India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News August 26, 2022

Sensex Rises 350 Points, Nifty Above 17,600; M&M and Titan Top Gainers Fri, 26 Aug 10:30 am

Asian stock markets opened higher today, lifted by US gains as investors awaited US Federal Reserve Chair Jerome Powell's speech.

The Nikkei rose by 1% while the Hang Seng was up by 0.8%. The Shanghai Composite is trading higher by 0.2%.

Wall Street indices ended sharply higher on Thursday, lifted by gains in Nvidia and other technology-related stocks as investors focused on the Federal Reserve's Jackson Hole conference for clues about the central bank's policy outlook.

The Dow Jones was up by 1% while the tech heavy Nasdaq was up by 1.7%.

Back home, Indian share markets are trading on a strong note.

Benchmark indices opened in green today following the trend on SGX Nifty. And as the session progressed, gains were extended.

At present, the BSE Sensex is trading higher by 363 points. Meanwhile, the NSE Nifty is trading up by 107 points.

Kotak Mahindra Bank and Titan are among the top gainers today.

IndusInd Bank and Bharti Airtel are among the top losers today.

Broader markets are trading on a positive note. The BSE Mid Cap index is up by 0.9% while the BSE Small Cap index is trading higher by 0.8%.

Sectoral indices are trading on a positive note, with stocks in the metal sector and industrial sector witnessing most of the buying.

Keep an eye out on these 5 beaten down small-cap stocks as Indian markets turn volatile yet again.

Bajaj Auto and Siemens hit their 52-week high today.

Tejas Networks share price is rising ever since the 5G auctions concluded.

Since you're interested in high flying stocks, check out our guide on how to pick the best multibagger stocks in 2022.

Also check out our editorial on the most profitable mid cap stocks and the most profitable bluechip stocks in India.

In the commodity markets, gold prices fall. Gold prices are trading lower by Rs 42. Currently, gold prices are trading at Rs 51,660 per 10 grams.

Note that gold prices have fallen and have taken quite a knock in recent weeks.

Meanwhile, silver prices are trading higher at Rs 55,535 per kg. Silver price too have fallen a lot in recent days.

The rupee is trading at 79.8 against the US dollar.

After getting a bird's eye view of the market, do you want to get a full analysis on how the markets will perform today? You know how the market started but do you want to know how the markets will close today?

In the below video, Brijesh Bhatia does a complete analysis of today's market.

People never thought that vehicles would run on anything other than petrol. But ethanol blending and electric vehicles (EVs) have revolutionised the way people travel.

EVs come with dual benefits...they are both environmentally friendly and cheap. EVs are progressing rapidly. With increasing awareness about environment, EVs have been in demand.

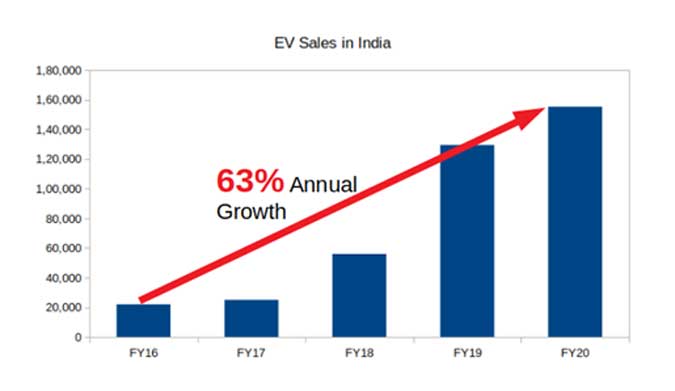

Take a look at how the EV sales have increased in the last five years.

With so much demand coming in... stocks of a few EV companies have only one way to go... that is UP.

Interestingly, it is not only passenger vehicles sales which are going up, the electric bus sales went up by 1250% in the last one year.

To know more about electric buses read our editorial on: these companies are critical to the success of India's electric bus revolution.

In news from the realty sector, DLF has set high targets.

Realty major DLF is targeting about Rs 13 bn sales revenue from its new luxury housing project at Panchkula in Haryana on better demand for independent floors.

DLF has launched a new 34-acre project Valley Gardens at Panchkula.

Under this project, DLF is developing 424 independent floors in this project. The construction work will start after the monsoon season and the project will get completed in the next three years.

The floors will be of around 3,500 square feet area each. There will be four floors on 500 square yards plot.The company has initially launched 200 independent floors. It will launch the remaining in two tranches.The project, nestled in the foothills of the Shivaliks, supplements the existing 175-acre site of The Valley, a residential development in Panchkula, and home to over 1,400 families.

Meanwhile, is targeting a 10% growth in its sales bookings to about Rs 80 bn in this financial year.Its sales bookings jumped to Rs 72.7 bn in 2021-22 fiscal from Rs 30.8 bn in the previous year.

Already, in the first quarter of this fiscal, DLF's sales bookings doubled to Rs 20.4c bn from Rs 10.1 bn in the year-ago period.

DLF is the largest real estate company in terms of market capitalisation. It has so far developed more than 153 real estate projects comprising over 330 million square feet of area.

Further in news from the pharma sector, Dr Reddy's Laboratories has received an establishment inspection report.

Dr Reddy's Laboratories formulations manufacturing facility in Srikakulam, Andhra Pradesh, has received an establishment inspection report (EIR) from the U.S. Food and Drug Administration (U.S. FDA).

Last month, Dr. Reddy's Laboratories had intimated the exchanges about U.S. FDA issuing a Form 483 with two observations following completion of a pre-approval inspection of the formulations manufacturing facility (FTO 11) from 30 June - 7 July.

The company had then said it would address the issues raised in observations, within the stipulated timeline.

Through Form 483, the USFDA notifies the company whose facility is inspected of objectionable conditions observed by its officials that may constitute violations of the Food Drug and Cosmetic Act and related Acts.

Since you are interested in pharma stocks you should read our editorial on: top 4 pharma stocks to add to your watchlist.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Rises 350 Points, Nifty Above 17,600; M&M and Titan Top Gainers". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!