India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News August 23, 2022

SGX Nifty Down 79 Points, Falling Crude Oil Prices, the Attrition Problem, and Top Buzzing Stocks Today Tue, 23 Aug Pre-Open

On Monday, Indian share market extended losses as the session progressed and ended deep in the red.

Benchmark indices crashed amid renewed fears of interest rate hikes following hawkish comments from US Federal Reserve officials and economic concerns.

The Sensex and Nifty ended near the day's low as majority of stocks from the index ended on a negative note.

The fall was heightened by tech stocks and banking stocks, as worries of global economic growth kept investors on tenterhooks.

At the closing bell on Monday, the BSE Sensex stood lower by 872 points (down 1.5%)

Meanwhile, the NSE Nifty closed lower by 268 points (down 1.5%)

The Sensex fell below the 59,000 mark and the Nifty crashed below 17,500 as the recent rally turned out to be short lived.

ITC and Nestle were among the top gainers.

Tata Steel, Asian Paints, and Wipro on the other hand, were among the top losers.

Broader markets ended on a negative note. The BSE Midcap index ended down by 1.8% while the BSE Smallcap index ended lower by 1.2%.

The numbers of companies announcing bonus shares to shareholders is on the rise. Check out these 5 stocks for bonus shares and stock splits in September 2022.

All sectoral indices ended on a negative note. Stocks in the realty and metal sector witnessed maximum selling pressure.

Adani Power hit its 52-week high. Adani group stocks are rising, continuing their momentum.

Since you're interested in high flying stocks, check out our guide on how to pick the best multibagger stocks in 2022.

Gold prices for the latest contract on MCX were trading down by 0.6% at Rs 51,156 per 10 grams, at the time of Indian market closing hours yesterday.

At 7:30 AM today, the SGX Nifty was trading down by 79 points or 0.5% lower at 17,410 levels.

Indian share markets are headed for a negative opening today following the trend on SGX Nifty.

Speaking of the stock markets, after a swift recovery seen in the past two months, Indian share markets have started to fall again.

Looking at the way the Indian stock market is performing lately, investors are again getting nervous. And more so with safe havens also falling.

The price of gold is falling again while silver prices have seen huge downfalls compared to gold.

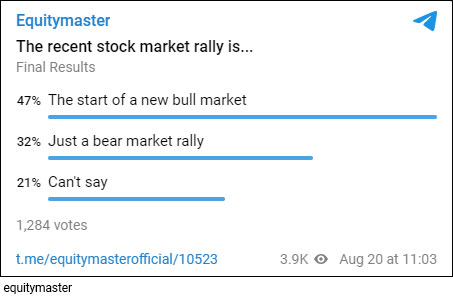

To understand what our readers are thinking, we ran a poll on Equitymaster's Telegram Channel over the weekend.

Here's what we asked our readers.

The recent stock market rally is...

- The start of a new bull market

- Just a bear market rally

- Can't say

With a response from over 1,250 participants, here is the final result:

As we're dealing with extreme volatility these days, it's always important to keep some money off the table rather than going all-in.

So, instead of parking your total capital in one asset class or a single category of stocks, allocate small equal parts across the board periodically.

For more details, check out Equitymaster's Asset Allocation guide which highlights the various factors influencing asset allocation in equities.

Top Buzzing Stocks Today

Godrej Agrovet share price will be among the top buzzing stocks today.

Godrej Agrovet yesterday announced that it has signed three Memorandum of Understand with Assam, Manipur and Tripura state governments for development and promotion of oil palm cultivation in the region under the National Mission on Edible Oils-Oil Palm (NMEO-OP) scheme.

As part of the MoU signed, Godrej Agrovet will be allotted land across the three states for promotion and development of sustainable palm oil plantations in the regions to support the farmers.

CarTrade Tech share price will also be in focus today.

Investors of the new-age companies feared a Zomato deja-vu on Dalal Street yesterday after the stock of CarTrade Tech dropped sharply after its mandatory lock-in ended on 20 August.

A similar thing had happened with shares of Zomato, whose lock in had ended last month.

Market participants will also track shares of West Coast Paper Mills.

Shares of the company have been on an uptrend amid healthy outlook. For the most recent quarter, the company posted over five-fold jump in consolidated net profit at Rs 2.1 bn on the back of strong operational performance.

Oil on the Boil

Crude oil prices fell yesterday, ending three days of gains, on fears aggressive US interest rate hikes may lead to a global economic slowdown and dent fuel demand.

Beijing cut its benchmark lending rate on Monday as part of measures to revive an economy hobbled by a property crisis and a resurgence of Covid-19 cases.

Also pushing down crude prices, the dollar index rose to a five-week high. A stronger US currency is generally bearish for the market because much of the world's oil trade is conducted in dollars.

Cipla to Double India Business

Pharma major Cipla is hoping to transform itself into a global healthcare organisation with a sharp focus on strengthening its presence in the US market, along with doubling its Indian business, said the company's Global Managing Director and CEO Umang Vohra.

In an exclusive interview, Vohra stated that he sees "incredible amounts" of deepening of the Indian healthcare market.

When asked about the growth strategy in the US market, Vohra added that Cipla, the third largest pharma company in India, is looking at innovation and R&D in the US market that can perhaps take them to new areas like biosimilars, mRNA technology and more, along with seeing benefits of respiratory and peptide pipelines there.

Overall, he said that Cipla hopes to double its Indian business from the current Rs 100 bn in the next five years.

Attrition Problem far from Over

According to market experts, a decision to hold back variable pay by top IT companies in India such as Wipro could imply softening revenue growth for the US$200 bn software services export industry.

It could also mean attrition could further spike up due to the cut in the performance-linked incentive.

The above developments come after last week Wipro communicated to employees that mid- to senior-level staff will not receive their variable pay for June-ended quarter while junior associates will get only 70% of the targeted pay.

India's largest company TCS too had delayed a performance bonus by a month for a certain band of employees due to administrative reasons.

For the quarter gone by, IT companies saw their operating margins being significantly squeezed due to inflated employee costs due to high attrition and high wage costs due to salary hikes and other incentive measures being deployed to stem the employee churn.

How this pans out remains to be seen. Meanwhile, we will keep you updated on the latest developments from this space.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "SGX Nifty Down 79 Points, Falling Crude Oil Prices, the Attrition Problem, and Top Buzzing Stocks Today". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!