India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News July 2, 2024

Sensex Today Ends 35 Points Lower | Nifty Below 24,150 | Bank Stocks Drag Tue, 2 Jul Closing

Image source: asbe/www.istockphoto.com

Image source: asbe/www.istockphoto.comAfter opening the day on a quiet note, benchmark indices remained muted on Tuesday and ended the day lower.

Equity benchmark indices ended with marginal losses on Tuesday owing to selling pressure in banking shares.

At the closing bell, the BSE Sensex stood lower by 35 points.

Meanwhile, the NSE Nifty closed lower by 18 points (down 0.1%).

TCS, Infosys and Wipro among the top gainers today.

Tata Motors, Bharti Airtel and Kotak Mahindra on the other hand, were among the top losers today.

The GIFT Nifty was trading at 24,237, up by 32 points, at the time of writing.

For a comprehensive overview of key players in the financial sector, check out list of Fin Nifty Companies.

For impact of the Bank Nifty companies and comprehensive overview of the index, check out Equitymaster's Bank Nifty Companies list

The BSE MidCap index ended 0.6% lower and BSE SmallCap index ended flat.

Sectoral indices are trading mixed, with socks in realty sector, energy sector and IT sector witnessing most buying. Meanwhile stocks in power sector and FMCG sector witnessed selling pressure.

Shares of 3M India, Info Edge and Trent hit their respective 52-week highs today.

Now track the biggest movers of the stock market using stocks to watch today section. This should help you keep updated with the latest developments...

The rupee is trading at 83.5 against the US$.

Gold prices for the latest contract on MCX are trading flat at Rs 71,615 per 10 grams.

Meanwhile, silver prices were trading marginally higher at Rs 89,790 per 1 kg.

Speaking of the stock market, two experienced fund managers, James Chanos (US) and Sankaran Naren (India), are concerned about high speculation and low margins of safety in their respective stock markets. This means there's a greater risk of losses if the market crashes.

The advice? Invest cautiously. Consider "stock market insurance".

Rahul Shah, Co-head of research at Equitymaster, talks about what exactly is this insurance and how does it work?

Tune into below video for more details.

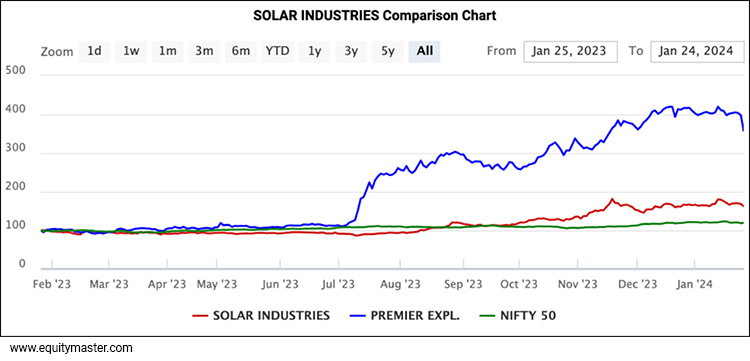

Why Solar Industries Share Price is Rising?

In news from the defence space, shares of Solar Industries are at a record high, touching a market capitalisation of Rs 1 trillion (tn) on 2 July, just days after its subsidiary disclosed a new explosive formulation that was certified by the Indian Navy.

The development is expected to boost revenue potential for Solar Industries.

Solar's new formulation - SEBEX 2 - has been developed by its unit and claims to produce a more powerful TNT equivalent explosion than any solid explosive that is available right now.

The new explosive is reported to be 2.01 times more powerful than a standard TNT (Trinitrotoluene) explosion.

The impact of an explosive is measured in terms of TNT equivalence, and any explosive with a higher TNT equivalence has greater destructive power.

Solar Industries is a leading manufacturer of bulk explosives, packaged explosives and initiating systems.

Its products find use in mining, infrastructure, and construction industries.

For more details on Solar Industries, check out Which Companies Manufacture Military Drones in India?

Why did IOL Chemicals Soar 10% today?

Moving on to news from the chemical sector, IOL Chemicals and Pharmaceuticals shares soared as much as 10% on 2 July after the drugmaker received approval from the National Medical Products Administration (NMPA) of China to export its drug fenofibrate to the Chinese market.

Fenofibrate is a medication prescribed to manage high levels of cholesterol and triglycerides in the blood, thereby supporting cardiovascular health.

Nonetheless, the approval did tip off a spike in volumes in the counter as 30 lakh shares changed hands so far, a meteoric rise from the one-month daily traded average of four lakh shares.

Even though shares of the drugmaker are still down around 7% year-to-date, they've risen nearly 20% in the past month.

Last quarter, the company got a nod from China's drug regulator for metformin hydrochloride, opening the doors to export it to the Chinese market. Metformin hydrochloride is used to treat diabetes mellitus and is also being studied in the treatment of cancer.

Why Godrej Properties hits Record High today?

Moving on to the news from the realty sector, shares of Godrej Properties rallied over 55 to touch a new all-time high of Rs 3,337.8 per share on July 2 after it sold over 2,000 homes worth over Rs 3,150 crore at the launch of its project Godrej Woodscapes in Bengaluru, Karnataka.

So far this year, the stock of this realty major skyrocketed over 65%, as compared to a 10% rise in the benchmark Nifty 50 index.

At the Whitefield-Budigere Cross property in Bengaluru, Godrej Properties sold over 3.4 million square feet of the project area, marking its most successful quarter launch in terms of both value and volume. This achievement represents the sixth project across four different cities in the past year to achieve inventory sales exceeding Rs 20 bn at launch.

The success of Godrej Woodscapes has driven over 500% quarter-on-quarter sales growth for Godrej Properties in Bengaluru, surpassing its full-year FY24 sales in South India within the first quarter.

Godrej Properties, established in 1990 is one of India's leading realty companies.

Godrej Properties is part of the 125-year-old Godrej group, one of India's most trusted business houses. Real estate is considered a key growth business for the Godrej group.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Today Ends 35 Points Lower | Nifty Below 24,150 | Bank Stocks Drag". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!