India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News September 24, 2016

Global Markets End on a Robust Note Sat, 24 Sep RoundUp

The US Federal Reserve in its meeting on Wednesday left the interest rates unchanged. However, Fed Chair Janet Yellen signaled that it could still tighten monetary policy by the end of this year provided the labour markets improved. During the week, Dow Jones Industrial Average (DJIA) went up marginally by 0.8%.

Along with the Fed, the Bank of Japan (BoJ) too left the interest rates unchanged at negative 0.1%. The BOJ had introduced negative interest rates early this year. The move was introduced on hopes that it would encourage people to lend more and thereby spur spending and inflation. However, there has been no sign of this working yet.

Along with the Fed and the BoJ, the monetary policies and low interest rates by other central banks have made things far worse than before for the global economy. Benchmark indices in Japan surged by 1.4% during the week.

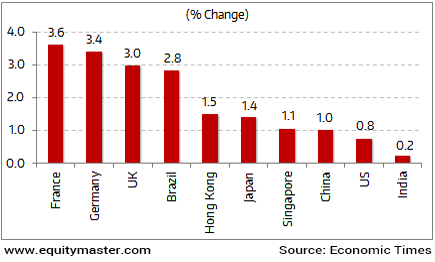

European stock markets too witnessed a robust week with benchmark indices in France and Germany surging by 3.6% and 3.4% respectively.

Back home, the Indian indices closed marginally higher during the week. The BSE Sensex was up by 0.2%. The current account deficit of India in the quarter ended June narrowed to 0.1% of gross domestic product (GDP). This is a considerable improvement as compared to three years back, when this figure stood at an unprecedented 4.1% of GDP.

Key World Markets During the Week

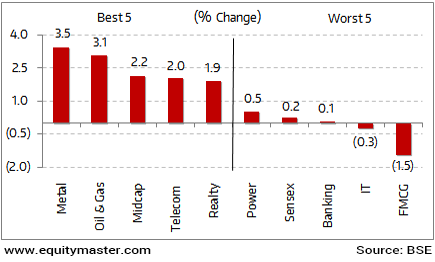

On the sectoral indices front, metal and oil & gas stocks led the gainers this week. On the other hand, stocks from fast moving consumer goods (FMCG) witnessed selling pressures.

BSE Indices During the Week

Now let us discuss some key economic and industry developments during the week gone by.

Cement manufacturers have hiked prices in some regions in anticipation of good demand. Normally cement manufacturers hike prices at this time of the year as the monsoon comes to end and the construction activities resume.

However, the hikes, this time, have been more than usual. In some regions, the hike has been as steep as Rs 50/bag. The steep hike can be partly attributed to the increase in the fuel costs.

Prices of petroleum coke (petcoke) used in the manufacture of cement have increased significantly. Reportedly, petcoke prices have nearly risen by 80% over the past six months.

Experts believe that the cement prices could further increase as manufacturers replenish their petcoke stocks at increased prices.

Stock prices of cement companies have risen sharply since the beginning of the year. In order for this rally to sustain it will be of utmost importance that the demand for the real estate as well as construction activities recovers.

As per an article in Livemint, the current account deficit of India in the quarter ended June narrowed to 0.1% of gross domestic product (GDP). Three years back, this figure stood at an unprecedented 4.1% of GDP. The obvious conclusion to this is that India is in a much better position deficit wise as compared to three years back.

A current account deficit takes place when the value of imports of goods, services etc is greater than the value of exports.

However, it is imperative to note that the current account deficit has not narrowed due to increase in exports. Rather, the deficit has gone down due to a significant decrease in the country's imports. This just goes on to signify the weak investment demand conditions in the economy. During the quarter ended June, merchandise imports declined by 11.5%.

Reportedly, there are several other indicators too that show a bleak picture. One is the decline in foreign direct investments (FDI) inflow. FDI inflow was US$ 4 billion for the quarter ended June as compared to US$ 10 billion a year ago.

Not only this, remittances from abroad-India's strongest source of dollar inflows have been weak. Flows from personal transfers, money that Indians abroad remit back home dropped to US$ 13.8 billion in the June quarter from US$ 15.7 billion a year ago.

Increase in FDI inflows coupled with remittances and a surge in exports will play as key variables to keep the current account deficit in check.

Movers and Shakers During the Week

| Company | 02-Sep-16 | 9-Sep-16 | Change | 52-wk High/Low |

|---|---|---|---|---|

| Top Gainers During the Week (BSE Group A) | ||||

| Bajaj Finserv | 2909.35 | 3317.9 | 14.0% | 3,420/1,576 |

| MRF Ltd | 40503.1 | 45816.3 | 13.1% | 46,355/30,464 |

| IFCI | 28.05 | 30.5 | 8.7% | 31/20 |

| Muthoot Finance | 342.9 | 372.2 | 8.5% | 405/153 |

| Gitanjali Gems | 60.15 | 65.1 | 8.2% | 68/30 |

| Top Losers During the Week (BSE Group A) | ||||

| Axis Bank | 601.2 | 557.4 | -7.3% | 638/367 |

| Gujarat Mineral Development Corp | 91.7 | 86.0 | -6.2% | 101/52 |

| Godrej Consumer | 1684.9 | 1582.7 | -6.1% | 1,710/1,120 |

| UNITECH | 6.4 | 6.1 | -5.4% | 9/3 |

| OPTO Circuits | 12.9 | 12.3 | -5.3% | 19/8 |

And here are some of the key corporate developments in the week gone by.

As per an article in Livemint, Lupin is looking for opportunities for an acquisition in the domestic market. The company has made significant number of acquisitions in the overseas market in the preceding two years. This includes the likes Gavis Pharmaceutical acquired for a sum of US$ 880 million and Shionogi's product portfolio in Japan.

Now it is looking out for opportunities in the domestic market, considering that pharmaceutical market in India is expected to grow to US$ 55 billion in 2020 from the current US$ 20 billion as per reports.

Reportedly, according to management the acquisition in the domestic space will be done for the therapies in which the company has lower market share or little presence. This will enable the company to diversify its presence across varied therapies.

India business currently accounts for 29% of the company's revenues. Lupin is currently ranked 8th in the domestic Pharmaceutical market. It is the leading player in the Anti-TB segment. Further, the company also derives major portion of its revenues from respiratory, anti-diabetic and cardiology segments in the domestic market. Thus one will have to look into as to which new therapies Lupin will enter.

As per an article In Livemint, players like Bharti Airtel, Idea Cellular, Vodafone are not presently reacting to Relaince Jio's aggressive tariff.

Mr Mittal, chairman of Airtel in a recent interview stated that it is not possible to compete on pricing with Jio at the present stage as Jio is offering services for free till 31 December 2016.

However, the decision to not reduce the tariffs may lead to these operators losing some part of their market share to Jio as it sends a message to customers that their service provider is not interested in retaining them.

It is imperative to note that Jio wants to target the medium and high end segment of the market wherein the subscriber base is only 38%. However, these 38% subscribers account for almost 68% of the overall revenues of the industry.

Having said that, operators such as Airtel and Vodafone are making efforts to retain their high end value customers. This strategy will possibly help these companies to not lose significant market share to Jio in a category which Jio is targeting.

The incumbents are offering higher usage limits at lower tariffs. Besides, some segmented pricing offers have been tweaked for higher value customers.

Thus the incumbents at present are concentrating on retaining their high Average Revenue Per User (ARPU) customer and are willing to let go of low ARPU customers. The low ARPU segment accounts for just 32% of the overall revenues of the telecom industry.

As written in the article, Incumbents may appear calm right now as far their pricing response goes. But it appears to be the proverbial calm before the storm.

Stocks of tyre companies are clocking new highs almost every day. Reportedly, within a period of three months the stocks of Apollo Tyres Ltd has gone up by 48.3%, MRF Ltd by 36.9%, Ceat Ltd by 35% and JK Tyre by a whopping 70.5%.

The rally has been triggered mainly on account of lower rubber prices. Rubber prices are hovering at levels as seen a year ago. Further, there has been a sharp 20% drop in rubber price (RSS-Grade 4) in the last six weeks.

Rubber is the main constituent required in making a tyre and its prices play an important part in determining the profitability of the company.

However, for a rally to sustain it will be important that the sales volumes pick-up too. Sales volume of tyre companies is dependent on auto sales in the economy. The sales volume of tyre companies has been flat for the past two years. For profitability to spurt, it will be essential that the sales volumes increase.

As per an article in Livemint, Vodafone Group Plc has invested Rs 477 billion in its Indian unit-Vodafone India. This is a massive equity infusion. Reportedly, the funds raised are capable of purchasing all of Idea Cellular and Reliance Communications equity shares at current valuations.

Further, the equity infusion has been done at a time when India's largest spectrum auctions are just a week away. The management of Vodafone India stated that the equity infusion will enable it to continue its investments in spectrum and expansion of networks across various technology layers. All these aspects clearly indicate, Reliance Jio is not the only player with deep pockets.

This just goes on to state that the war in the telecom space is going to just get more intensified going forward. The real pricing war will be seen post December this year, when Jio's free service offers will end. While the consumers seem to be benefiting from this competitive but, the return ratios of the sector are set to deteriorate.

Recently, there is a flood of Initial Public Offer's (IPO) hitting the market. Confused as to which one's to apply and which ones to avoid?

Last week we promised you a special handbook on IPO investing. The wait is finally over. Without further ado, we would like to present Equitymaster's Handbook of IPO Investing (with special focus on never before Insurance IPOs). Click here to get your free copy right away...

And here's an update from our friends at Daily Profit Hunter...

The Nifty opened with a huge gap up on Tuesday and a rallied 130 points but ended the week with nominal gains on account of profit booking at higher levels. It seems like the channel line would act as a resistance on an immediate basis and keep prices in check. 8,800 could act as an immediate support while 9,000 could act as a resistance. You can read the detailed market update here...

Marginal Gains for Indian Indices

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Global Markets End on a Robust Note". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!