Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Savings of RS 6,050 on Our

Small Cap Research?

- Home

- Todays Market

- Indian Stock Market News August 10, 2021

Sensex Ends 152 Points Higher; Bharti Airtel and Tech Mahindra Among Top Nifty Gainers Tue, 10 Aug Closing

Indian share markets witnessed volatile trading activity throughout the day today and ended higher.

Amid buying interest in banks, financials and IT stocks, benchmark indices scaled record highs but gave up day's gains in the afternoon deals.

At the closing bell, the BSE Sensex stood higher by 152 points (up 0.3%).

Meanwhile, the NSE Nifty closed higher by 22 points (up 0.1%).

Bharti Airtel and Tech Mahindra were among the top gainers today.

Shree Cement and JSW Steel, on the other hand, were among the top losers today.

The SGX Nifty was trading at 16,279, up by 7 points, at the time of writing.

The BSE Mid Cap index and the BSE Small Cap index ended down by 0.9% and 2%, respectively.

Sectoral indices ended on a mixed note with stocks in the telecom sector and IT sector witnessing most of the buying interest.

Metal, realty and power stocks, on the other hand, witnessed selling pressure.

Shares of Bharti Airtel and Infosys hit their respective 52-week highs today.

Asian stock markets ended on a positive note today.

The Hang Seng and the Shanghai Composite ended the day up by 1.2% and 1%, respectively.

The Nikkei ended up by 0.2% in today's session.

US stock futures are trading on a flat note today with the Dow Futures trading down by 21 points.

The rupee is trading at 74.42 against the US$.

Gold prices for the latest contract on MCX are trading on a flat note today at Rs 45,920 per 10 grams.

Speaking of the stock markets, India's #1 trader, Vijay Bhambwani explains why the yellow metal has been in a down trend, in his latest video for Fast Profits Daily.

Tune in here to find out more:

Future Retail Rebounds 21% From Day's Low on Amazon Bail-Out Report

In news from the retailing sector, Future Retail was among the top buzzing stocks today.

Shares of Future Group companies were in focus today as they rallied up to 17% on the BSE in the intra-day trade on report that Amazon has drawn up blueprint to bailout for cash-strapped Future Retail.

Amazon.com Inc. is preparing a bailout plan for cash-strapped Future Retail if the Singapore international arbitration centre (SIAC) rules against a planned takeover of the Indian retail chain by Reliance Industries.

The stock of Future Retail was locked in the 10% upper circuit band at Rs 52 on the BSE. It bounced back 21% from its intra-day low of Rs 43.1.

Meanwhile, among others Future Group stocks, Future Consumer surged 17% on the BSE on the back of heavy volumes, Future Enterprises hit 10% upper circuit, while Future Lifestyle Fashions gained 9%.

In the past one week, all Future Group stocks declined between 24% and 26%, after the supreme court last week ruled in favour of Amazon in its tussle with the company.

The apex court allowed the appeal filed by Amazon against a Delhi High Court order staying attachment of properties of Future Group companies and Kishore Biyani in relation to the Rs 247.1 bn Future-Reliance deal. This came as a big boost to Amazon.

Future Retail share price ended the day up by 6.9% on the BSE.

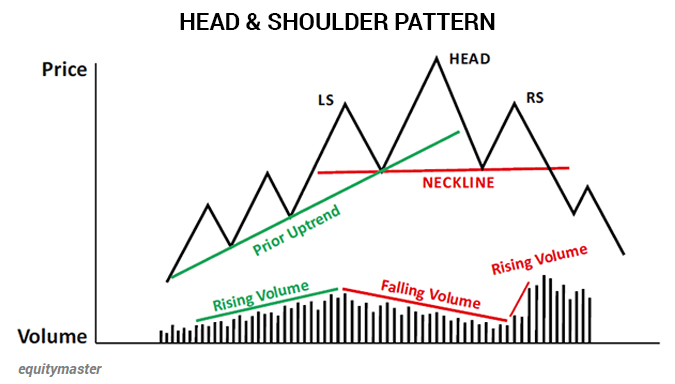

Speaking of stocks, here's a pattern that if you see, you must sell your position. After all, exits are more important than entries.

In the chart below, we can see the head and shoulder pattern - the stock goes up, makes a high, falls a little bit, goes up to a higher high, does not make a higher low, rallies again, fails to make a new high, and then starts to break down.

This usually happens in a situation where a stock or index has typically been in a bull trend for a while. Spotting this correctly can help you save money.

If you're interested in trading and want to know how you can use this pattern, you can read about it in one of the editions of Profit Hunter here: It's When You Sell that Counts

Moving on to news from the engineering sector...

Tata Group Firm Nelco Likely to Ink Pact with Telesat for Satellite Broadband

Tata group company Nelco is in advanced talks with Canadian firm Telesat to ink a commercial pact for launching fast satellite broadband services in India under the latter's lightspeed brand, a move which will pit the combine against Bharti Enterprises-backed OneWeb, Elon Musk's SpaceX and Amazon.

Nelco's managing director PJ Nath said,

- Nelco and Telesat will have a master services agreement (MSA) to provide lightspeed LEO (low-earth orbit) satellite services in India, we are in the process of finalising details of the commercial arrangements.

He said, though, that Nelco has 'no plans' to float a separate joint venture company with Telesat.

Telesat is the fourth global (LEO) satellite operator after OneWeb, SpaceX and Amazon that is keen to enter India's satellite services segment.

It proposes to offer satellite broadband services on the 28 gigahertz (GHz) band, popularly known as the Ka-band globally.

The Tata-Telesat foray into the relatively nascent fast broadband-from-space segment comes as experts see India as a key satellite internet market with almost a US$1 bn annual revenue opportunity.

This is the case since almost 75% of rural India does not have access to broadband, as many locations are without cellular or fibre connectivity.

As a result, LEO satellite systems are being seen as a viable alternative.

Nelco share price ended the day up by 5.6% on the BSE.

How this pans out remains to be seen. Meanwhile, stay tuned for more updates from this space.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Ends 152 Points Higher; Bharti Airtel and Tech Mahindra Among Top Nifty Gainers". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!