India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News August 1, 2024

Sensex Today Ends 126 Points Higher | Nifty Tops 25,000 | Sonata Software Sinks 9% Thu, 1 Aug Closing

Image source: phive2015/www.istockphoto.com

Image source: phive2015/www.istockphoto.comAfter opening the day on the higher, Indian benchmark indices continued the momentum as the session progressed but ended the day higher.

Benchmark equity indices, the BSE Sensex and NSE Nifty50, settled at record highs on closing levels on Thursday.

At the closing bell, the BSE Sensex stood higher by 126 points (up 0.2%).

Meanwhile, the NSE Nifty closed higher by 60 point (0.2%).

Coal India, ONGC and HDFC Bank among the top gainers today.

M&M, Hero MotoCorp and SBI on the other hand, were among the top losers today.

The GIFT Nifty was trading at 25,047, down by 2 points, at the time of writing.

For a comprehensive overview of key players in the financial sector, check out list of Fin Nifty Companies.

For impact of the Bank Nifty companies and comprehensive overview of the index, check out Equitymaster's Bank Nifty Companies list

The BSE MidCap index ended 0.8% lower and BSE SmallCap index ended 0.7% lower.

Sectoral indices are trading mixed, with socks in energy sector, power and oil & gas sector witnessing most buying. Meanwhile stocks in realty sector and telecom sector witnessed selling pressure.

Shares of Maruti Suzuki, 3M India and TVS Motors hit their respective 52-week highs today.

Now track the biggest movers of the stock market using stocks to watch today section. This should help you keep updated with the latest developments...

The rupee is trading at 83.73 against the US$.

Gold prices for the latest contract on MCX are trading 0.2% higher at Rs 69,777 per 10 grams.

Meanwhile, silver prices were trading 0.3% higher at Rs 83,879 per 1 kg.

Speaking of the stock market, learn why a surprising stock skyrocketed while this investor stayed cautious.

Discover the two investment styles - safe & steady vs. high risk, high reward - and how to choose the right one for YOU.

Rahul Shah, co-head of research at Equitymaster in his latest video talks about Suzlon and where did he go wrong.

Tune into below video for more details.

Adani Energy Solutions Jumps 10%

Moving on to news from the energy sector, shares of Adani Energy Solutions surged nearly 10% on Thursday after the US$1-billion qualified institutional placement (QIP) was oversubscribed six times, garnering a demand of over.

The two-day qualified institutional placement (QIP) opened on Wednesday. Duquesne Family Office, the fund founded by billionaire investor Stanley Druckenmiller, and two other US-based long-only funds - Driehaus Capital Management and Jennison Associates - have invested in it.

The report further revealed that Adani Energy raised Rs 500 bn through the issue, noting that these three funds invested in Indian equities for the first time.

More than 125 institutional investors participated in the fundraising of Adani Energy, stated the report. Other prominent investors in the QIP include Blackrock, Abu Dhabi Investment Authority (ADIA), Jupiter Asset Management, Nomura, Eastspring Investments, GQG Partners, and Qatar Investment Authority.

The issue comprised a base deal of up to Rs 58.6 bn (US$ 700 m) and a greenshoe option to upsize by up to an additional Rs 25.1 bn ($300 million). The company is issuing 60.1 m equity shares as the base issue with an option to upsize to 25.7 m shares.

According to the term sheet, the dilution at the base deal is 5.4% of the pre-issue outstanding equity capital, and at the upsized deal, it is 2.3% at the indicative issue price.

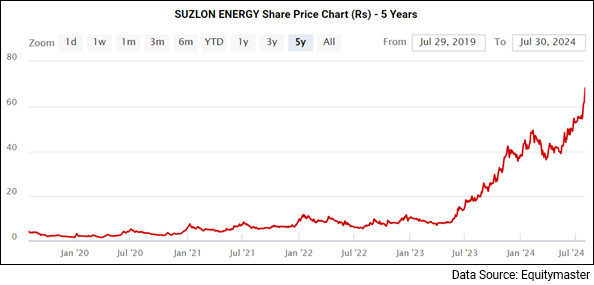

Why Suzlon Energy Share Price is Falling

Moving on to news from the energy sector, shares of Suzlon Energy are seeing some profit booking after eight days of relentless rise, slipping down by 3% to Rs 67 per share mark.

The sharp uptick comes after the wind energy player reported a solid 2% year-on-year surge in net profit, at Rs 3 bn for the June quarter. Revenue too rose 50% to Rs 20.2 bn, up from Rs 13.5 bn in the same period last year.

The wind turbine maker achieved its largest-ever order book of 3.8 GW in Q1FY25, which the management said provides strong visibility for future growth.

The recent price action in the stock can be described as 'vertical'.

Just look at the top right of its chart...

For more check out our editorial, Pros and Cons of Investing in the Stock of Suzlon Right Now.

Akums Drugs IPO Receives 7x Subscription

On 1 August, the final day of bidding for Akums Drugs and Pharmaceuticals Ltd's IPO, the issue was overall subscribed by 7.4 times.

Non-institutional investors (NIIs) showed the highest demand, subscribing 16.4 times of their allocated shares. Retail Individual Investors (RIIs) followed closely, subscribing to nearly 12 times their allotment, while Qualified Institutional Buyers (QIBs) subscribed 1.6 times their allocation.

The employee segment also demonstrated strong interest, with a subscription rate of 2.7 times.

The IPO, which aims to raise Rs 18.7 bn, opened for subscription on July 30.

The shares of the company are expected to debut on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) on 6 August.

The IPO comprises a fresh issue of 1 crore shares valued at Rs 6.8 bn, alongside an offer for sale of 1.73 crore shares amounting to Rs 11.8 bn. The price band for the shares is set between Rs 646 and Rs 679.

The IPO has already garnered substantial interest from anchor investors, raising Rs 8.3 bn. The anchor bid date was set for 29 July.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Today Ends 126 Points Higher | Nifty Tops 25,000 | Sonata Software Sinks 9%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!