India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News July 2, 2016

A Breather for Global Markets Sat, 2 Jul RoundUp

After the mayhem in global financial markets in the previous week over concerns on Britain leaving European Union, this week was a quite a breather as the global markets recovered.

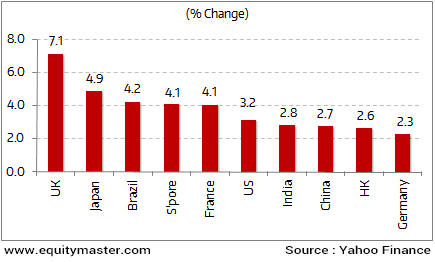

Stock markets in UK ended the week higher by 7%. The stock markets rallied on the hope that the central bank of England will pump fresh stimulus into the economy in the coming months. The stock markets in France and Germany too ended the week higher by 4.1% and 2.3% respectively.

Asian markets too recovered during the week. Further, weak inflation and lukewarm business sentiment are raising expectations that the Bank of Japan will have to act again to shore up inflation. This coupled with global factors led to stock markets in Japan ending the week higher by 4.9%. While, stock markets in Singapore and China too ended the week higher by 4.1% and 2.7% respectively.

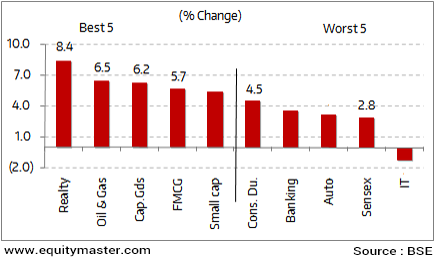

Back home in India, the BSE Sensex ended the week higher by 2.8%. During the week, the Union Cabinet approved the recommendations of the Seventh Pay Commission. The commission had recommended an overall increase of 23.6% in the salary of the central government employees and the pensions of those who have retired from central government jobs. The move is expected to deliver a potential boost to private consumption demand and economic activity.

Key World Markets During the Week

Barring information technology, major sectoral indices ended the week in green with stocks from realty, oil & gas and capital goods sector witnessing the maximum buying interest.

BSE Indices During the Week

Now let us discuss some key economic and industry developments during the week gone by.

Twice a year, the Reserve Bank of India releases the Financial Stability Report (FSR). The latest report was released yesterday (i.e. June 28, 2016). As per the report, the performance of the corporate sector has improved in the past year. This is believed to be on the back of decline in the number of leveraged companies.

The report stated that the proportion of both leveraged and highly leveraged companies fell in March on a YoY basis. The number of leveraged companies, with a negative net worth or a debt-to-equity ratio of 2x or more, dropped to 14% of the RBI sample size. Further, the debt of these companies also dropped 20.6% of the total corporate debt compared to 33.8% last year.

As for stressed assets, the report pointed that three sectors viz.- infrastructure, metal and textile have contributed most to stressed loans in the banking sector. On the other hand, retail loan segment continues to be the least stressed.

The report stated that the share of gross NPAs (non-performing assets) of the top 100 large borrowers rose 22.3% in March from 3.4% six months ago. The gross NPAs for the banking system rose 79.7% as of March over the previous year. It was noted that the sharp rise in NPAs resulted from the asset quality review (AQR) exercise undertaken by the RBI.

The above data states while the number of leveraged companies have fallen, the banking sector still remains in the mess of NPAs. The clean-up exercise undertaken in line with RBI's Asset Quality Review (AQR) will keep a check on the bad loans of banks going forward.

Union Cabinet has approved the recommendation of the Seventh Pay Commission. The Commission had recommended an overall increase of 23.6% in the salary of the central government employees and the pensions of those who have retired from central government jobs.

Reportedly, entry-level basic pay will more than double to Rs 18,000 per month from Rs 7,000 at present. While at the level of cabinet secretary, the topmost civil servant, the pay will rise to Rs 2.5 lakh per month from the current Rs 90,000.

An aggregate outflow of Rs 1020 billion would flow from the government's kitty to 10 million central government employees and pensioners in the current fiscal year. As the increase will take place retrospectively from January 2016, an additional Rs 121.3 billion is expected to land in the hands of the central government employees.

The wage hike is expected to deliver a potential boost to the consumer economy. Further, the auto, consumer durables and fast moving consumer goods (FMCG) sectors too would witness a much higher demand. However, the Finance Minister, Mr Jailtley cautioned that while stimulating demand and boosting savings, the move may also push up inflation.

Though, Vivek Kaul is of the opinion that the implementation of the Seventh Pay Commission won't have a significant impact on the inflation levels. He has justified the same by making solid points in one of his many articles on the Seventh Pay Commission. Click here to get Vivek's insights on this interesting topic.

Movers and Shakers During the Week

Now let us move on to some of the key corporate developments in the week gone by.

State owned lender Bank of Baroda has undertaken a comprehensive review of its business and has finalized a detailed plan to reposition it for the future.

The bank will sell its non-core assets gradually. This in-turn would help the company to exit its unprofitable ventures. Further, the move will also help the company to improve its margins and free up capital that could be deployed for customers with a better credit profile.

The company had posted a mammoth loss of Rs 50.6 billion in the preceding fiscal year. However, the management expects the bank to return to historical levels of profitability going forward.

Although the management is of the view that the asset quality has stabilized but fresh slippages or slippages from restructured assets cannot be ruled out. A check on the asset quality will be the key things to watch out for going forward.

The Indian Meteorological Department stated that half of India has received normal rainfall as the first month of monsoon nears an end.

As of Tuesday, 49% of the country had received normal rainfall, 17% had received excess rainfall and 34% had got deficient or scanty rainfall.

Rainfall deficiency has narrowed to 13% from the earlier 25% as of 28 June. However, parts of Central India are still facing a deficit. Though, IMD estimates that these parts would receive normal rainfall in early July.

A normal monsoon will lead to higher disposable income in the hands of farmers, which in-turn will boost the rural consumption. To add to this, a normal monsoon will also help to keep the inflation at low levels. The possibility of a good monsoon would also increase the chances of the country's central bank retaining its easy money policy. However, there have been many instances in the past wherein the forecasts have gone wrong. Provided, they are accurate it will help to revive the rural sentiments.

As per an article in Livemint, increasing activity and acquisitions are taking place in the Ayurveda and Herbal space. The demand for Ayurveda products is on an uptrend.

Reportedly, the overall beauty and personal care market in India is pegged at around Rs 747 billion. Of which Rs 45 billion is Ayurveda. Though, Ayurveda just accounts for 6% of the overall personal care product markets, experts believe that sales of ayurvedic products by volumes are growing at almost double rate of the overall segment (beauty and personal care market) average.

Baba Ramdev, the face of Patanjali, is actively endorsing the themes such as Ayurveda and yoga. This has not only benefiting Patanjali, but the move has also opened up a big market for all those who sell ayurvedic or herbal products.

Owing to increasing traction for Ayurvedic products, companies such as Hindustan Unilever Limited (HUL) re-launched Lever Ayush for its ayurvedic range, which is exclusively sold online. Further, the company also acquired ayurvedic hair oil and shampoo brand Indulekha in December 2015 to strengthen its presence in the premium category.

Reportedly, companies such as Dabur and Emami, already having a strong ayurvedic product portfolio, are also looking to scale up the business from this category.

A dozens of fast moving consumer goods (FMCG) companies have partially been affected due to the increasing traction for ayurvedic products. The companies are adjusting their business strategy to accommodate more ayurvedic products in their portfolio.

Further, emergence of Patanjali too has affected their sales. Given that, Patanjali still lacks distribution strength as compared to other FMCG companies, it will be interesting to see how things pan out in this space going forward.

The deal between UltraTech Cement and Jaiprakash Associates for the sale of the latter's cement assets has hit a hurdle. This is on account of Jaypee Group not meeting certain financial commitments. This includes clearance of statutory dues and insufficient working capital for the plants under review. However, the deal has not been called off as yet and efforts are under way to salvage the same.

On 31 March, UltraTech and Jaiprakash Associates signed a definitive agreement for the sale of Jaiprakash's cement division.

Under the agreement, UltraTech was to purchase 21.2 million tonnes in cement capacity located across five states for Rs 159 billion. UltraTech was also to pay Rs 4.7 billion on the completion of Jaiprakash's under-construction cement plants, which were part of the deal.

The likely departure of Britain from the European Union is expected to add to the uncertainty in global markets already grappling with recession. We believe global markets are likely to remain under pressure going forward. None of the concerns of global investors are likely to go away anytime soon. Indian markets too will continue to experience the fallout of this turmoil. However, long term investors need not be too concerned. Times like these could offer good opportunities to enter good quality stocks at reasonable valuations.

Indian Indices Register Gains

The index put up a staggering 240 points during the week despite the Brexit woes. The index has shrugged off the worries and headed higher, rallying consistently all five days of the week. It is now just above the range resistance of 8,300. Bulls appear to be in the stronger position, but they may soon run out of steam after such a sharp rally. You can read the detailed market update here...

Indian Indices Skid Downward

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "A Breather for Global Markets". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!