India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News June 25, 2016

Markets Tumble on Brexit Sat, 25 Jun RoundUp

Global stock markets fell in the aftermath of Brexit. In a surprise move, Britain voted to leave the European Union in the crucial June 23rd referendum after the 'leave' campaign secured around 51.8% of the votes. While England voted overwhelmingly for Brexit, Scotland and Northern Ireland backed 'remain'. This development is likely to have far reaching consequences for the survival of the European Union that was formed 60 years ago after World War II.

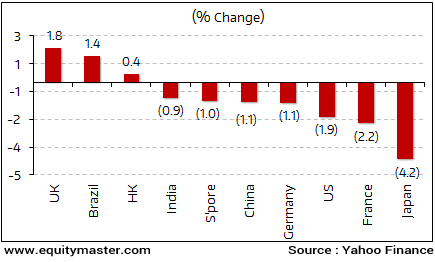

The exit of Britain from EU or 'Brexit' has caused mayhem in global financial markets. It sent the pound to its lowest level since 1985 with a decline of 11%. Euro too slumped around 3.3%. Crude prices in global markets plunged as much as 6%. With investors flocking to safe havens, assets such as gold firmed up 4.5%. Barring Britain, Brazil and, Hong Kong all the other markets ended in the red in the week gone by.

The FTSE 100 index was up by around 2% backed by recovery in blue chip stocks. However, indices in Germany and France were down by more than 1% for the week. The US markets were down by 2%. The Japanese market was the biggest loser, plunging by 4%, as currency traders scrambled to buy yen in the financial turmoil. The Japanese currency strengthened by more than 7% against the US$, dropping below 100 for the first time since November 2013.

Back home in India, the Sensex fell by more than 3% but recovery towards the end of the day saw the index ending lower by a mere 0.9% for the week.

Key World Markets During the Week

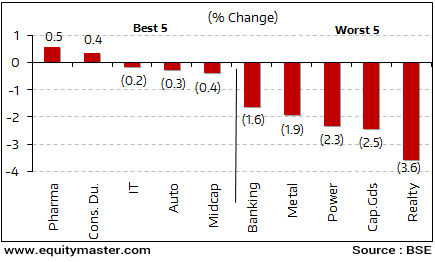

Among the sectoral indices, only pharma and consumer durable managed to stay afloat while stocks from realty and capital goods were biggest losers.

BSE Indices During the Week

Now let us discuss some

The domestic textile industry received a leg-up after the government has given approval for a special Rs 60 billion package for promotion of exports in textile and apparel sector. This is likely to boost the competitiveness of the Indian garments sector globally.

The package is being looked upon to create one crore new jobs in the textile and apparel industry in three years. It is also being expected to attract investments of US$11 billion and generate US$30 billion in exports. The package includes a slew of measures such as additional incentives for duty drawback scheme for garments. It offers flexibility in labour laws to increase productivity as well as tax and production incentives for job creation in garment manufacturing. It also provides more flexible labour laws and financial incentives for the sector.

Moreover, the government has announced that it will bear the entire burden of employers' contribution to the Employees' Provident Fund (EPF) scheme for new employees of the garments industry earning less than Rs 15,000 a month for the first three years. Also, the EPF has been made optional for employees earning less than Rs 15,000 per month.

In a positive move, the government has further relaxed the FDI norms in seven sectors including defence, pharmaceuticals, aviation and single-brand retailing. This is barely seven months after it had eased norms for foreign investments in 15 sectors. These liberalisation measures are likely to fuel growth in the economy in the long run.

This move comes at a time when the equity and currency markets battled investor concerns over Mr Rajans's announcement to exit as the RBI governor with effect from September.

Here is Ajit Dayal's view on Rajan exit. Click here to access this interesting piece.

The ministry has taken initial steps towards commercial mining of coal in India, wherein it would allot the mines to states that would be free to sell to industries. As per the ministry of coal, the government plans to evolve the mechanism of commercial mining by involving the states first and then private miners.

The Centre has identified 16 coal mines with an estimated annual capacity of around 40 million tonnes. A state would be able to own a mine in other states as well and use it for commercial purposes. According to revised mechanism, the states would apply for coal mines citing their demands, reasons for demand and expected sale plan. Joint ventures by the states are allowed as long as the states maintain a majority stake in it. Further, once the coal mines are allocated, the states would not be able to transfer the mine to a private company. This would ensure that mineral rich states earn surplus revenue from selling coal rather than just receive royalty.

The Union government cleared India's largest ever telecom spectrum auction that could earn revenues to the tune of Rs 5.66 trillion. The receipts from the auction will help the government to keep the ambitious target of fiscal deficit in check. The spectrum will also help address the problem of call drops.

The government is putting on sale spectrum bands of 700MHz, 800MHz, 900MHz 1,800MHz, 2,100MHz, 2,300 MHz and 2,500 MHz. Amongst these, the 700MHz band is the most effective and expensive band.

A 25% upfront will have to be made for all bands under 1000MHz. While, a 50% upfront would be required for 1,800 MHz, 2,100MHz, 2,300MHz and 2,500MHz bands. The balance will have to be paid on two-year moratorium and ten year's installment.

Movers and Shakers During the Week

| Company | 17-Jun-16 | 24-Jun-16 | Change | 52-wk High/Low | Top Gainers During the Week (BSE A Group) |

|---|---|---|---|---|

| Ambuja Cement | 236 | 248 | 5.2% | 257/185 |

| Dr Reddy's Lab. | 3,003 | 3,153 | 5.0% | 4,387/2,750 |

| Bajaj Auto | 2,581 | 2,679 | 3.8% | 2,685/2,134 |

| M&M | 1,344 | 1,389 | 3.3% | 1,442/1,091 |

| Sun Pharma | 743 | 755 | 1.6% | 966/704 |

| Top Losers During the Week (BSE A Group) | ||||

| Tech Mahindra | 535 | 507 | -5.3% | 582/407 |

| Bosch | 22,076 | 21,160 | -4.1% | 26,720/15,736 |

| Tata Steel | 325 | 313 | -3.9% | 364/200 |

| L&T | 1,480 | 1,431 | -3.4% | 1,888/1,016 |

| BHEL | 122 | 118 | -3.4% | 190/90 |

Source : Equitymaster

Now let us move on to some of the key corporate developments in the week gone by.

Sun Pharmaceutical is set to buy back 7.5 million shares from the public. The buyback price is Rs 900 with the record date set at 15 July 2016.The buyback is intended to return surplus funds to shareholders and enhance overall returns. Further, the promoter's shareholding post buy back would not fall below the current aggregate shareholding of 54.97%.

In a bid to ward off rising competition in its lucrative US dermatology business, Sun Pharmaceuticals is betting on newer and more complex products. The company is banking on Tildrakizumab, an experimental psoriasis drug that recently completed late-stage trials. It is to be noted that Sun Pharma was the first among the Indian companies to enter the US dermatology space. The company did so by acquiring a controlling stake in Israel's Taro Pharmaceuticals Industries Ltd in 2010.

The company, earlier this month, launched its first dermatology product in the form of its sunscreen brand 'Suncros'. The product had been launched through the company's Global Consumer Healthcare business vertical.

Bharti Airtel recently announced that it will sell its operations in Africa's Burkina Faso and Sierra Leone to France-based telecom operator Orange. As of present, Orange has completed the acquisition of 100% of the operations of Airtel in Burkina Faso via its subsidiaries. Reportedly, the entire acquisition is estimated to be worth US$ 800-US$ 900 million. One must note that Airtel is the second largest mobile operator in Burkina Faso, with a 4.6 million customer base. Bharti Airtel's operations in Africa have not been very successful. At the end of March 2016, Bharti Africa reported a net loss of US$ 585 million.

Siemens Ltd has won an order worth Rs 830 million from the Indian Railways' Diesel Locomotive Works. The order is to design, supply and install 40 alternating current (AC) traction systems for dual-cab high horsepower diesel engine locomotives.

The AC traction systems will be produced at Siemens' Nashik factory in Maharashtra and have been developed based on the insulated gate bipolar transistors (IGBTs) technology. The company has also signed an agreement with Spain's Gamesa to merge its wind energy businesses with it for the creation of the world's biggest windfarms company. Siemens has struggled to turn around its wind energy business in India. Siemens will hold 59% stake in the merged entity, while Gamesa will hold the balance 41%.

Yes Bank recently got the nod from Indian government to increase its FDI limit to 74%. It is likely to raise US$ 1 billion from overseas investors in the ongoing fiscal. The bank claims to have become the first bank in India to have received such an approval for a fully fungible composite foreign investment limit of 74%. YES Bank intends to expand across Asia. Once RBI approves its application, YES Bank targets to get a full banking license in Singapore.

Tata Consultancy Services has entered into a joint venture with Sernova Financial to deliver the next generation cloud based derivative post trade processing service. This technology will enable banks to manage risk and effectively maintain compliance with the changing global regulatory environment. The services will be delivered by Sernova on the Calypso platform while the Business Process Services will be delivered by TCS.

TCS recently also collaborated with the Central University of Rajasthan to offer a two-year program in Big Data Analysis. The course is designed by eminent experts in Data Science and Data Analytics from academia and industries with initiative from the TCS.

With an aim to fight rising competition, Nestle India is set to launch nearly 25 new products in the market. The range of products comprise seven variants of Maggi, Greek yogurt brand 'Grekyo' and protein growth brand 'Pro-Gro' in the dairy segment. Products in chocolate and confectionery and offerings in coffee and tea are also a part of launch. The launch period is being brought down to 4-months from 10-12 months to keep pace with changing aspects.

The instant noodles market in India is estimated to be Rs 20 billion with Yippee, Wai Wai and Patanjali Noodles among major players besides Maggi. Nestle has stated that Maggi has regained 55.5% share in the noodles market compared to 77% before ban. The company still has to recover the 5 billion losses that it had to bear after the ban. Two cases are still pending against the company.

The departure of Britain from the European Union is expected to add to the uncertainty in global markets already grappling with recession. However, the likely slowdown that Brexit will trigger in several economies is being seen as pulling down crude prices and help countries like India manage their trade deficits. But instead of banking too much on the global macro trends, that are difficult to predict, investors should focus on fundamentals of individual stocks and utilise the correction to cherry pick stocks with strong fundamentals.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Markets Tumble on Brexit". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!