Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Grab Our Small Cap Recommendation

Service at a 60% Discount

- Home

- Todays Market

- Indian Stock Market News August 31, 2021

Sensex Soars 663 Points, Nifty Tops 17,100; Bharti Airtel & Bajaj Finance Surge 5% Tue, 31 Aug Closing

Indian share markets witnessed positive trading activity throughout the day today and ended higher.

Benchmark indices rallied for the third consecutive day in a row today, tracking firm cues from global peers and led by sharp gains in telecom stocks.

The benchmark BSE Sensex claimed new all-time high of 57,625.3 while the Nifty 50 crossed 17,100 mark for the very first time.

At the closing bell, the BSE Sensex stood higher by 663 points (up 1.2%).

Meanwhile, the NSE Nifty closed higher by 201 points (up 1.2%).

Bharti Airtel and Bajaj Finance were among the top gainers today.

Tata Motors and Nestle India, on the other hand, were among the top losers today.

The SGX Nifty was trading at 17,128, up by 186 points, at the time of writing.

The BSE Mid Cap index and the BSE Small Cap index ended up by 0.8% and 0.9%, respectively.

Sectoral indices ended on a positive note with stocks in the telecom sector, consumer durables sector and healthcare sector witnessing most of the buying interest.

Shares of Coforge and SRF hit their respective 52-week highs today.

Asian stock markets ended on a positive note today.

The Hang Seng and the Shanghai Composite ended the day up by 1.3% and 0.5%, respectively. The Nikkei ended up by 1.1% in today's session.

US stock futures are trading on a positive note today with the Dow Futures trading up by 77 points.

The rupee is trading at 72.98 against the US$.

Gold prices for the latest contract on MCX are trading down by 0.1% at Rs 47,137 per 10 grams.

Speaking of the stock market, India's #1 trader, Vijay Bhambwani, talks about how you should trade in the month of September, in his latest video for Fast Profits Daily.

Tune in to the video below to find out more:

In news from the energy sector, Reliance Industries was among the top buzzing stocks today.

Billionaire Mukesh Ambani-controlled Reliance Industries (RIL) is poised to acquire Norwegian solar module maker REC Group for US$1-1.2 bn from China National Chemical Corp (ChemChina) as part of the oil-to-telecom conglomerate's Rs 750 bn push into clean energy.

Talks are underway with global banks to raise about US$500-600 m in acquisition financing for the deal, while the rest will be funded via equity.

Further, the acquisition will open doors for Reliance to access cutting-edge technology and global manufacturing capabilities as it continues to move forward on its plan to expand into the solar energy sector.

Founded in 1996, REC group is an international 'member' of state-run chemicals major ChemChina, which is the largest shareholder in Pirelli Tyres and Syngenta.

REC group, the leading European brand for solar photovoltaic (PV) panels, has an annual solar panel production capacity of 1.8 gigawatts (GW) and has installed around 10 GW capacity globally.

Also, it is important to note that India is all set to develop 175 GW of renewable capacity, including 100 GW of solar, by 2022.

At present, the solar equipment market is dominated by Beijing-based companies such as Trina Solar, ET Solar, and Jinko Solar among others.

India has a manufacturing capacity of only 3 GW for solar cells and 15 GW for solar modules.

Reliance Industries share price ended the day down by 0.5% on the BSE.

Moving on to news from the auto sector...

Maruti Suzuki to Hike Prices Across Models from September

Maruti Suzuki, India's largest carmaker, is set to increase prices in September across models making it the third such hike in the financial year 2021-22.

The Delhi-based carmaker had hiked prices in April and July.

In a stock exchange filing, Maruti Suzuki said,

- We wish to inform you that over the past year the cost of the company's vehicles continues to be adversely impacted due to an increase in various input costs.

Hence, it has become imperative to pass on some impact of the additional cost to the customers through a price rise.

The company, however, did not specify the quantum of hike planned for next month.

The hike will come just before the start of the festive season which kicks off with Ganesh Chaturthi on September 10.

Tata Motors, Honda Cars, Mahindra & Mahindra, Renault, and Toyota had raised prices in the July-August period.

The hikes have been exercised to negate the increase in raw material costs such as steel and precious metals.

Maruti Suzuki share price ended the day up by 0.6% on the BSE.

Speaking of stocks, here's a pattern that if you see, you must sell your position. After all, exits are more important than entries.

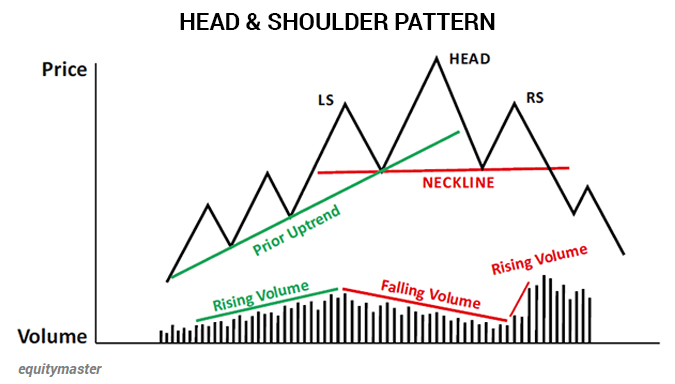

In the chart below, we can see the head and shoulder pattern - the stock goes up, makes a high, falls a little bit, goes up to a higher high, does not make a higher low, rallies again, fails to make a new high, and then starts to break down.

This usually happens in a situation where a stock or index has typically been in a bull trend for a while. Spotting this correctly can help you save money.

If you're interested in trading and want to know how you can use this pattern, you can read about it in one of the editions of Profit Hunter here: It's When You Sell that Counts

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Soars 663 Points, Nifty Tops 17,100; Bharti Airtel & Bajaj Finance Surge 5%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!