India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News August 22, 2022

Sensex Tanks 872 Points, Nifty Ends Below 17,500; Tata Steel & Asian Paints Top Losers Mon, 22 Aug Closing

After opening the day on a negative note, Indian share market extended losses as the session progressed and ended deep in the red.

Benchmark indices crashed amid renewed fears of interest rate hikes following hawkish comments from US Federal Reserve officials and economic concerns.

Benchmark indices ended near the day's low as majority of stocks from the index ended on a negative note.

The fall was heightened by tech stocks and banking stocks, as worries of global economic growth kept investors on tenterhooks.

At the closing bell, the BSE Sensex stood lower by 872 points (down 1.5%)

Meanwhile, the NSE Nifty closed lower by 268 points (down 1.5%)

The Sensex fell below the 59,000 mark and the Nifty crashed below 17,500 as the recent rally turned out to be short lived.

ITC and Nestle were among the top gainers today.

Tata Steel, Asian Paints, and Wipro on the other hand, were among the top losers today.

The SGX Nifty was trading at 17,498, down by 247 points, at the time of writing.

Broader markets ended on a negative note. The BSE Midcap index ended down by 1.8% while the BSE Smallcap index ended lower by 1.2%.

The numbers of companies announcing bonus shares to shareholders is on the rise. Check out these 5 stocks for bonus shares and stock splits in September 2022.

All sectoral indices ended on a negative note. Stocks in the realty and metal sector witnessed maximum selling pressure.

Shares of Adani Power, Akshar Spintex, and AMD Industries hit their 52-week highs today.

Adani group stocks are rising, continuing their momentum.

Since you're interested in high flying stocks, check out our guide on how to pick the best multibagger stocks in 2022.

Adani Ports, ICICI Banks, and Reliance were among the most active shares on the BSE today.

If you're interested in knowing which shares to trade, read our guide on the best intraday stocks for today.

Asian stock markets ended on a mixed note. The Nikkei ended the day lower by 0.5%, while the Hang Seng inched lower by 0.6%. The Shanghai Composite ended 0.6% higher.

The rupee is trading at 79.8 against the US$.

Gold prices for the latest contract on MCX are trading down by 0.6% at Rs 51,156 per 10 grams.

Meanwhile, silver prices for the latest contract on MCX are trading down by 1% at Rs 54,932 per kg.

Speaking of the stock markets, after a swift recovery seen in the past two months, Indian share markets have started to fall again.

Looking at the way the Indian stock market is performing lately, investors are again getting nervous. And more so with safe havens also falling.

The price of gold is falling again while silver prices have seen huge downfalls compared to gold.

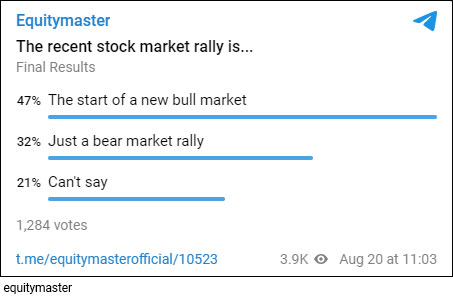

To understand what our readers are thinking, we ran a poll on Equitymaster's Telegram Channel over the weekend.

Here's what we asked our readers.

The recent stock market rally is...

- The start of a new bull market

- Just a bear market rally

- Can't say

With a response from over 1,250 participants, here is the final result:

As we're dealing with extreme volatility these days, it's always important to keep some money off the table rather than going all-in.

So, instead of parking your total capital in one asset class or a single category of stocks, allocate small equal parts across the board periodically.

For more details, check out Equitymaster's Asset Allocation guide which highlights the various factors influencing asset allocation in equities.

Also, at times when share market has been consistently inconsistent, it becomes increasingly difficult to predict the price pattern of any share.

Hence, it becomes important to have a system in place where in your investments and returns both, can also be regularised. This can be done by Systematic Investment Plans (SIP).

Rahul Shah - Editor and Co-head of Research at Equitymaster, explained how SIP would benefit an investor, if the investor invests in SIPs in the bull market.

He showed through the following chart how returns would have progressed if an investor would have held on to investment in SIP for a period of 15-18 months.

For more details, read the entire editorial: How to Earn 15% Returns Even if the Market is at All-Time Highs.

In news from the engineering sector, share price of Gensol Engineering gained 5% today in an otherwise weak market.

Renewable energy solution provider Gensol Engineering today sold 10% stake to pool investors for Rs 1.4 bn.

The company will deploy the raised amount to set up an electric vehicle manufacturing unit at Chakan, Pune, and to grow its solar EPC business.

The company plans to introduce an electric car for the masses to take on WagonR.

It is also planning to launch a cargo version of model. he urban cargo vehicle, with a range of 140 km, a full payload of 800 kg and a three-hour charging time.

Anmol Singh Jaggi, managing director of Gensol Engineering, said

- We are targeting to start production at Pune facility during the first quarter of 2023 with a capacity of 14,400 cars a year initially and give deliveries from January 2024.

We will also hire at least 150 automobile engineers and designers for this venture and invest Rs 250-400 crore in multiple phases.

Recently, the company in a BSE filing informed that it has signed a term sheet to buy a majority stake in a US-based EV startup and acquire technical and business know-how, patents, trademarks and brand name.

To know more, check out Gensol Engineering's latest news and analysis.

Moving on the news from the pharma sector, API Holdings has called off its initial public offering (IPO).

API Holdings, the parent company of PharmEasy, has withdrawn its draft red herring prospectus (DRHP) filed with the market regulators citing volatile market conditions and 'strategic considerations'.

It had plans to raise around Rs 62.5 bn from its public offering. It had raised funds at a valuation of $5-5.7 bn in a pre-IPO round.

The company is planning to raise money through private placement now.

Note that after a prolonged wait, the primary market was back in action as companies started to come out with IPOs.

Last week, Syrma SGS Tech concluded its IPO while this week, a new IPO is set to open on Wednesday.

However, the DRHP withdrawal by PharmEasy suggests that the IPO market will be affected and fewer companies will opt for an IPO.

We will keep you updated on the latest developments from this space. Stay tuned.

And to know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Tanks 872 Points, Nifty Ends Below 17,500; Tata Steel & Asian Paints Top Losers". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!