger consumer spending and construction. Gross domestic product rose by 3.9%, up from the 3.7% reported in August.

Among the major Asian stock markets, stocks in HongKong and Singapore were down by 3.4% & 1.6% respectively. The India indices closed the week down by 1.4% owing to the global cues. The net outflow from foreign institutional investors (FII) in equities during the week was Rs 10.38 bn.

|

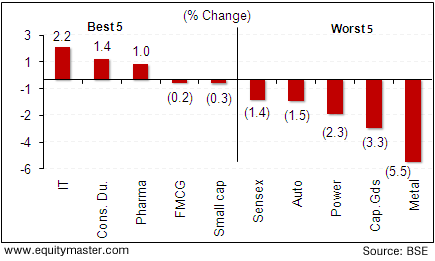

Among the sectoral indices, stocks from the information technology and consumer durables were the top gainers, while metals and capital goods closed in the red.

|

Now let us discuss some of the key economic and industry developments in the week gone by.

The government stated that foreign companies without a permanent establishment in India will be exempt from minimum alternative tax (MAT). Earlier the government exempted the Foreign Portfolio Investor (FPIs) from MAT by accepting the A.P.Shah committee report. Exempting foreign companies from MAT lays the entire controversy over the tax to rest. The government will now amend section 115JB of the income tax Act to ensure that MAT provisions are also not applicable to a foreign company that does not have a permanent establishment in the country or is a resident of a nation having a double taxation avoidance agreement (DTAA) with India.

The Chinese Manufacturing gauge fell to the lowest in six and a half years. The preliminary Purchasing Manger's Index (PMI) was at 47 for September. The index is an indicator of the economic health of the manufacturing sector. The soft PMI reflected weak external demand. The PMI data bears out the heightened concerns about China expressed by US Federal Reserve chair Janet Yellen. The FOMC (Federal Open Market Committee) maintained status quo on interest rates owing to these worries.

| Company | 18-Sep-15 | 24-Sep-15 | Change | 52-wk High/Low | |

| Top gainers during the week (BSE-A Group) | |||||

| IDBI Bank | 60 | 74 | 24.2% | 85/52 | |

| Jaiprakash Associates | 10 | 12 | 18.2% | 35/8 | |

| Jaiprakash Power | 6 | 7 | 11.2% | 16/5 | |

| Torrent Power Ltd | 164 | 181 | 10.4% | 192/131 | |

| Strides Arcolab | 1,146 | 1,238 | 8.1% | 1373/625 | |

| Top losers during the week (BSE-A Group) | |||||

| Motherson Sumi | 284 | 251 | -11.5% | 396/229 | |

| Adani Port & SEZ | 339 | 302 | -11.0% | 375/244 | |

| Shree Cement | 12,085 | 11,159 | -7.7% | 12509/8113 | |

| NMDC Ltd | 103 | 95 | -7.6% | 174/90 | |

| Tata Motors | 328 | 304 | -7.5% | 606/302 | |

Now let us move on to some of the key corporate developments of the week gone by.

As per an article in Livemint, Hinduja Leyland Finance Ltd (HLF) a subsidiary of Ashok Leyland Ltd is planning to raise Rs 6-6.5bn through an Initial Public Offer (IPO). The subsidiary is in the business of providing customized finance for utility vehicles, tractors, cars and two-wheelers. The firm is planning to list on the stock market by the second half of the next financial year. The company has recently diversified its business by entering into housing loans category. As of 31 March, HLF had Rs 6.5 bn in assets under management and a presence across 1500 locations.

National Thermal Power Company (NTPC) plans to raise Rs 7 bn by selling tax free bonds. These funds will be utilized for its renewable energy project. Of the total issue, 40% is reserved for the retail sector. The raised amount will help the company to cut the cost of its renewable energy. The earlier private placement of Rs 3bn was oversubscribed by 7.25 times. NTPC also plans to raise US$ 500m each from its first global rupee bond and green bonds that it plans to sell soon. The move comes at a time when the company is trying to reduce electricity tariff to improve power off-take from its projects.

As per a report by Investment Information and Credit Rating Agency (ICRA), L&T Halol Shamlaji Tollway Ltd (HSTL) delayed scheduled payments to its lenders on a loan worth Rs 10bn in August. The special purpose vehicle carried out the four -laning of 173.06km of state highway from Halol to Shamlaji in Gujarat. Following the default, ICRA has downgraded the long term loan programme of L&T HSTL to 'D' from its previous rating of 'BB+'. As per an article in Livemint, a 'D' rating indicates that the instrument in question is in default or will default on maturity. ICRA stated that the delay in payments were because of lower than expected traffic volumes, leading to shortfall in toll collection. However the company official stated that the payment towards the loan due on August has been paid.

Bajaj Auto is set to export its quadricycle vehicle named 'RE60', after the company got the required approvals from a European certification agency to export the vehicle. Quadricycle is an alternative to the auto rickshaw that comes with four wheels instead of three. The vehicle can accommodate 4 passengers, provides a mileage of 35km per litre of fuel and has a top speed of 70km per hour. However several public interest litigations filled by auto rickshaw drivers had stalled the launch of the model in India. Bajaj has spent around Rs 5.5bn to develop the quadricycle. It has created a capacity to produce 5000 vehicles a month at its Aurangabad facility in Maharashtra.

Hero MotoCorp plans to roll out new motorcycles with indigenously developed engines and platforms. The company has developed three engines and platforms in the range of 110-150cc. Currently, the motorcycles have engines manufactured by Honda. The indigenously developed engines will be used in some of its top selling models such as Splendor, Passion and Glamour. The engines have been developed under the supervision of Markus Feichtner, former head of Austrian engine maker AVL's India Technology Centre who joined Hero late last year as its vice-president for research and development (R&D).

The economic & earnings growth numbers in China and US Federal Bank's decision on interest rates in October meeting will play a key role in the movements of the market going forward.

However we recommend investors to pick stocks with sound fundamentals when they are on sale at reasonable prices. Then hold on to them for the long term or until something bad happens to the business. Sticking to this simple formula will relieve you from the stress of market volatility.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Global Markets Remain Volatile". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!