Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Grab Our Small Cap Recommendation

Service at a 60% Discount

- Home

- Todays Market

- Indian Stock Market News September 3, 2021

Sensex Ends Above 58,000 Mark, Nifty Tops 17,300; Reliance Industries & ONGC Surge 4% Fri, 3 Sep Closing

Indian share markets witnessed positive trading activity throughout the day today and ended higher.

Benchmark indices rallied for the second consecutive day after witnessing strong buying in index heavyweight Reliance Industries.

The Sensex closed above the 58,000-mark for the first time in history, while Nifty settled above 17,300 level.

At the closing bell, the BSE Sensex stood higher by 277 points (up 0.5%).

Meanwhile, the NSE Nifty closed higher by 87 points (up 0.5%).

Reliance Industries and ONGC were among the top gainers today.

HDFC Life Insurance and Cipla, on the other hand, were among the top losers today.

The SGX Nifty was trading at 17,353, up by 106 points, at the time of writing.

Both, the BSE Mid Cap index and the BSE Small Cap index ended up by 0.4%.

Sectoral indices ended on a positive note with stocks in the energy sector, oil& gas sector and metal sector witnessing most of the buying interest.

Telecom and finance stocks, on the other hand, witnessed selling pressure.

Shares of L&T Technology and Deepak Nitrite hit their respective 52-week highs today.

Asian stock markets ended on a mixed note today.

The Hang Seng and the Shanghai Composite ended the day down by 0.7% and 0.4%, respectively. The Nikkei ended up by 2.1% in today's session.

US stock futures are trading on a positive note today with the Dow Futures trading up by 39 points.

The rupee is trading at 73.02 against the US$.

Gold prices for the latest contract on MCX are trading up by 0.2% at Rs 47,070 per 10 grams.

Speaking of the stock market, India's #1 trader, Vijay Bhambwani shares his top six day trading hacks, in his latest video for Fast Profits Daily.

Tune in to the video below to find out more:

In news from the real estate sector, IRB Infra was among the top buzzing stocks today.

IRB Infrastructure Developers share price gained 5.6% on the BSE today after the company emerged as a preferred bidder for the construction of a road project in Tamil Nadu.

The company emerged as a preferred bidder for the construction of six lanes of 20 kms Pondavakkam to Kannigaipair stretch on the upcoming Chittoor - Thachur Highway in the state of Tamil Nadu at the cost outlay of Rs 9.1 bn.

Virendra D Mhaiskar, Chairman & Managing Director, IRB Infrastructure Developers said,

- We are happy to have another project in Tamil Nadu after the existing Omalur - Salem - Namakkal Project, which is under the build-operate-transfer (BOT) space.

Winning this project has validated our integrated strengths, developed in last more than 20 years, in executing all types and sizes of highway infrastructure projects, be it under BOT, toll-operate-transfer (TOT), hybrid annuity model (HAM) or engineering, procurement and construction (EPC), irrespective of the geographical terrains.

The concession period for the project will comprise 730 days for construction and 15 years operations & maintenance rights thereafter.

Upon award of this project, company's order Book will stand at Rs 141.9 bn.

Two weeks back, IRB Infrastructure Developers-led SPV, the CG Tollway received its completion certificate for the Chittorgarh - Gulabpura six lane highway project in Rajasthan.

This certificate enables the company to collect toll fees at full tariffs on the project which are around 60% over the existing rates.

IRB Infra share price ended the day up by 4.7% on the BSE.

Moving on to news from the chemicals sector...

Rossari Biotech has completed the acquisition of the first tranche of 76% of the equity share capital (on a fully diluted basis) of Tristar Intermediates on Wednesday, 1 September 2021.

In July this year, the board of Rossari Biotech approved the acquisition of Tristar Intermediates.

As per the agreement and subject to customary closing conditions, Rossari will be acquiring 100% of the equity share capital of Tristar Intermediates.

The company said 76% of the equity share capital will be acquired upon closure of the transaction, and the balance 24% over the next 3 years.

The total enterprise value of the transaction is Rs 1.2 bn. Rossari plans to fund the investment through cash on balance sheet and doesn't intend to raise any debt for this acquisition.

The transaction brings together two high-potential companies within the speciality chemical space.

The blend of capabilities will add scale, provide cross-selling opportunities, and accelerate growth for Rossari, while significantly enhancing value creation in the longer term.

The acquisition provides Rossari with enhanced portfolio of products, stronger presence in new & untapped international markets and access to newer technologies.

Tristar Intermediates is one of the prominent companies in India in the field of preservatives, aroma chemicals, and home & personal care additives with high-tech distillation facilities.

Rossari Biotech share price ended the day down by 0.1% on the BSE.

Speaking of stocks, here's a pattern that if you see, you must sell your position. After all, exits are more important than entries.

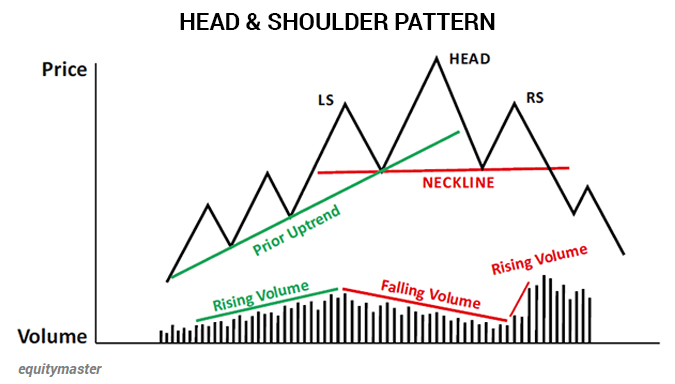

In the chart below, we can see the head and shoulder pattern - the stock goes up, makes a high, falls a little bit, goes up to a higher high, does not make a higher low, rallies again, fails to make a new high, and then starts to break down.

This usually happens in a situation where a stock or index has typically been in a bull trend for a while. Spotting this correctly can help you save money.

If you're interested in trading and want to know how you can use this pattern, you can read about it in one of the editions of Profit Hunter here: It's When You Sell that Counts

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Ends Above 58,000 Mark, Nifty Tops 17,300; Reliance Industries & ONGC Surge 4%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!