India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News August 13, 2024

Sensex Today Tanks 692 Points | Nifty Ends Below 24,150 | 4 Reasons Why Indian Share Market is Falling Tue, 13 Aug Closing

Image source: Chunumunu/www.istockphoto.com

Image source: Chunumunu/www.istockphoto.comAfter opening the negative note, Indian share markets Slipped further as the session progressed and ended the day weak.

Equity benchmark indices, BSE Sensex and NSE Nifty50, ended in negative territory on Wednesday.

At the closing bell, the BSE Sensex stood lower by 692 points (down 0.9%).

Meanwhile, the NSE Nifty closed lower by 208 points (down 0.9%).

Titan, Nestle and Apollo Hospital were among the top gainers today.

HDFC Bank, BPCL and Bajaj Finance on the other hand, were among the top losers today.

For a comprehensive overview of key players in the financial sector, check out list of Fin Nifty Companies.

The GIFT Nifty ended at 24,154 down by 190 points.

For impact of the Bank Nifty companies and comprehensive overview of the index, check out Equitymaster's Bank Nifty Companies list.

Broader markets ended the day negative. The BSE Mid Cap ended 0.9% lower and the BSE Small Cap index ended 1.2% lower.

Sectoral indices are trading on negative note with stocks in metal sector, telecom sector and finance sector witnessing buying most selling pressure.

Shares of Trent, Torrent Pharma, and Colgate hit their respective 52-week highs today.

Now track the biggest movers of the stock market using stocks to watch today section. This should help you keep updated with the latest developments...

The rupee is trading at 83.96 against the US$.

Gold prices for the latest contract on MCX are trading 0.3% lower at Rs 70,560 per 10 grams.

Meanwhile, silver prices are trading 0.5% lower at Rs 83,960 per 1 kg.

Here are four reasons why Indian Markets are falling today

#1 Index Heavyweights Decline

Mumbai: Equity benchmark indices Sensex and Nifty declined in early trade on Tuesday dragged by blue-chip.

From the 30 Sensex firms, HDFC Bank, Tata Motors, Asian Paints, Bajaj Finance, Power Grid and Hindustan Unilever were the biggest laggards.

#2 FII Selling

From the 30 Sensex firms, HDFC Bank, Tata Motors, Asian Paints, Bajaj Finance, Power Grid and Hindustan Unilever were the biggest laggards.

#3 Missing Trigger in Earnings

The June quarter result of India Inc. has been mixed so far, raising concerns that the market may not sustain the current valuation levels.

#4 US Inflation Data

Most of the other broader market indices also fell sharply, triggered by a sharp rise in volatility due to geopolitical uncertainty and anxiousness ahead of US inflation data.

Speaking of the stock market, Indian Pharma companies have been at the receiving end of increased enquiries from the US pharma companies that could potentially be a big business opportunity.

Richa Shah, Research Analyst at Equitymaster in her latest video talks about why biosecurity Act could be a potential shot in the arm for pharma stocks

Tune into below video for more details.

Hindalco Q1 Results

In news from the aluminium sector, Hindalco Industries reported on Tuesday, 13 August its Q1 FY25 net profit rose 25% on-year to Rs 30.7 bn.

The Aditya Birla group company said its April-June consolidated revenue from operations rose 7.5% to Rs 570.1 bn.

Revenue from the copper business came in at Rs 132.9 bn, up 15.6%, on account of higher shipments and realisation, while revenue from aluminium upstream and downstream increased 9.6% and 18% respectively.

The mining and metal major reported an EBITDA of Rs 79.9 bn in Q1 FY25, up 31% YoY, driven by lower input costs and higher volumes.

Novelis' net sales for the first quarter rose by 2% year-over-year (YoY) to reach US$ 4.2 bn, primarily due to higher average aluminium prices and an increase in overall shipments.

Total shipments of flat rolled products were at 951 KT in Q1 FY25, up 8% YoY supported by normalised demand for beverage packaging sheets.

The net income attributable to common shareholders dipped 3% to US$ 151 m in the first quarter of the fiscal year due to initial charges associated with flooding at the company's Sierre, Switzerland, plant at the end of June, as well as higher restructuring and unfavourable metal price lag, largely offset by higher adjusted EBITDA.

Hindalco Industries is an Indian aluminium and copper manufacturing company. The company is a subsidiary of the Aditya Birla Group.

Hindalco is the largest aluminium rolling and recycling corporation in the world, as well as a major copper player. It is also one of Asia's top primary aluminium producers

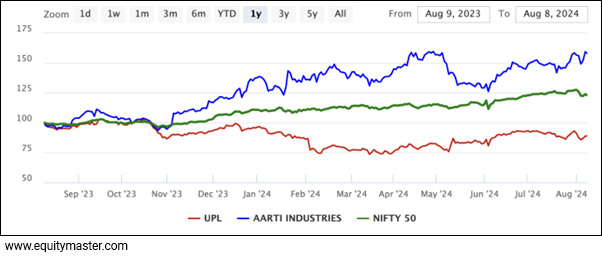

Aarti Industries Down 15%. Here's Why

Moving on to news from the pharma sector, shares of speciality chemicals maker Aarti Industries are sharply lower in trade, down by as much as 14% on concerns over pressure on margins.

The management spoke to analysts during a concall on 12 August and said they would be able to decide on the EBITDA guidance of Rs 14.5 bn only after assessing the global landscape. There has been a fair amount of volatility in global prices and pressure of dumping from China.

However, the volume growth guidance for the fiscal year has been maintained at 20-30%, though logistical concerns arising from disruptions in the Red Sea could hurt volume in some segments, the company admitted.

The management is hopeful that a recovery of volumes and ramp-up of capacities along with higher operating leverages should be able to drive EBITDA growth.

The company's proposed capex could take the debt on books slightly higher to Rs 36 bn.

Aarti Industries, the flagship company of the Aarti group, manufactures organic and inorganic chemicals.

It has a strong position in speciality chemicals segment especially in the nitro-chlorobenzene (NCB) and di-chloro benzene (DCB)-based specialty chemicals.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Today Tanks 692 Points | Nifty Ends Below 24,150 | 4 Reasons Why Indian Share Market is Falling". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!