Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Savings of RS 6,050 on Our

Small Cap Research?

- Home

- Todays Market

- Indian Stock Market News July 23, 2021

Sensex Trades Marginally Higher, Dow Futures Up by 85 Points Fri, 23 Jul 12:30 pm

Share markets in India are presently trading marginally higher.

The BSE Sensex is trading up by 180 points, up 0.3%, at 53,017 levels.

Meanwhile, the NSE Nifty is trading up by 45 points.

ICICI Bank and Wipro are among the top gainers today. Tata Motors and Adani Ports & SEZ are among the top losers today.

The BSE Mid Cap index is trading flat.

The BSE Small Cap index is trading up by 0.1%.

On the sectoral front, stocks from the real estate sector are witnessing most of the buying interest.

On the other hand, stocks from the power sector are witnessing most of the selling pressure.

US stock futures are trading higher today, indicating a positive opening for Wall Street.

Nasdaq Futures are trading up by 51 points (up 0.3%) while Dow Futures are trading up by 85 points (up 0.2%).

The rupee is trading at 74.46 against the US$.

Gold prices are trading flat at Rs 47,629 per 10 grams.

Gold prices were trading lower in domestic markets today following a muted trend in international spot prices. On the MCX, August gold contracts were trading 0.2% lower at Rs 47,564 per 10 grams.

International gold prices edged lower and were heading for their first weekly decline in five days amid a stronger dollar. Spot gold was down 0.2% at US$ 1,803.3 per ounce.

Note that bullion is down 0.4% for the week. An expensive dollar made gold pricier for holders of other currencies and offset support from lower US bond yields and weak economic data.

To know more about gold, check out our article on how to invest in gold here: How to Invest in Gold?

Moving on to stock-specific news...

Among the buzzing stocks today is Hindustan Zinc.

Vedanta group firm Hindustan Zinc (HZL) reported a 45.9% year on year (YoY) rise in net profit at Rs 19.8 bn for the June 2021 quarter driven by a recovery in metal prices and higher volumes.

The company had posted a net profit of Rs 13.6 bn in the same period last year.

Total income of the company during the quarter increased to Rs 68.8 bn compared to Rs 46.7 bn in the June 2020 quarter whereas total expenses increased to Rs 37.2 bn from Rs 30.1 bn.

Commenting on the results, the company's CEO Arun Misra said,

- We delivered the highest-ever Q1 ore, refined metal and silver production.

After exiting at a run-rate of 1.2 million tonnes per annum (MTPA) in the fiscal year 2021, we maintained the momentum of production in Q1 with a year on year growth of 15% in ore, 17% in refined metal and 37% in silver in spite of the spurt in Covid-19 cases in the second wave of the pandemic.

The company's mined metal production for the quarter was up 9% year YoY at 221,000 tonnes on account of higher ore production. It was also partly offset by lower overall grade, the company said.

Integrated metal production stood at 236,000 tonnes for the quarter, up 17% YoY in line with higher mined metal availability. Integrated zinc production came in at 188,000 tonnes, up 20%.

Integrated silver production was also up 37% from a year ago, in line with higher lead production. However, it was down 21% sequentially.

The company maintains it guidance on operational and financial metrics for the financial year 2022. In light of rising input commodity prices, the company's management is closely monitoring the situation and taking all necessary actions to combat it.

We will keep you posted on more updates from this space. Stay tuned.

At the time of writing, Hindustan Zinc shares were trading up by 1.9% on the BSE.

Speaking of the stock markets, India's #1 trader, Vijay Bhambwani shares a trading hack that you can use to multiply your profits, in his latest video for Fast Profits Daily.

Tune in here to find out more:

Moving on to news from the telecom sector...

Supreme Court Dismisses Applications by Telecom Majors to Recompute AGR Dues

The Supreme Court on 23 July 2021 dismissed the applications filed by telecom majors, including Vodafone Idea and Bharti Airtel, which raised the issue of alleged errors in calculation of adjusted gross revenue (AGR) related dues payable by them.

"All the miscellaneous applications are dismissed," a bench headed by Justice L Nageswara Rao said while pronouncing the order.

The telecom companies had submitted before the apex court that arithmetical errors in the calculation be rectified as there are cases of duplication of entries.

The top court had on 19 July said it would pass orders on the applications filed by the telecom majors.

In September last year, it had given a time of ten years to telecom service providers to clear their outstanding amount to the government.

An earlier judgment of the court in the AGR case had originally ordered the telecom firms to make their repayments in three months.

How this pans out remains to be seen. Meanwhile, stay tuned for more updates from this space.

Speaking of stocks, here's a pattern that if you see, you must sell your position. After all, exits are more important than entries.

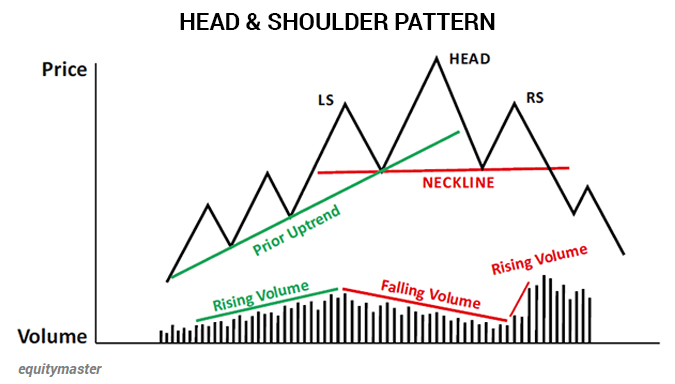

In the chart below, we can see the head and shoulder pattern - the stock goes up, makes a high, falls a little bit, goes up to a higher high, does not make a higher low, rallies again, fails to make a new high, and then starts to break down.

This usually happens in a situation where a stock or index has typically been in a bull trend for a while. Spotting this correctly can help you save money.

If you're interested in trading and want to know how you can use this pattern, you can read about it in one of the editions of Profit Hunter here: It's When You Sell that Counts

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades Marginally Higher, Dow Futures Up by 85 Points". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!