India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News June 28, 2022

Sensex, Nifty Rebound from Day's Low to End Flat; IT & Auto Stocks Witness Buying Tue, 28 Jun Closing

Indian share markets witnessed a volatile trading session today as crude oil prices rebounded following last week's rout.

After a gap down opening, benchmark indices were lifted by positive global peers while oil prices rose over renewed supply concerns.

At the closing bell, the BSE Sensex ended flat at 53,177 (up 16 points).

Meanwhile, the NSE Nifty closed higher by 18 points (up 0.1%).

M&M, Reliance Industries, and Tata Steel were among the top gainers today.

Asian Paints, Titan, and Bajaj Finserv, on the other hand, were among the top losers today.

The SGX Nifty was trading at 15,849, up by 11 points, at the time of writing.

The BSE MidCap index and the BSE SmallCap index both ended up by 0.2%.

Among the sectoral indices, stocks in the metal sector, IT sector, and auto sector witnessed buying. On the other hand, stocks in the banking and financial sector witnessed most of the selling.

Shares of Maharashtra Seamless and M&M hit their respective 52-week highs today.

As crude oil prices fell last week and there are rumors that central banks may go slow on rising interest rates, the Indian share markets recovered a bit.

But no one knows how long the stock market recovery will continue.

In volatile times like current one, it's better to have high ROE stocks and high dividend yield stocks in your portfolio.

If you are interested in penny stocks, have a look at these fundamentally strong penny stocks.

Asian share markets ended on a positive note today.

The Nikkei gained 0.7% while the Hang Seng and the Shanghai Composite both ended higher by 0.9%.

US stock futures are trading on a positive note today with the Dow Jones Futures trading up by 150 points.

The rupee hit a record low and is trading at 78.79 against the US$.

Concerns of sustained inflation have sent the rupee tumbling although intermittent dollar selling by the central bank helped limit losses.

Gold prices for the latest contract on MCX are trading up by 0.4% at Rs 50,860 per 10 grams.

Speaking of stock markets, in the latest episode of the Investor Hour podcast, Rahul Goel talks to Ajit Dayal about asset allocation and making better investment decisions.

We highly recommend you watch the hour-long podcast because Ajit Dayal has nearly four decades of experience in asset management. When he talks about asset allocation, it makes sense.

Tune in below to find out more:

In news from the automobile sector, Tata Motors has announced an impending price hike of its commercial vehicle range.

The steep rise in overall input costs at various levels of manufacturing has pushed the company to go for a price hike.

An increase in price in the range of 1.5-2.5%, will come into effect from 1 July 2022 across the range, depending upon individual model and variant, announced the company.

Tata Motors' domestic total sales jumped nearly three folds in May to 76,210 units compared to 26,661 units in COVID-hit May 2021.

Tata Motors share price ended 0.6% higher on the BSE today.

To know more about the company, check out Tata Motors' financial factsheet and its latest quarterly results.

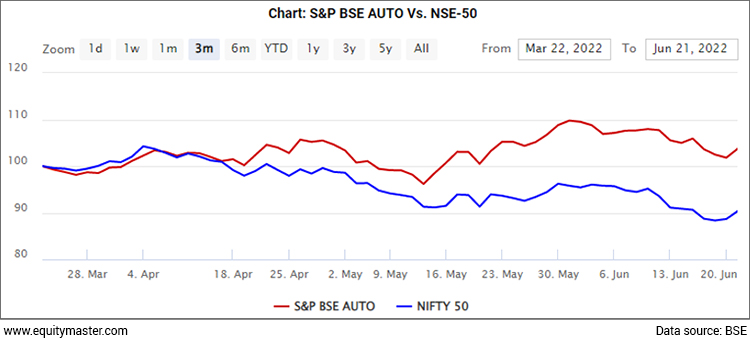

Speaking of automobile sector, note that the BSE Auto Index has given a 3% positive return over the past 3 months whereas the Nifty has fallen by 8% during the same period.

Have a look at the price action over the past 3 months.

The Auto index has Outperformed the Nifty over the Last 3 Months

While auto stocks are rising, you must be wondering if it's a good time to buy?

Aditya Vora, Research Analyst at Equitymaster answers the very question in his recent editorial and expresses his views on the current outlook.

You can read the entire editorial here: Auto Stocks are in the Fast Lane. Is it Time to Buy?

Moving on to news from the banking sector, SBI share price was among the top buzzing stocks today.

This week State Bank of India received in-principle approval from central bank for its proposed operations support subsidiary which is aimed at bringing down the cost-to-income ratio.

The subsidiary will enable the lender to leverage its high cost manpower for more productive services.

SBI's cost to income ratio stood at 53.3% in financial year 2022, an improvement of 240 basis points over fiscal 2019 levels.

In comparison, the cost to income ratio of top three private banks are well below SBI's, at 35-40%.

Hence, the subsidiary aimed at bettering the operating efficiencies can help India's largest bank significantly improve its profitability over time.

The bank will soon start a pilot run in a few regions before launching the new subsidiary pan India, the company announced.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex, Nifty Rebound from Day's Low to End Flat; IT & Auto Stocks Witness Buying". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!